Com Allowance

How do I educate my teenager about budgeting and money management ?

Teaching your teenager about budgeting and money management is crucial for their financial independence and future success. Start with basic concepts, provide an allowance to practice, set financial goals together, introduce banking and investment principles, use technology, lead by example, encourage part-time work, discuss credit and debt, and plan for the future. This continuous process requires patience, consistency, and practical examples to set your teen on a path to financial stability.

What are the best practices for teaching children about money management and savings ?

Teaching children about money management and savings is an essential life skill that can help them develop good financial habits. Here are some best practices for teaching children about money management: 1. Start early: Even toddlers can understand basic concepts like saving and spending. Use everyday opportunities to talk about money and its value. 2. Lead by example: Children learn by example, so it's important to model good financial habits yourself. Show them how you budget, save, and make decisions about spending. 3. Use allowances wisely: Giving your child an allowance is a great way to teach them about money management. Encourage saving, teach spending, and introduce giving as part of their allowance. 4. Play money games: Board games and online games can be fun and educational at the same time. Some popular ones include Monopoly, The Game of Life, and PiggyBot. 5. Involve them in family finances: Involving your children in family finances can help them understand the real-world implications of money management. Have them help you create a budget, go grocery shopping with you, and talk to them about bills and expenses. Remember to be patient, consistent, and positive when teaching children about money management and savings. With these best practices, your child will develop good financial habits that will serve them well throughout their life.

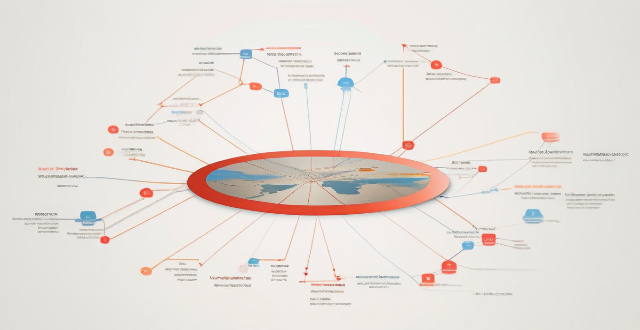

Who are the main participants in the carbon trading market ?

The carbon trading market is a complex ecosystem involving various stakeholders who play crucial roles in reducing greenhouse gas emissions and promoting sustainable development. These participants include governments and regulatory bodies, companies and businesses, investors and financial institutions, project developers and consulting firms, and NGOs and environmental groups. Governments establish the legal framework and policies that govern the market, while companies are required to hold sufficient allowances to cover their emissions or purchase additional allowances if needed. Investors provide liquidity by buying and selling allowances based on their expectations of future price movements. Project developers design and implement projects that generate credits for sale on the carbon market, working closely with governments, companies, and investors. NGOs and environmental groups advocate for stronger climate policies and support initiatives that promote sustainable development.

How do I teach my children about saving money ?

Teaching children about saving money is a vital life skill that can benefit them throughout their lives. Here are some effective strategies to help your kids learn the value of saving: 1. Start early by introducing the concept of money and using visual aids like charts or piggy banks. 2. Set an example by demonstrating responsible financial behavior and sharing your own experiences with saving. 3. Make it fun by creating games that teach children about earning and saving money, and offering small rewards for reaching savings goals. 4. Encourage earning by encouraging part-time jobs or chores around the house, and teaching them about allowances. 5. Set goals together by establishing specific savings goals and tracking progress towards these goals. 6. Teach them about budgeting by explaining its importance and practicing budgeting together. 7. Introduce them to banking by opening a savings account for your child and explaining how interest works. 8. Discuss long-term goals like college tuition or car payments, and encourage long-term saving. 9. Teach them about credit by explaining what credit cards are and how they work, including the dangers of overspending. 10. Foster independence by encouraging financial independence and providing support as needed.

What are the most promising approaches for achieving climate and environmental policy goals, such as carbon pricing or renewable energy mandates ?

Achieving climate and environmental policy goals requires a multifaceted approach that involves various strategies. Two of the most promising approaches include carbon pricing and renewable energy mandates. Carbon pricing is a market-based approach that puts a price on carbon emissions to encourage reductions. This can be done through either a carbon tax or a cap-and-trade system. A carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas). The revenue generated from this tax can be used to fund clean energy initiatives or returned to taxpayers in the form of dividends. Cap-and-trade sets a limit on carbon emissions and allows companies to buy and sell emission allowances. Companies that emit less than their allowance can sell their excess credits, while those that emit more must purchase additional credits. Renewable energy mandates require a certain percentage of energy production or consumption to come from renewable sources by a specific date. This can include wind, solar, hydroelectric, and other forms of clean energy. Both carbon pricing and renewable energy mandates have their strengths and weaknesses, but they share a common goal of reducing greenhouse gas emissions and promoting sustainable practices. Ideally, these policies should be implemented in tandem with other measures such as energy efficiency standards, public transportation investments, and reforestation efforts to create a comprehensive strategy for achieving climate and environmental policy goals effectively.

How do carbon credits differ from carbon taxes ?

Carbon credits and carbon taxes are two distinct mechanisms that aim to reduce greenhouse gas emissions and mitigate climate change. While both strategies involve a financial incentive to encourage companies and individuals to reduce their carbon footprint, they operate differently in terms of their structure, implementation, and impact. Carbon credits represent a certificate or a tradable allowance proving that a specific amount of carbon dioxide (or its equivalent in other greenhouse gases) has been reduced, avoided, or sequestered by an emission-reducing project. Companies or countries can earn carbon credits by investing in projects that reduce emissions below a certain baseline, such as renewable energy projects or reforestation efforts. These credits can then be sold to entities that are looking to offset their own emissions or meet regulatory requirements. The price of carbon credits is determined by supply and demand in markets where they are traded. On the other hand, a carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas) that are responsible for greenhouse gas emissions. Governments set a tax rate per ton of CO2 emitted, which is paid by companies and sometimes individuals using fossil fuels. The goal is to make polluting activities more expensive, thereby encouraging a shift towards cleaner alternatives. Carbon taxes are typically implemented at a national level through legislation. The revenue generated from the tax can be used to fund environmental initiatives or be returned to taxpayers in various ways. Key differences between carbon credits and carbon taxes include their regulatory vs. voluntary nature, direct vs. indirect incentives, and price certainty vs. market fluctuation. Carbon taxes offer price certainty for businesses when planning expenses, while carbon credit prices can fluctuate based on market demand and the success of emission reduction projects. In summary, both carbon credits and carbon taxes serve important roles in addressing climate change, but they do so through different means and with different outcomes.

Can I use my unlimited data plan for tethering or mobile hotspot ?

Using unlimited data plan for tethering or mobile hotspot is possible, but it's important to understand the potential restrictions and limitations associated with doing so. Always check with your carrier to ensure you fully understand the terms of your unlimited data plan.

How do I know if I need an unlimited data plan for my smartphone usage ?

Do you need an unlimited data plan for your smartphone usage? Consider factors such as data usage, cost, network coverage, and family plans to make an informed decision.

What are the benefits of having an unlimited data plan ?

An unlimited data plan offers benefits such as no data caps or overage charges, the ability to stream videos and music without worrying about data usage, using multiple devices simultaneously, working from anywhere, enjoying online gaming and social media, and better value for money.

How does the carbon trading market work ?

The carbon trading market is a mechanism designed to reduce greenhouse gas emissions by providing economic incentives for their reduction, operating on the principle of "cap and trade." It involves setting a cap on the total amount of greenhouse gases that can be emitted by regulated entities, who can then buy and sell allowances or credits for emissions. The process includes establishing the cap, allocating allowances, trading allowances, banking allowances, offsetting emissions through projects, verification and certification, regulation and oversight, and dealing with benefits and criticisms.

Can I use my iPhone as a portable Wi-Fi hotspot and how do I set it up ?

You can use your iPhone as a portable Wi-Fi hotspot by setting up its "Personal Hotspot" feature. This allows you to share your iPhone's cellular data connection with other devices like laptops, tablets, or smartphones. To set it up, check compatibility and carrier plan, enable Personal Hotspot in settings, connect devices to the hotspot via Wi-Fi, USB, or Bluetooth, and monitor data usage. Troubleshooting tips include checking for strong cellular signal, restarting devices, verifying password accuracy, and ensuring iPhone is not in Airplane Mode.

How much should I be saving each month ?

Saving money is crucial for financial planning, but determining how much to save monthly can be challenging. Factors to consider include income, expenses, debts, goals, and lifestyle preferences. It's generally recommended to save at least 20% of your income, prioritize paying off debts, allocate savings towards short-term and long-term goals, and adjust based on lifestyle choices. By creating a personalized savings plan, you can work towards achieving your financial objectives and securing your future.

How do I provide for minor children in my estate plan ?

When it comes to estate planning, one of the most important considerations is how to provide for your minor children. Here are some steps you can take to ensure that your children are taken care of financially and emotionally after you're gone: Create a will or trust, name a guardian, establish a trust fund, consider life insurance, and make sure your beneficiaries are up-to-date.

What factors determine the amount of a student loan ?

The amount of a student loan is determined by several key factors, including eligibility criteria set by the lender, the cost of attendance at the chosen school, the student's financial need, and the type of loan (federal or private). Other influential factors include repayment options, school choice, and the availability of other financial aid. Students should consider all these elements and explore all possible funding options before taking out a loan.

Will my unlimited data plan slow down after reaching a certain amount of data usage ?

Throttling refers to the intentional slowing down of internet speeds by an internet service provider (ISP) once a user reaches a certain threshold of data usage within a billing cycle. While unlimited data plans do not have a specific data cap like limited data plans, some ISPs may still throttle your speeds under certain circumstances such as network congestion, fair use policy, time of day, and data prioritization. It is essential to read the terms and conditions of your unlimited data plan carefully to understand any restrictions and be aware of the factors that can influence whether your plan will be throttled.

How can we involve marginalized communities in climate decision-making processes ?

Involving marginalized communities in climate decision-making is crucial for equitable solutions. Identify and engage these communities, build trust, provide info & resources, incorporate local knowledge, ensure participation, address power imbalances, and monitor progress.

How can companies implement TCFD disclosures effectively ?

Effective implementation of TCFD disclosures in companies involves establishing a governance framework, assessing climate-related risks and opportunities, developing scenario analysis, reporting and disclosing information, and ongoing management and updates. This process helps companies meet the requirements of the TCFD and prepare for a low-carbon future.

How can regulators encourage adoption of TCFD among companies ?

The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in 2015 to develop voluntary, consistent global climate-related financial risk disclosures for use by companies. Regulators can encourage adoption of TCFD among companies through various means, including mandatory reporting with clear enforcement mechanisms and penalties, incentives such as tax breaks and funding, education and awareness campaigns, and collaboration with investors, NGOs, and other stakeholders.