Private Charging

What role do private companies play in building and operating EV charging networks ?

Private companies play a pivotal role in the development and operation of electric vehicle (EV) charging networks, contributing to infrastructure development, network operation, partnerships and collaboration, and data analysis and optimization. They are involved in planning, design, construction, technology innovation, maintenance, management, customer service, pricing strategies, public-private partnerships, industry alliances, community engagement, performance tracking, and market research. Their efforts ensure that EV charging infrastructure is developed efficiently, innovatively, and with the end-user in mind.

What role do private companies play in the development of charging networks ?

The role of private companies is essential in the development of charging networks for electric vehicles (EVs). They contribute to infrastructure deployment, technology advancement, financing, customer service, and collaboration with other stakeholders. However, they face challenges such as regulatory hurdles and economic viability concerns. Private companies will continue to play a crucial role in shaping the future of sustainable transportation.

How can cities with limited space accommodate the construction of charging networks ?

In cities where space is scarce, building charging networks for EVs requires creative solutions. Public-private partnerships, smart urban design, and repurposing underutilized spaces are among the strategies that can help integrate charging infrastructure into compact city environments. Encouraging residential charging, investing in modular and mobile units, implementing digital management systems, and integrating charging infrastructure into public transit systems are also effective approaches. By employing these tactics, cities can create a robust charging network that supports electric vehicle adoption, even in densely populated areas with limited space.

What is the impact of charging network availability on the adoption of electric vehicles ?

The impact of charging network availability on the adoption of electric vehicles is significant. Factors such as range anxiety, charging time, and the cost of building and maintaining charging infrastructure can influence consumer confidence in EVs. Strategies to improve charging network availability include public-private partnerships, incentives and regulations, and innovation in charging technology. A well-developed charging network can alleviate concerns about EVs and accelerate their adoption.

What are the challenges in building a nationwide charging network ?

**Summary:** Building a nationwide charging network for electric vehicles (EVs) presents several challenges that can be categorized into technical, infrastructure, financial, and social/environmental aspects. Technical challenges include ensuring scalability, compatibility, reliability, energy management, and fast charging capabilities. Infrastructure challenges involve achieving comprehensive coverage, site selection, infrastructure development, land use and zoning compliance, and maintenance operations. Financial challenges encompass high initial costs, return on investment, funding sources, pricing strategies, and economic viability assessment. Social and environmental challenges include gaining public acceptance, education and awareness, minimizing environmental impact, ensuring equitable access, and regulatory compliance. Addressing these challenges is crucial for the successful implementation and long-term success of a nationwide charging network for EVs.

Can I use a wireless charging pad for fast charging my iPhone ?

Can you use a wireless charging pad for fast charging your iPhone? Yes, but there are important considerations. First, ensure your iPhone model supports wireless charging (iPhone 8 and later). Second, choose a Qi-certified wireless charging pad that supports fast charging. While wireless fast charging isn't as fast as wired fast charging, it's still faster than traditional wireless charging. Follow the steps outlined to enjoy the convenience of wireless charging with relatively fast charging speeds for your iPhone.

How do different types of charging stations (e.g., fast charging, slow charging) affect the overall network design ?

The impact of different types of charging stations on the overall network design can be seen in various aspects such as infrastructure, cost, energy consumption, and user experience. Fast charging requires higher power output and specialized equipment, leading to more expensive installation and maintenance costs and increased energy consumption. Slow charging has less stringent infrastructure requirements and is more cost-effective but may not meet the needs of users who require quick charges. The overall network design needs to consider these trade-offs and ensure that the grid remains stable and reliable while providing a good user experience for all types of charging needs.

How much faster is fast charging compared to regular charging on an iPhone ?

Fast charging on an iPhone is significantly faster than regular charging, saving time when quickly charging the device. However, frequent use of fast charging may impact battery health over time, so it's recommended to use it only when necessary and not as a regular charging method.

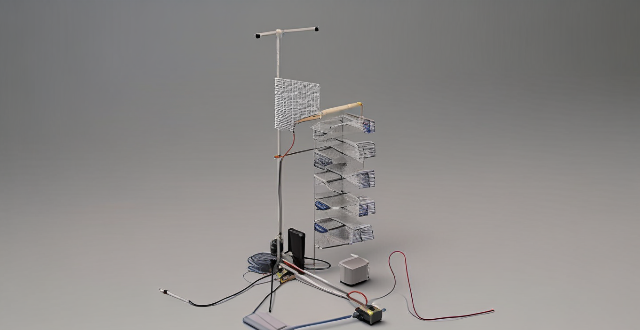

How does a super fast charging station work ?

Super fast charging stations rapidly charge electric vehicles (EVs) using complex technology involving multiple components. The power supply, charging equipment, and battery management system (BMS) are key elements in the process. The BMS monitors and controls the charging to ensure safety and efficiency. Challenges include potential impacts on battery health, infrastructure costs, and standardization issues across different EV models. As EV popularity increases, advancements in super fast charging technology will be vital for convenience and accessibility.

How do electric car charging stations work ?

Electric car charging stations are essential facilities for powering electric vehicles, utilizing off-board conductive charging to transfer electricity. They come in three main types based on power output and charging speed: Level 1 (slowest, using standard domestic sockets), Level 2 (faster, requiring special EV charging units), and DC Fast Charging (Level 3, fastest, primarily for highway use). The charging process involves connecting the charger, activating it, transferring power (AC for Level 1&2, DC for Level 3), regulating and monitoring battery charging, and disconnecting once complete. Safety features include GFCIs, temperature monitoring, and smart software. Environmental impact depends on the electricity source; green energy sources enhance sustainability, while fossil fuels reduce benefits. As technology advances, these stations will contribute more significantly to a cleaner transport sector.

Can all electric vehicles use a super fast charging station ?

Electric vehicles (EVs) follow different charging standards and protocols that dictate the speed at which they can be charged. The type of battery technology used in an EV also affects its compatibility with super-fast charging, as some batteries may not be able to handle the high power output without damage or reduced lifespan. Manufacturers design their vehicles to work best with specific charging infrastructure, and not all EVs are equipped to take full advantage of super-fast charging. Safety concerns related to heat generation during super-fast charging must also be considered. Therefore, it is essential for EV owners to understand their vehicle's capabilities and limitations when it comes to charging options.

What are the benefits of using a super fast charging station ?

Using a super-fast charging station for electric vehicles offers benefits including time efficiency, convenience, battery health optimization, environmental considerations, economic benefits, and improved user experience. These charging stations enable rapid recharging, reduce range anxiety, optimize battery lifespan, support the use of renewable energy sources, lower operational costs, and provide peace of mind for EV drivers. As technology advances, further improvements in charging infrastructure are expected to enhance these advantages.

How can I enable fast charging on my iPhone ?

Fast charging is a feature that allows your device to charge more quickly than traditional methods. If you have an iPhone 8 or later model, you can take advantage of fast charging by using a compatible charger and cable. Here's how to enable fast charging on your iPhone: Check compatibility, get the right charger and cable, plug in your iPhone, start charging, and enjoy faster charging times.

Are there any specific cables or adapters required for fast charging an iPhone ?

Fast charging an iPhone is convenient but requires specific components: a compatible model, USB-C to Lightning Cable, USB-C power adapter, and a reliable power source. Regular charging may be beneficial for maintaining battery health over time.

What are the best fast charging solutions for iPhones ?

The article discusses various fast charging solutions for iPhones, including Apple's official 18W USB-C Power Adapter and MagSafe Charger, as well as third-party options like Anker Nano II, Belkin Boost Charge Pro, and RAVPower 18W PD Pioneer. Tips for faster charging include using a USB-C to Lightning cable, avoiding wireless charging, turning off the iPhone or reducing screen brightness during charging, and choosing reliable and certified products to avoid damage or safety issues.

How can governments promote the development of charging networks ?

Governments can promote the development of charging networks for electric vehicles by implementing financial incentives, regulatory support, public-private partnerships, and public awareness campaigns. These strategies aim to reduce costs, update building codes, establish data standards, collaborate on infrastructure planning, and educate the public about the benefits of EVs and charging networks.

What are the benefits of investing in private equity ?

Investing in private equity offers higher potential returns, diversification benefits, active management and control, access to unique opportunities, tax efficiency, and a disciplined approach to investing. However, it also comes with risks such as illiquidity, high entry barriers, and the need for specialized knowledge. Proper due diligence and consideration of one's overall investment objectives and risk tolerance are essential before committing capital to private equity.

Will Apple's upcoming iPhone models support even faster charging solutions ?

The article discusses the possibility of Apple's upcoming iPhone models supporting faster charging solutions. It explains the current charging solutions used by Apple and compares them to competitors. Rumors about larger charging coils and improved heat dissipation mechanisms are also mentioned. The potential benefits of faster charging, such as reduced downtime and improved convenience, are discussed. However, challenges like battery health and heat management must be considered. The conclusion states that there is no official confirmation from Apple regarding faster charging solutions in its upcoming iPhone models, but rumors suggest that this feature is being considered.

Are fast charging car chargers safe to use ?

Fast charging car chargers have raised safety concerns due to risks such as overheating, battery degradation, and electrical hazards. To ensure safe use, it is recommended to use approved chargers, follow manufacturer's guidelines, monitor charging temperatures, avoid overcharging, inspect wiring and connections, use a surge protector, and store the charger properly. By following these tips, the risks associated with fast charging can be minimized.

What are the main challenges in expanding electric vehicle charging infrastructure ?

The expansion of electric vehicle (EV) charging infrastructure faces several challenges, including economic and financial barriers, technological and compatibility issues, logistical and planning challenges, regulatory and policy hurdles, and social and cultural factors. Addressing these challenges through collaborative efforts between governments, industry stakeholders, and consumers can accelerate the expansion of EV charging infrastructure and pave the way for a more sustainable transportation future.

How has private investment impacted the development of space technology ?

Private investment has significantly impacted space technology development by increasing research and development funding, reducing costs, improving efficiency, and driving innovation. Private companies like SpaceX and Blue Origin have made advancements in reusable rockets, satellite communications, and lunar exploration. These investments have also enabled new business models and increased accessibility to space for smaller organizations.

How do super fast charging stations compare to traditional gas stations in terms of convenience and efficiency ?

Super fast charging stations offer greater convenience and efficiency compared to traditional gas stations. They are strategically located, offer faster charging speeds, provide multiple payment options, consume less energy, and have a lower environmental impact.

How does private equity affect corporate governance ?

Private equity (PE) plays a significant role in shaping the governance of companies. It can have both positive and negative impacts on corporate governance, depending on various factors such as the PE firm's strategy, the nature of the investment, and the target company's existing governance structure. This article will explore the ways in which private equity affects corporate governance. ### Positive Impacts of Private Equity on Corporate Governance - **Improved Decision-Making Processes**: Private equity firms often bring fresh perspectives and expertise to the decision-making processes within a company. They may introduce new management practices or technologies that enhance efficiency and productivity. This can lead to better strategic planning and more informed decisions being made by the board of directors. - **Greater Transparency and Accountability**: Private equity investors typically demand greater transparency and accountability from the companies they invest in. This can result in improved financial reporting, regular board meetings, and increased communication between management and shareholders. Such measures help to ensure that all stakeholders are kept informed about the company's performance and future plans. - **Increased Focus on Long-Term Value Creation**: Private equity firms generally have a long-term investment horizon, which means they are more likely to focus on creating value over the long term rather than pursuing short-term gains. This can lead to a greater emphasis on sustainable growth, innovation, and responsible business practices. ### Negative Impacts of Private Equity on Corporate Governance - **Potential Conflicts of Interest**: Private equity investors may have conflicts of interest with other stakeholders, such as employees, customers, or suppliers. For example, a PE firm might push for cost-cutting measures that negatively impact employee morale or customer satisfaction. These conflicts can undermine good governance practices and harm the company's reputation. - **Pressure for Short-Term Profits**: While some private equity firms focus on long-term value creation, others may prioritize short-term profits at the expense of long-term sustainability. This can lead to excessive risk-taking, aggressive financial engineering, or even fraudulent activities aimed at boosting short-term earnings. Such behaviors can ultimately damage the company's reputation and financial health. - **Lack of Diversity in Board Composition**: Private equity firms often control a majority of the seats on a company's board of directors. This can limit diversity in terms of gender, ethnicity, and professional background among board members. A lack of diversity can lead to groupthink and reduce the effectiveness of the board in providing independent oversight and guidance to management. In conclusion, private equity has both positive and negative effects on corporate governance. The key is for PE firms to balance their pursuit of profit with a commitment to ethical business practices and responsible stewardship of the companies they invest in. By doing so, they can help build stronger, more sustainable businesses that benefit all stakeholders.

Is there a significant difference in fast charging performance between different iPhone models ?

The article discusses the differences in fast charging capabilities between various iPhone models. It mentions that iPhone 8 and later models support fast charging up to 18W using a compatible USB-C power adapter and Lightning to USB-C cable. The iPhone 11 Pro and iPhone 11 Pro Max can charge up to 18W with their included USB-C to Lightning Cable and Power Adapter. The iPhone 12 series introduces MagSafe wireless charging with up to 15W of power, while the iPhone 13 series maintains 18W wired charging and improves MagSafe wireless charging to up to 15W. The article also mentions that the iPhone 14 series is expected to support even faster charging speeds, potentially reaching 30W or higher. Overall, the article highlights the improvements in fast charging capabilities across different iPhone models.

What are some notable private equity firms ?

Private equity firms are investment companies that pool funds from various investors to acquire and manage private companies, typically investing in undervalued or distressed businesses, restructuring them, and selling them at a profit. Some of the most notable private equity firms include Blackstone Group, The Carlyle Group, Kohlberg Kravis Roberts & Co. (KKR), TPG Capital, and Warburg Pincus. These firms have diverse portfolios and investment strategies, with assets under management ranging from $600 billion to $79 billion as of 2022.

How does private equity differ from public equity ?

Private equity and public equity are two different types of investment vehicles that offer distinct characteristics, benefits, and risks. Private equity refers to investments in companies that are not publicly traded on stock exchanges, while public equity refers to investments in companies that are publicly traded on stock exchanges. Key differences between private equity and public equity include accessibility, liquidity, regulation, investment horizon, and returns. Private equity investments are typically only available to accredited investors, such as institutional investors, high net worth individuals, and family offices. Public equity investments are more accessible to a wider range of investors, as anyone can buy shares of publicly traded companies on stock exchanges. Private equity investments are generally illiquid, meaning it can be difficult to sell your stake in a company if you need to exit the investment. Public equity investments are highly liquid, as shares of publicly traded companies can be easily bought and sold on stock exchanges. Private equity firms are not subject to the same level of regulation as publicly traded companies. This allows them greater flexibility in managing their investments and making strategic decisions without the scrutiny of public markets. Publicly traded companies are subject to strict regulations and reporting requirements set by regulatory bodies such as the Securities and Exchange Commission (SEC). Private equity investments typically have a longer investment horizon than public equity investments. This is because private equity firms focus on long-term growth and value creation within the companies they invest in. Public equity investments can be held for shorter periods of time, as investors can easily buy and sell shares on stock exchanges based on market conditions and personal financial goals. Private equity investments often aim for higher returns than public equity investments, as they involve higher levels of risk and illiquidity. However, these returns are not guaranteed and depend on the success of the companies being invested in. Public equity investments may offer more stable returns over time, as publicly traded companies tend to be more established and have a proven track record of financial performance. In conclusion, private equity and public equity offer different advantages and disadvantages depending on an investor's goals, risk tolerance, and investment horizon. It is important for investors to carefully consider their investment objectives and risk profile before choosing between private equity and public equity investments.

What factors should be considered when planning the location of charging stations ?

When planning the location of charging stations, several factors must be considered to ensure their effectiveness and accessibility. These factors include demand analysis, geographic considerations, infrastructure availability, economic factors, environmental impact, user experience, and technology advancements. By considering these factors, planners can ensure that charging stations are strategically located to meet the needs of electric vehicle owners while also considering economic, environmental, and societal impacts.

Are there any safety concerns with using a super fast charging station ?

The text discusses the safety concerns associated with using a super fast charging station, such as potential damage to the battery and risk of overheating. It also highlights other safety concerns like electrical shock, poor quality chargers, and overcharging. The text emphasizes the importance of taking proper precautions and following safety guidelines to minimize these risks.

Can private sector investments play a significant role in climate financing ?

The article discusses the potential of private sector investments in climate financing, highlighting their current involvement and potential impact on various aspects such as access to larger pools of capital, innovation, risk management, and scaling up successful approaches. It also addresses challenges and considerations like alignment with public goals, transparency, inclusivity, and regulatory frameworks. The conclusion emphasizes the importance of collaboration between public and private sectors for effective utilization of private capital in climate action.

What is the average cost of using a super fast charging station ?

The average cost of using a super fast charging station can vary depending on several factors, such as location, time of day, and type of vehicle. Urban areas tend to have higher prices due to increased demand and limited availability of charging infrastructure, while rural or less populated areas may offer lower rates. Many charging stations implement time-of-use pricing, with off-peak hours during late night or early morning being cheaper than peak hours during rush hour traffic. The size of your electric vehicle's battery and its maximum charging capacity can also affect the overall cost, with larger batteries requiring more energy to charge and potentially resulting in higher costs. The estimated range for the average cost of using a super fast charging station is $0.20 - $1.00 per kWh, but actual costs may vary widely depending on local conditions and specific charging providers.