Gi Bank

Should I use a bank or a currency exchange service ?

When it comes to exchanging currencies, you have two main options: banks and currency exchange services. Both have their advantages and disadvantages, so it's important to consider your specific needs before making a decision. Advantages of Using a Bank: - Security: Banks are generally considered more secure than currency exchange services because they are regulated by government agencies. Your money is protected by insurance policies, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. - Convenience: Many banks offer online and mobile banking services, allowing you to easily manage your account and make transactions from anywhere. You can also withdraw cash from ATMs worldwide without additional fees. - Fees: Banks typically charge lower fees for currency exchange compared to currency exchange services. Some banks even offer fee-free currency exchange if you have an account with them. Advantages of Using a Currency Exchange Service: - Better Exchange Rates: Currency exchange services often offer better exchange rates than banks because they specialize in foreign currency exchange. This means you can get more money for your currency than if you were to use a bank. - No Fees: Many currency exchange services do not charge any fees for exchanging currencies. However, some may still charge a small commission or service fee. - Speed: Currency exchange services are usually faster than banks when it comes to exchanging currencies. They often have shorter processing times and can provide you with the currency you need quickly. Disadvantages of Using a Bank: - Limited Availability: Not all banks offer foreign currency exchange services, especially smaller local banks. You may need to visit multiple banks to find one that offers this service. - Higher Fees: As mentioned earlier, banks typically charge higher fees for currency exchange compared to currency exchange services. This can add up quickly if you need to exchange large amounts of currency. Disadvantages of Using a Currency Exchange Service: - Security Risks: Currency exchange services are not regulated by government agencies like banks are. This means there is a higher risk of fraud or theft when using these services. - Limited Locations: Currency exchange services may not be available in all locations, especially in rural areas or smaller towns. You may need to travel to a larger city or airport to find one. - Limited Services: Currency exchange services typically only offer foreign currency exchange and do not provide other banking services like checking accounts or loans. If you need additional financial services, you will need to use a separate bank.

How does credit management work in a bank ?

Credit management is a crucial function of banks that involves assessing and managing the risks associated with lending money to individuals and businesses. The process includes evaluating borrowers' creditworthiness, using credit scoring models to determine risk, making loan decisions, servicing and monitoring loans, and managing credit risk through diversification and risk management strategies.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

How can I create a personalized gift without breaking the bank ?

The text provides guidance on creating personalized gifts without spending a lot of money. It suggests getting crafty by making handmade items, using what one already has to create sentimental gifts, thinking creatively about non-material presents, shopping sales and using coupons for purchased gifts, and collaborating with others for group gifts. The tips aim to help readers give meaningful presents while staying within budget.

How do I troubleshoot issues with Apple Pay ?

Troubleshooting issues with Apple Pay involves checking device compatibility, updating software, adding a new card, verifying bank support, and contacting Apple Support. Compatible devices include iPhone 8 or later, iPad Pro (all models), Apple Watch Series 1 or later, and Mac with Touch ID or T2 Security Chip. Updating software can be done through Settings > General > Software Update on iPhone or iPad, or System Preferences > Software Update on Mac. To add a new card, open the Wallet app, tap the plus sign, follow prompts, and call the bank if needed. Not all banks support Apple Pay, so check with your bank or visit Apple's website for a list of supported banks. If issues persist, contact Apple Support via phone, email, or chat on their website for further assistance.

What banks and credit card providers support Apple Pay ?

Apple Pay is a mobile payment and digital wallet service that works with Apple devices. It allows users to make secure purchases in person, in iOS apps, and on the web using Safari. Many banks and credit card providers support Apple Pay, including Bank of America, Capital One, Chase, Citi, Wells Fargo, American Express, Discover, MasterCard, and Visa. Adding your card to Apple Pay is a straightforward process involving opening the Wallet app, tapping the plus sign, and following the steps to add a new card. The availability of Apple Pay and the specific cards it supports may vary by country or region, so it's important to check with your bank or card issuer to confirm compatibility and get any necessary instructions.

What role do economic indicators play in policy making by central banks ?

Economic indicators play a crucial role in policy making by central banks. They provide valuable information about the state of the economy, which helps central banks make informed decisions about monetary policy. Economic indicators are used to measure economic performance, identify risks and challenges, guide monetary policy decisions, and communicate with markets. Central banks use these indicators to assess whether the economy is growing at a sustainable pace or if there are any imbalances that need to be addressed. They also help central banks identify potential risks and challenges facing the economy, such as a widening trade deficit or rising imports. Economic indicators guide monetary policy decisions by helping central banks determine whether to raise or lower interest rates based on inflation targets. Finally, economic indicators play an important role in communicating with markets by providing transparency and clarity about central bank policy decisions.

What is the role of international organizations in financial regulation ?

International organizations are crucial in financial regulation, promoting stability, cooperation, and coordination among countries. They set global standards, enhance coordination, provide policy advice, facilitate information exchange, and monitor market developments. The Basel Committee on Banking Supervision, International Organization of Securities Commissions, and International Association of Insurance Supervisors develop regulatory standards for banks, securities regulators, and insurance, respectively. The Financial Stability Board coordinates international financial regulation, while the Bank for International Settlements facilitates cooperation among central banks. The World Bank and IMF offer technical assistance and support for financial sector development and reform. The Committee on Payment and Settlement Systems promotes payment system stability, and the Joint Forum of Tax Administrations addresses tax evasion. The Global Financial Stability Report and Early Warning Exercises monitor market developments and emerging risks. Overall, these organizations help ensure financial stability, reduce systemic risks, and foster a more transparent and resilient global financial system.

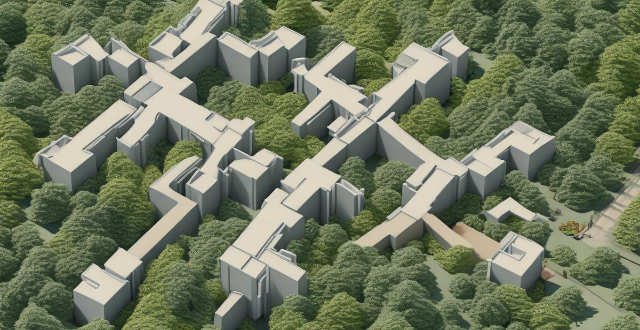

What is the significance of green infrastructure in managing urban runoff and improving water quality ?

Green infrastructure (GI) is a sustainable approach that uses natural processes to manage stormwater, reduce pollution, and enhance the overall health of urban ecosystems. It plays a crucial role in managing urban runoff and improving water quality. Some benefits of GI include reducing stormwater runoff, improving water quality, enhancing habitat and biodiversity, and mitigating climate change impacts. To effectively implement green infrastructure in urban areas, factors such as site selection, design considerations, and maintenance and management should be considered. Proper maintenance and management are essential for ensuring the long-term success of green infrastructure projects. By implementing effective green infrastructure practices, cities can create healthier, more resilient environments for both people and wildlife.

How has the COVID-19 pandemic affected the financial markets ?

The COVID-19 pandemic caused significant disruptions in financial markets, including increased volatility, sector-specific impacts, and central bank interventions. Stock markets experienced sharp declines initially, with travel and retail sectors hit hard, while healthcare and technology sectors generally fared well. Central banks cut interest rates and injected liquidity to stabilize markets. Bond markets saw increased activity, and oil prices experienced dramatic swings. Investor behavior shifted towards defensive investing, and economic indicators showed negative trends. The long-term implications of these changes are still unfolding but are likely to shape the financial landscape for years to come.

Where can I enjoy haute cuisine in Hong Kong without breaking the bank ?

Hong Kong is a food lover's paradise, offering a wide range of culinary delights at various price points. Here are some budget-friendly options for enjoying haute cuisine in the city: 1. **Tim Ho Wan** - The World's Cheapest Michelin-starred Restaurant offers dim sum dishes like Baked Buns with BBQ Pork for HK$20-50 per dish. 2. **Yung Kee Restaurant** - Affordable Roast Goose is renowned for its crispy and juicy roast goose, with meals costing HK$100-200. 3. **Tai Ping Koon** - Budget-Friendly Seafood Restaurant serves fresh seafood dishes like steamed fish and shrimp with garlic for HK$50-100 per dish. 4. **Lan Fong Yuen** - No-frills Tea House with Reasonable Prices offers traditional Cantonese tea and snacks since 1956, with prices ranging from HK$20-40 per person. 5. **Kau Kee Restaurant** - Affordable Noodles and Congee is known for its beef brisket noodles and congee, with meals costing HK$30-50. 6. **Lin Heung Kuttay** - Cheap and Cheerful Desserts specializes in traditional Chinese desserts like mango pomelo sago soup and durian pudding, with prices ranging from HK$10-30 per dessert. These options prove that you don't have to spend a fortune to enjoy delicious food in Hong Kong.

How can small businesses implement automation without breaking the bank ?

In summary, small businesses can effectively integrate automation into their operations by starting small, utilizing affordable tools, simplifying processes beforehand, implementing gradually, outsourcing when needed, and monitoring performance to make necessary adjustments. These strategies help in achieving efficiency gains without excessive costs, allowing for continuous improvement and growth.

How does cryptocurrency work ?

Cryptocurrency is a digital or virtual currency that uses cryptography for security, operating independently of a central bank. It allows direct transfers between individuals without intermediaries like banks. Key components include cryptography (public and private keys, encryption, decryption), blockchain technology (decentralization, transparency, immutability, consensus mechanism), mining (Proof of Work, Proof of Stake, mining rewards, network security), and smart contracts (automation, efficiency, security, transparency). These technologies work together to create a secure, decentralized, and transparent digital payment system with fast, low-cost, and borderless transactions while maintaining user privacy and security.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

Are there alternatives to taking out a student loan for college expenses ?

There are several alternatives to student loans for covering college expenses, including scholarships and grants, work-study programs, employer tuition assistance, military benefits, and crowdfunding and community support. Scholarships and grants are typically awarded based on academic merit or financial need, while work-study programs allow students to earn money through part-time jobs. Employer tuition assistance programs may cover all or a portion of tuition costs, and serving in the military can provide access to educational benefits like the GI Bill. Crowdfunding platforms and community organizations can also provide financial support for students in need.

Can dietary changes influence a woman's fertility ?

Dietary changes play a significant role in a woman's fertility by supporting hormonal balance, managing weight, reducing inflammation, regulating blood sugar, adopting healthy lifestyle habits, minimizing exposure to environmental toxins, and promoting gut health. It is recommended to consult with a healthcare provider or a registered dietitian for personalized advice on how dietary changes can support individual fertility goals.

What are some strategies for finding discounted travel packages and deals ?

Strategies for Finding Discounted Travel Packages and Deals Traveling can be expensive, but there are several strategies to find discounted travel packages and deals. Being flexible with travel dates, signing up for email alerts and newsletters, using travel rewards programs, looking for bundled packages, checking for last-minute deals, considering alternative accommodations, and researching local discounts and freebies are all effective ways to save money on travel expenses. By employing these strategies, travelers can enjoy memorable adventures without overspending.

Who are the main financial regulators in the world ?

Financial regulators worldwide play a pivotal role in maintaining the stability and integrity of the global financial system. Key institutions include the SEC, Fed, CFTC, and FINRA in the US; ECB and ESMA in the EU; BoE and FCA in the UK; BoJ and FSA in Japan; and PBOC and CBIRC in China. The Basel Committee on Banking Supervision and IOSCO also set global standards for bank regulation and securities markets, respectively. These regulators collaborate to address cross-border issues and enhance the health and integrity of the global financial system through implementing regulations, monitoring market activities, promoting transparency, and taking action against illegal or unethical practices.

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

What documents do I need to exchange currency ?

Exchanging currency at Bank of China or any other financial institution requires presenting valid personal identification documents and relevant materials proving the necessity for the exchange, including proof of need and a usage declaration. The process adheres to specific regulations set by the State Administration of Foreign Exchange, such as annual total amount management and verification and approval procedures. It is crucial to understand these requirements and check with your bank beforehand to ensure a smooth currency exchange experience.

What fees are associated with Cross-Border Payment ?

Cross-border payments are subject to various fees, including transfer fees, exchange rate markups, receiving fees, and intermediary bank fees. Understanding these fees is crucial for cost-effective international money transfers.

What are some successful examples of green finance initiatives around the world ?

Green finance initiatives are gaining momentum as governments, financial institutions, and investors increasingly recognize the importance of addressing climate change and promoting sustainable development. Here are some successful examples of green finance initiatives around the world: 1. Green Bonds: The Climate Bonds Initiative (CBI) and World Bank Green Bonds are two successful examples of green bonds that have been issued to finance renewable energy projects, forest conservation, and other environmentally friendly initiatives. 2. Green Banks: The Connecticut Green Bank and New York Green Bank are two successful examples of green banks that focus on investing in clean energy and sustainability projects. 3. Green Investment Funds: The Parnassus Endeavor Fund and Calvert Social Investment Fund are two successful examples of green investment funds that invest in companies with strong environmental, social, and governance (ESG) practices. 4. Green Microfinance Institutions: Grameen Shakti and EcoZoom are two successful examples of green microfinance institutions that provide loans and other financial services to small-scale entrepreneurs who are involved in environmentally friendly activities. 5. Public-Private Partnerships for Sustainable Development: The Global Environmental Facility (GEF) and International Finance Corporation (IFC) are two successful examples of public-private partnerships that leverage private sector expertise and resources to achieve sustainable development goals.

How do I avoid high fees when exchanging money ?

Exchanging money can be costly, but there are ways to avoid high fees. Use your bank or credit card for transactions, consider a prepaid travel card, look for no-fee ATMs, use online currency exchange services, and negotiate with local currency exchange offices. By being aware of your options and doing research ahead of time, you can save money and make your travels more enjoyable.

What are the most common types of telecommunications fraud ?

Telecommunications fraud is a serious issue that affects millions of people worldwide. It involves using technology to deceive individuals or organizations for financial gain. Here are some of the most common types of telecommunications fraud: 1. Phishing Attacks: In this type of attack, cybercriminals send fraudulent emails or messages that appear to be from a legitimate source, such as a bank or a government agency. The message typically asks the recipient to click on a link or provide sensitive information, such as login credentials or credit card details. Once the victim provides the requested information, the attacker can use it to access their accounts and steal money or personal data. 2. Vishing Attacks: In this type of attack, cybercriminals use automated phone calls or live callers to trick victims into providing sensitive information over the phone. The attacker may pretend to be from a legitimate organization, such as a bank or a government agency, and ask for personal information or payment for a fake service. 3. Smishing Attacks: Smishing, or SMS phishing, is a relatively new form of telecommunications fraud that involves sending fraudulent text messages to victims' mobile devices. These messages often claim to be from a legitimate source, such as a bank or a government agency, and ask for sensitive information or payment for a fake service. Unlike traditional phishing attacks, which rely on email, smishing attacks use SMS messages to reach victims directly on their mobile devices.

What information is required to register a SIM card ?

Required Information for SIM Card Registration Personal Information: Full name, date of birth, address, phone number, email address. Identification Documents: Government-issued ID and proof of address. Payment Information: Credit/debit card or bank account details. Additional Information: Employment information, social security number or tax ID, referral code (if applicable).

What is the latest gossip about celebrity relationships ?

The latest celebrity relationship gossip includes updates on Taylor Swift and Joe Alwyn, Chris Pratt and Katherine Schwarzenegger, Jennifer Lopez and Alex Rodriguez, and Gigi Hadid and Zayn Malik.

Can I use my credit card for currency exchange ?

Using a credit card for currency exchange is convenient but comes with potential fees and less favorable exchange rates. It involves dynamic currency conversion by your bank or credit card issuer, which may add a spread or margin to the rate. To use your credit card for currency exchange, ensure it's eligible for international use, notify your bank of travel plans, understand associated fees, choose to pay in local currency, and monitor transactions. While offering convenience and security, drawbacks include fees, potentially unfavorable rates, and the need to manage credit limits. Comparing cards based on fees and rewards can optimize benefits.

Does Apple Pay offer any rewards or cashback programs ?

Apple Pay is a digital wallet and payment system developed by Apple Inc. It allows users to make payments using their iPhone, iPad, Apple Watch, and Mac. While Apple Pay itself does not offer any specific rewards or cashback programs, there are several ways to earn rewards and cashback when using Apple Pay for purchases. Many credit cards offer rewards and cashback programs that can be used with Apple Pay. Some banks also offer rewards and cashback programs for using Apple Pay. In addition to credit card and bank-sponsored offers, some retailers and merchants also offer rewards and cashback programs for using Apple Pay. By taking advantage of these programs, users can maximize their savings and enjoy additional benefits when paying with Apple Pay.