Cost Market

Can you explain the concept of dollar-cost averaging in investing ?

Dollar-cost averaging is an investment method where a fixed amount of money is invested at regular intervals, regardless of the asset's current price. This approach aims to reduce the impact of market volatility and timing on the overall investment portfolio. Key principles include regular investments, a fixed dollar amount, and a long-term focus. Advantages include less volatility, reduced market timing risk, and disciplined convenience. Disadvantages may include opportunity cost, transaction costs, and potential underperformance in a steadily rising market. The strategy works by selecting an investment, determining the investment amount, setting up automatic purchases, and staying disciplined. Dollar-cost averaging offers a straightforward method for building an investment portfolio over time but should be considered alongside individual circumstances and financial advice.

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

What role does natural gas play in the global energy market ?

Natural gas is a key player in the global energy market due to its environmental advantages, economic benefits, contributions to energy security, technological advancements, and versatile applications across sectors.

How is the demand for electricity affecting the energy market ?

The demand for electricity is a crucial factor that affects the energy market. As the world becomes more reliant on electricity, the demand for it continues to grow. This increased demand has significant implications for the energy market, including the types of energy sources used, the cost of electricity, and the environmental impact of energy production. The key points include population growth, economic development, technological advancements, diversification of energy sources, investment in infrastructure, cost of electricity, environmental impact, renewable energy sources, energy efficiency, smart grid technology, and electric vehicles. By considering sustainable energy solutions, we can work towards a more sustainable and equitable energy future.

Is buying in bulk always more cost-effective, or are there exceptions ?

The text explores the concept of buying in bulk, highlighting its potential benefits and drawbacks. It notes that while bulk buying can offer cost savings, convenience, and reduced waste, it might not always be the most cost-effective strategy due to factors such as perishability, space constraints, single-use items, expiration dates, quality control, market fluctuations, and personal consumption rates. The conclusion suggests considering these factors before deciding on bulk buying to ensure it aligns with individual needs and circumstances.

What is the impact of market volatility on my investment strategy ?

Market volatility can significantly impact your investment strategy by affecting risk tolerance, portfolio allocation, timing of investments, emotional responses, and both long-term and short-term goals. It's crucial to anticipate and account for market fluctuations in your approach. Diversification, rebalancing, and strategies like dollar-cost averaging can help mitigate risks and smooth out the effects of volatility over time. Emotional discipline is also essential, as fear and greed can lead to suboptimal decisions. Opportunities may arise during volatile periods, but it's important not to overreact to short-term events and maintain a focus on long-term fundamentals. A well-diversified portfolio and a long-term perspective are key tools for navigating market volatility successfully.

What is the role of macroeconomic indicators in stock market analysis ?

The article discusses the importance of macroeconomic indicators in stock market analysis, highlighting key indicators such as economic growth, inflation, interest rates, employment, and government policies. It suggests monitoring these indicators to identify trends and patterns that can impact the stock market, integrating this analysis with other tools for a comprehensive view.

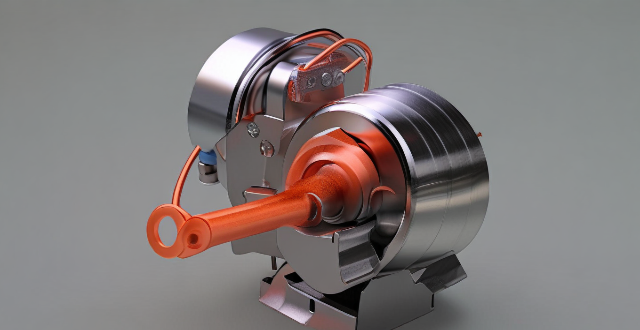

What is the typical cost difference between a permanent magnet motor and an equivalent size induction motor ?

Permanent magnet motors (PMMs) and induction motors (IMs) are two common types of electric motors used in various applications. The cost difference between them is often a significant factor in deciding which one to use. PMMs are known for their high efficiency, compact size, and low noise levels, while IMs are simpler and more robust. The cost difference depends on factors such as size, power rating, materials used, and manufacturing processes. Generally, PMMs are more expensive than IMs of equivalent size due to material costs, manufacturing processes, efficiency and performance requirements, and market demand and availability. When choosing between these two types of motors, it is essential to consider both the technical requirements and budget constraints of your specific application.

How is renewable energy affecting the traditional energy market ?

Renewable energy sources are having a significant impact on the traditional energy market, affecting pricing, market share, job creation, and environmental concerns. The increased efficiency and reduced installation costs of renewable technologies have made them more competitive with traditional energy sources, leading to declining electricity prices overall. Additionally, the growing demand for renewable energy sources has led to an increase in their market share, particularly for solar and wind power. The transition to renewable energy is also creating new job opportunities across various sectors of the economy, while addressing environmental concerns associated with fossil fuel consumption.

How do economic indicators affect stock market performance ?

Economic indicators significantly impact stock market performance by reflecting the health of an economy. Key indicators include GDP, inflation rate, unemployment rate, interest rates, trade balance, consumer confidence index, and manufacturing index. Each of these measures provides insights into different aspects of economic activity, influencing investor sentiment and decision-making processes. By understanding how these indicators affect the stock market, investors can make informed decisions to maximize returns while minimizing risks.

What is the current state of the US stock market ?

The US stock market is currently experiencing a mix of positive and negative trends, including strong economic growth and technology sector performance, but also significant market volatility and trade tensions. Factors impacting the market include interest rates, global economic conditions, and geopolitical risks.

What are the best practices for pricing items in a second-hand market ?

When selling items in a second-hand market, it's essential to follow best practices for pricing to maximize profits and ensure a smooth transaction. Key tips include researching market value, considering the item's condition, setting a fair price, being open to negotiations, and updating the listing regularly. By following these guidelines, sellers can attract more potential buyers and increase their chances of making a successful sale.

What are the challenges and opportunities for developing countries in the carbon trading market ?

Challenges and opportunities for developing countries in the carbon trading market include lack of infrastructure, legal and regulatory hurdles, market access and information asymmetry, capacity building needs, economic growth and investment, technology transfer and innovation, environmental sustainability, policy influence and leadership.

How much does fiber optic broadband cost ?

The cost of fiber optic broadband varies based on provider, location, speed, and additional fees. It is recommended to compare plans from different providers and consider all associated costs before making a decision.

How does the cost of building a charging network compare to traditional gas stations ?

Building a charging network for electric vehicles and traditional gas stations involve different costs and considerations. The initial investment may be higher for a charging network due to the need for electrical infrastructure, while operational costs may be lower due to lower electricity costs compared to fuel procurement. Additionally, the scalability and growth potential of a charging network may be higher as the market share of EVs continues to increase.

How has social distancing impacted the economy and job market ?

Social distancing measures have had a significant impact on the economy and job market, including decreased consumer spending, supply chain disruptions, high unemployment rates, increased demand for remote work, and changes in job seeking behavior.

What are the economic benefits of investing in clean production technologies ?

Investing in clean production technologies can bring a range of economic benefits to businesses, governments, and society at large. These benefits include cost savings through energy efficiency, resource efficiency, reduced maintenance costs, market advantages such as enhanced brand image and access to new markets, risk mitigation from environmental regulations and resource scarcity, innovation and growth opportunities, and broader environmental and social benefits that contribute to long-term economic prosperity.

How do political events affect the stock market, and how can they be analyzed ?

This comprehensive analysis explores the impact of political events on the stock market, including economic policies, regulatory changes, international relations, and elections. It also provides strategies for analyzing their potential effects, such as staying informed, diversifying your portfolio, using technical and fundamental analysis, and monitoring sentiment indicators.

How much does a fitness instructor course cost ?

The cost of a fitness instructor course can vary depending on the type of certification, location, duration, and extra costs. It is important to research all potential costs before making a decision to ensure that the course fits both your budget and career goals.

How can I invest in the carbon trading market ?

The carbon trading market offers a lucrative investment opportunity for those interested in environmental sustainability and financial gain. To invest successfully, one should understand the basics of carbon trading, research different carbon markets, choose a broker or exchange, determine an investment strategy, and start trading while managing risk.

How has the COVID-19 pandemic impacted the stock market, and what insights can be gained from this analysis ?

The COVID-19 pandemic has caused increased volatility and uncertainty in the stock market. Certain industries, such as travel and hospitality, have been negatively impacted while others, like healthcare and technology, have experienced growth. Government interventions aimed at mitigating economic effects have both stabilized markets and created long-term concerns. The rise of remote work and digital transformation has benefitted companies able to adapt quickly. As economies begin to recover with widespread vaccination, investors should monitor developments closely to make informed decisions.

What is the role of a broker in the stock market ?

Brokers play a key role in the stock market, acting as intermediaries between investors and financial markets. They facilitate trades, provide market information, offer investment advice, manage accounts, and execute complex trades. Their expertise helps investors make informed decisions and manage their portfolios effectively.

What is the difference between a bull and bear market ?

The main difference between a bull and bear market lies in the direction of the market trend and the overall sentiment among investors. Bull markets are characterized by rising stock prices and optimism, while bear markets are characterized by falling stock prices and pessimism.

How might a lunar base influence the global economy and job market ?

The establishment of a lunar base could significantly impact the global economy and job market by increasing investment in space technology, creating new industries, driving innovation, and fostering international collaboration. It could also create numerous job opportunities and expand educational opportunities focused on space-related disciplines.

What is the stock market and how does it work ?

The stock market is a financial ecosystem where investors can buy and sell ownership shares of publicly traded companies. Companies use it to raise capital, while investors aim to share in the company's success. Prices of stocks are determined by supply and demand, influenced by various factors including company performance, market trends, and economic conditions. The market is regulated to protect investors and maintain fairness. Investing in stocks comes with risks but also offers potential rewards, making it a popular choice for long-term investments.

How much does it cost to upgrade my broadband service ?

Upgrading your broadband service's cost depends on the plan type, contract terms, installation fees, device rental or purchase, promotions and discounts, taxes and fees. To determine the most cost-effective upgrade, research different providers, assess your needs, contact your current provider, request a breakdown of fees, read the fine print, and finalize your decision.

How can I protect my growing wealth from market fluctuations ?

Market fluctuations are a natural part of any investment journey. However, as your wealth grows, it becomes increasingly important to implement strategies that can help protect your assets from the ups and downs of the market. Here's how you can do it: - Diversify Your Portfolio - Use Hedging Strategies - Stay Updated on Economic Indicators - Regularly Review and Rebalance Your Portfolio - Work with Financial Advisors

How much will the new product cost ?

This text provides a comprehensive overview of the factors affecting the cost of a new product and outlines a step-by-step process for estimating these costs. It emphasizes the importance of accurate cost estimation for ensuring profitability and competitive pricing in the market. The factors discussed include material, labor, manufacturing overheads, R&D, marketing and sales, administrative expenses, capital expenses, transportation and logistics, taxes and duties, and contingency costs. The cost estimation process involves identifying all cost components, estimating individual costs, calculating total cost, determining pricing strategy, and conducting sensitivity analysis. Overall, this text serves as a valuable guide for businesses looking to estimate the cost of a new product accurately and set a competitive price that ensures profitability.

How do I invest in the stock market ?

The text provides a step-by-step guide on how to invest in the stock market. It emphasizes the importance of education, determining investment goals, choosing a strategy, opening a brokerage account, selecting investments, monitoring them, and maintaining patience and discipline. The process involves learning about different types of stocks, understanding risks, diversification, and risk management. It also includes researching brokerage firms, funding an account, choosing individual stocks or mutual funds based on company performance, and staying informed about market changes. Overall, the text encourages potential investors to approach stock market investing with careful planning and research to achieve their financial goals over time.

What is the importance of market trends in stock analysis ?

Market trends play a crucial role in stock analysis by providing insights into the overall direction and momentum of the market. There are three types of market trends: uptrends, downtrends, and sideways trends. Understanding market trends is essential for making informed investment decisions. By analyzing market trends, investors can identify potential opportunities and risks associated with specific stocks or sectors. To effectively use market trends in stock analysis, investors should first identify the current market trend and then analyze individual stocks or sectors relative to the overall market. Make informed investment decisions based on your analysis of market trends and individual stocks or sectors. Monitor changes in market trends and adjust your investment strategy accordingly.