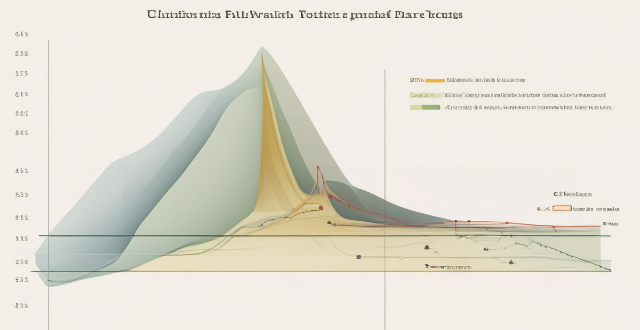

Risk Measure

How can governments implement climate risk management policies to protect their citizens and infrastructure ?

Governments can implement climate risk management policies by assessing the risks, developing a comprehensive plan, investing in resilience and adaptation measures, engaging stakeholders and building public awareness, and monitoring and evaluating progress.

How can we measure climate vulnerability ?

Measuring climate vulnerability involves identifying relevant indicators, collecting data and information, analyzing vulnerability levels, prioritizing adaptation measures, and monitoring progress. This process helps identify areas most at risk from climate change impacts and develop strategies to reduce their vulnerability.

Which economic indicators are used to measure the health of the labor market ?

The health of the labor market is crucial for any economy, and several economic indicators are used to measure it. These include the unemployment rate, employment growth, labor force participation rate, wage growth, and job openings and vacancies. The unemployment rate measures the percentage of the labor force that is unemployed but actively seeking work, while employment growth refers to the number of new jobs created over a specific period. The labor force participation rate measures the percentage of working-age individuals who are either employed or actively seeking employment, and wage growth reflects the earning power of workers. Job openings and vacancies provide insight into the demand for labor within the economy. By monitoring these indicators regularly, stakeholders can identify trends and potential issues early on, allowing them to take proactive steps to address any challenges and promote a healthy labor market.

What are some best practices for managing risk associated with climate change in a global supply chain ?

This article outlines best practices for managing risk associated with climate change in a global supply chain. It suggests assessing climate change risks by identifying potential impacts and evaluating vulnerabilities, developing a risk management plan that includes setting clear objectives and implementing mitigation measures, and monitoring and reviewing performance through tracking progress against objectives and continuously improving strategies. Key strategies include diversifying supplier networks, investing in resilient infrastructure, improving energy efficiency, enhancing supply chain transparency, promoting sustainable practices, establishing regular reporting processes, benchmarking against industry standards, soliciting stakeholder feedback, revising risk management plans regularly, participating in collaborative learning opportunities, and fostering a culture of innovation within the organization.

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

What is the GDP and why is it considered a crucial economic indicator ?

GDP is a crucial economic indicator that measures the market value of all final goods and services produced by a country in a specific time period. It serves as a measure of economic activity, national wealth, and a benchmark for international comparisons. GDP also impacts financial markets, reflects the standard of living, influences global perceptions, and drives employment opportunities. However, it should be considered in conjunction with other indicators for a more holistic understanding of an economy's health.

What are the key components of a successful disaster risk management plan ?

Key Components of a Successful Disaster Risk Management Plan include: 1. Risk Assessment 2. Prevention and Mitigation Strategies 3. Preparedness Activities 4. Response Mechanisms 5. Recovery and Rehabilitation 6. Continuous Improvement

Why is it important to conduct a climate risk assessment ?

Climate risk assessment is crucial for understanding the potential impacts of climate change on different sectors and systems, identifying vulnerabilities and risks, developing adaptation strategies and policies, enhancing resilience and reducing losses, and supporting decision making. It helps in building a more resilient and sustainable future for all.

What is disaster risk management ?

Disaster risk management (DRM) is a comprehensive approach aimed at reducing the impact of natural and human-made disasters on communities. It involves understanding, assessing, and reducing risks through prevention, preparedness, response, and recovery strategies. The goal is to ensure that people's lives and livelihoods are not compromised by disaster events. Key components include risk assessment, hazard mitigation, early warning systems, emergency planning, community education, immediate action, coordination, rehabilitation, reconstruction, and sustainable development. Best practices involve multi-stakeholder collaboration, gender sensitivity, use of technology, inclusive planning, and regular review and updating. Challenges include limited resources, political will, information gaps, and cultural differences. Effective DRM requires a multifaceted approach that considers social, economic, and environmental factors.

What is climate risk assessment ?

Climate risk assessment is a systematic process that identifies, evaluates, and prioritizes the potential impacts of climate change on a specific region or sector. It involves analyzing the likelihood and severity of various climate-related risks, such as extreme weather events, sea level rise, and changes in temperature and precipitation patterns. The goal of climate risk assessment is to inform decision-makers about the risks associated with climate change and help them develop strategies to manage and adapt to these risks. Key components of climate risk assessment include identifying potential risks, evaluating their potential impacts, prioritizing them based on severity and likelihood of occurrence, and developing adaptation strategies to reduce potential impacts. By implementing these strategies, decision-makers can help ensure that their communities are better prepared for the challenges posed by climate change.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

What role do scientists play in climate risk assessments ?

Scientists are crucial in climate risk assessments, analyzing data, developing models, and providing recommendations for mitigating risks. They collect data from multiple sources and use statistical methods to identify trends, create computer models to predict impacts, develop strategies to mitigate risks, and communicate their findings to build support for policies and actions.

How can organizations create a culture of risk awareness among employees ?

Organizations can create a culture of risk awareness among employees by implementing strategies such as leadership buy-in, training and education, open communication channels, integrating risk management into daily operations, recognizing and rewarding risk awareness, and continuous improvement. These efforts will help employees proactively identify, assess, and manage risks more effectively.

Is there a way to measure network latency ?

Measuring network latency is crucial for understanding a network's performance. The ping test, traceroute, and online tools are methods to measure latency. Ping tests estimate the round-trip time, while traceroute identifies bottlenecks in the network path. Online tools provide visual representations of network performance.

How can we measure the effectiveness of community climate adaptation efforts ?

Measuring the effectiveness of community climate adaptation efforts is crucial for understanding their impact on resilience to climate change. Key steps include setting clear objectives, developing relevant indicators, collecting and analyzing data, transparent reporting, evaluating success, iterative improvement, community engagement, and policy alignment. By following these steps, communities can ensure their adaptation efforts are effective and continuously improved.

How can companies implement effective risk management strategies ?

Effective Risk Management Strategies for Companies Risk management is a critical aspect of any business operation. It involves identifying, assessing, and prioritizing potential risks that could impact the company's objectives. Here are some effective risk management strategies that companies can implement: 1. Identify Potential Risks: The first step in implementing effective risk management is to identify potential risks. This involves analyzing the company's operations and processes to determine what could go wrong. Some common types of risks include financial risks, operational risks, strategic risks, and compliance risks. 2. Assess and Prioritize Risks: Once potential risks have been identified, they need to be assessed and prioritized based on their likelihood and potential impact. This involves assigning each risk a score based on its severity and probability of occurrence. The risks can then be ranked in order of priority, with the most significant risks being addressed first. 3. Develop Risk Mitigation Plans: For each identified risk, a mitigation plan should be developed. This plan should outline the steps that will be taken to reduce or eliminate the risk. Mitigation plans can include avoidance, reduction, transfer, or acceptance. 4. Monitor and Review Risks Regularly: Risk management is an ongoing process, and companies should regularly monitor and review their risks. This involves tracking changes in the business environment and updating risk assessments accordingly. It also involves evaluating the effectiveness of risk mitigation plans and making adjustments as needed. In conclusion, effective risk management strategies involve identifying potential risks, assessing and prioritizing them, developing mitigation plans, and regularly monitoring and reviewing them. By implementing these strategies, companies can reduce their exposure to risks and protect their operations and bottom line.

How do I measure progress in my sports training plan ?

Measuring progress is crucial for athletes to track development and adjust their training plans. Set SMART goals, track performance, evaluate technique, monitor body composition, assess fitness level, and reflect on mental state to measure progress effectively.

How do professional bartenders measure ingredients for consistency ?

Professional bartenders use a variety of tools and techniques to measure ingredients consistently. Accuracy is crucial for maintaining the same flavor profile and balancing different tastes in cocktails. Efficiency is also important, as it speeds up drink-making and allows bartenders to focus on customer interaction. Jiggers are commonly used tools for measuring both large and small quantities of liquids. Measuring spoons are used for smaller amounts like bitters or syrup. Digital scales are used for precise measurements by weight, especially for ingredients like fruit juices or syrups. Pour spouts and containers help control the flow of liquids to reduce spillage and waste. Standardization processes such as recipe cards, batching, and taste testing are also essential. Recipe cards include detailed measurements for each ingredient, helping new bartenders learn quickly and maintain consistency. Batching involves pre-mixing a large volume of a single cocktail ingredient or an entire recipe, saving time during busy shifts and ensuring uniformity. Taste tests are crucial even with precise measurements, as bartenders adjust recipes based on customer feedback and ingredient freshness. In conclusion, professional bartenders rely on a combination of tools, techniques, and standardized processes to measure ingredients consistently. This ensures that they can replicate the perfect cocktail every time, providing a high-quality experience for their customers.

How do fitness trackers measure calories burned ?

**How Fitness Trackers Measure Calories Burned: A Comprehensive Overview** Fitness trackers have revolutionized the way we monitor our physical activities and health. One of their most popular features is the ability to estimate the number of calories burned during various exercises. But how do these devices actually calculate this information? In this article, we delve into the science behind fitness trackers and explore the key components that contribute to their calorie-burning estimates. Firstly, heart rate monitoring plays a crucial role. By tracking your heart rate, fitness trackers can gauge the intensity of your workout and, therefore, the approximate number of calories you're burning. Secondly, activity recognition allows the device to identify specific types of movement, such as walking or running, and apply corresponding metabolic equivalent (MET) values to calculate energy expenditure. Thirdly, personal information like age, gender, height, weight, and daily activity level are essential for customizing calorie burn calculations to your unique profile. Finally, sophisticated algorithms combine all these data points to provide an estimate of calories burned. However, it's important to remember that these estimates are not exact measurements but rather approximations based on scientific research and technological advancements. As such, fitness trackers should be viewed as valuable tools to aid in your fitness journey rather than definitive indicators of progress.

What are some common tools and techniques used in risk management ?

Risk management is a process that involves identifying, assessing, and prioritizing potential risks. There are various tools and techniques used in risk management, including brainstorming, Delphi method, checklists, qualitative and quantitative assessment, risk matrix, cost-benefit analysis, avoidance, reduction, transference, acceptance, continuous monitoring, and audits. These tools and techniques help organizations and individuals manage risks effectively and make informed decisions.

How can climate risk management help reduce the impact of climate change on the environment ?

Climate risk management is a multi-step approach that helps mitigate the effects of climate change on the environment. It involves identifying and assessing risks, prioritizing them, developing adaptation strategies, implementing mitigation efforts, fostering collaboration, and continuously monitoring outcomes. This proactive method aims to protect natural systems from adverse climate impacts, promote sustainable practices, and reduce greenhouse gas emissions. By adopting these measures, we can build resilience against climate-related risks and contribute to a more sustainable future for all.

How can we measure the value of ecosystem services ?

The article discusses various methods to measure the value of ecosystem services, which are benefits humans derive from ecosystems. These include provisioning, regulating, cultural, and supporting services. Measuring their value is crucial for informed decisions about management and conservation. Methods include direct market valuation, indirect market valuation, revealed preference methods, avoided cost method, replacement cost method, and benefit transfer method. By using these techniques, policymakers and managers can make informed decisions about resource allocation for ecosystem conservation and restoration.

How can we measure the effectiveness of climate resilience strategies ?

Measuring the effectiveness of climate resilience strategies is crucial for ensuring that communities and ecosystems are adequately prepared for the impacts of climate change. Key factors to consider when evaluating the success of these strategies include assessing impact reduction, monitoring adaptive capacity, evaluating systemic resilience, long-term sustainability, scalability and replication, and community engagement and perception. By considering these factors and using a combination of quantitative data analysis and qualitative assessments, we can comprehensively measure the effectiveness of climate resilience strategies. This will help in refining current approaches and informing future strategies to build a more resilient world in the face of ongoing climate change.

What is risk management and why is it important ?

Risk management is a systematic approach used by organizations to identify, assess, and prioritize potential risks that may impact their objectives. It involves implementing strategies to monitor and control these risks effectively. The goal of risk management is to minimize the probability and impact of negative events and maximize the opportunities for positive outcomes. The importance of risk management includes mitigating uncertainty, enhancing decision-making, compliance and regulatory requirements, protection of reputation, financial performance, and promoting innovation. Effective risk management is crucial for any organization looking to sustain its operations, protect its assets, enhance decision-making, maintain compliance, preserve its reputation, and improve its financial performance. It enables companies to navigate challenges proactively and capitalize on opportunities while minimizing the impact of potential threats.

What are the different types of sensors used in environmental monitoring ?

Environmental monitoring involves the use of various sensors to collect data on different environmental parameters. These sensors include temperature sensors, humidity sensors, pressure sensors, light sensors, and chemical sensors. Temperature sensors measure the temperature of the environment and are crucial for monitoring weather patterns, climate change, and the impact of human activities on the environment. Humidity sensors measure the moisture content in the air and are essential for monitoring weather patterns, air quality, and the impact of human activities on the environment. Pressure sensors measure the force per unit area exerted by a fluid or gas and are crucial for monitoring weather patterns, air quality, and the impact of human activities on the environment. Light sensors measure the intensity and wavelength of light in the environment and are essential for monitoring solar radiation, atmospheric conditions, and the impact of human activities on the environment. Chemical sensors measure the presence and concentration of specific chemicals in the environment and are crucial for monitoring air and water quality, soil contamination, and the impact of human activities on the environment. Overall, these sensors help us understand the state of our environment and take necessary actions to protect it.

What role do insurers play in climate risk management ?

Insurers play a crucial role in climate risk management by providing financial protection against losses and damages caused by climate-related events. They help manage exposure to climate risks through insurance policies, risk assessments, and risk transfer tools. Insurers contribute to climate risk management by assessing risks, offering insurance policies, utilizing risk transfer tools, investing in resilience and adaptation, collaborating with governments and stakeholders, raising awareness, and conducting research and development.

How can climate data analysis help in disaster risk reduction and management ?

Climate data analysis is crucial for disaster risk reduction and management. It helps identify high-risk areas, predict future weather patterns, develop mitigation strategies, and enhance disaster response and recovery efforts. By analyzing past and current climate data, we can better prepare for and respond to natural disasters such as floods, hurricanes, wildfires, and droughts.

How does climate change affect disaster risk management strategies ?

The article discusses how climate change affects disaster risk management strategies. It explains that as the Earth's climate warms, extreme weather events such as hurricanes, floods, and wildfires are becoming more frequent and severe. This means that disaster risk management strategies must be adapted to address these new challenges. The article explores the increased frequency of extreme weather events, changes in agriculture and food security, and impacts on human health. It suggests that disaster risk management strategies should focus on improved forecasting, infrastructure improvements, evacuation planning, sustainable farming practices, crop diversification, food storage and distribution systems, healthcare infrastructure, public health education, and disease surveillance. By taking these steps, we can better prepare for and respond to natural disasters in a changing climate.

How can I invest in stocks with a minimal risk ?

How to Invest in Stocks with Minimal Risk Investing in stocks can be risky, but there are strategies to minimize these risks. Diversification across stocks, sectors, and asset classes is crucial. Dollar-cost averaging helps smooth market fluctuations. Stop-loss orders limit potential losses. Long-term investing allows for market recoveries. Understanding the companies you invest in reduces unknown risks. Start small and learn as you go, staying informed about financial news. Working with a financial advisor can provide personalized guidance. Remember, no investment is completely risk-free, so assess your comfort level before making decisions.