Enhance Cross

What is the role of cross-training in marathon preparation ?

Cross-training is a vital component of marathon preparation that involves incorporating different forms of exercise into your training routine to improve overall fitness, prevent injuries, and enhance performance. The benefits of cross-training include improved cardiovascular fitness, reduced risk of injuries, enhanced muscle balance and flexibility, and a mental break from running. Some types of cross-training activities include cycling, swimming, yoga/Pilates, and strength training. Incorporating these activities into your training routine can help you achieve your marathon goals.

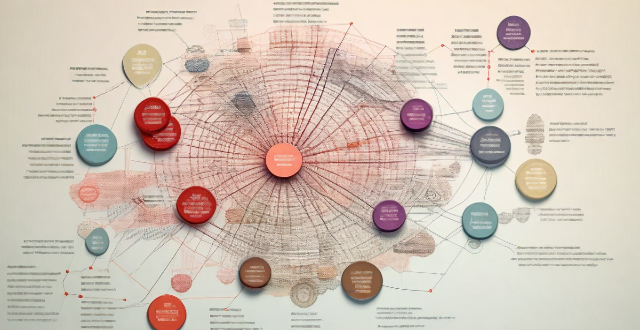

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

What is the balance between specialized training and cross-training for optimal sports performance ?

In the realm of sports performance, achieving a balance between specialized training and cross-training is crucial for athletes to reach their peak potential. Specialized training focuses on improving skills, techniques, and strategies specific to an athlete's chosen sport, while cross-training involves engaging in other forms of exercise or activities that complement and enhance overall fitness and athleticism. This article explores the importance of finding the right balance between these two approaches and how it can lead to optimal sports performance. Specialized training helps athletes develop sport-specific skills, fitness, and mental preparation, while cross-training promotes injury prevention, overall fitness, and mental health. Achieving the right balance depends on various factors such as an athlete's goals, age, experience level, and individual needs. Tips for finding the right balance include assessing goals, consulting with professionals, monitoring your body, incorporating variety, and staying motivated. By finding the right balance between specialized training and cross-training, athletes can optimize their sports performance while minimizing the risk of injury and maintaining overall health and well-being.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

How can cross-contamination be prevented in a commercial kitchen ?

Cross-contamination is a significant concern in commercial kitchens, where food safety and quality are paramount. To prevent it, strict procedures and practices must be implemented to minimize the risk of harmful bacteria or allergens spreading from one food item to another. Key strategies include using separate cutting boards and utensils for different types of food, proper handling of raw foods, sanitizing work surfaces and equipment, avoiding cross-contact during cooking, safe storage practices, allergen management, and maintaining personal hygiene and staff training. By implementing these practices, you can significantly reduce the risk of cross-contamination in your commercial kitchen, ensuring that your customers receive safe and high-quality meals every time.

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

How can educational games be designed to effectively enhance learning ?

Designing educational games that effectively enhance learning involves a combination of educational theory, game design principles, and an understanding of the target audience. To create engaging and effective educational games, it is crucial to identify learning objectives, understand the target audience, incorporate educational theory, use engaging game mechanics, incorporate multimedia elements, provide opportunities for practice and repetition, include assessment and feedback mechanisms, foster collaboration and social interaction, and iterate and refine the game. By following these guidelines, you can design educational games that effectively enhance learning by engaging players, providing meaningful experiences, and fostering long-term retention of knowledge and skills.

Can social media platforms be used to enhance social harmony ?

Can social media platforms be used to enhance social harmony? The text discusses the positive impact of social media on social harmony, including connectivity and communication, sharing information and ideas, and civic engagement and activism. However, it also highlights challenges and risks such as misinformation and fake news, online harassment and cyberbullying, and echo chambers and polarization. The conclusion states that social media platforms have the potential to enhance social harmony, but challenges must be addressed to ensure their positive impact.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

What kind of accessories are appropriate and enhance a woman's professional image ?

In the article "Appropriate Accessories to Enhance a Woman's Professional Image," the author discusses the importance of selecting the right accessories to enhance a woman's professional image. The author suggests that women should keep their jewelry simple and understated, opt for classic timepieces, choose structured handbags that are large enough to carry essentials yet sleek enough to maintain a polished appearance, select well-chosen scarves in neutral colors, and consider ties or blazers for more formal settings. Overall, the key points emphasize the importance of keeping accessories simple, sophisticated, and practical to achieve a polished and professional look.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

How does Cross-Border Payment impact global trade ?

Cross-border payment plays a crucial role in the global trade ecosystem by enabling businesses to buy and sell goods and services internationally. It reduces transaction costs, enhances transparency and efficiency, and promotes economic growth. However, challenges related to regulatory compliance, currency fluctuations, and technological barriers need to be addressed.

Can I use Cross-Border Payment for personal transactions ?

Cross-border payment systems are designed to facilitate international transactions, allowing individuals and businesses to send and receive money across borders. These systems can be used for various purposes, including personal transactions. In this article, we will discuss the use of cross-border payment systems for personal transactions and provide some tips on how to make the most of them. Cross-border payment refers to the process of transferring money from one country to another. This can be done through various methods, such as wire transfers, credit cards, or digital wallets. The main purpose of cross-border payment systems is to simplify the process of sending and receiving money internationally, making it easier for people to conduct business or personal transactions with others around the world. While cross-border payment systems are primarily used for business transactions, they can also be used for personal transactions. Here are some examples of when you might use a cross-border payment system for personal transactions: Sending Money to Friends and Family Abroad: If you have friends or family members living in another country, you may need to send them money occasionally. Cross-border payment systems allow you to do this quickly and easily, without having to worry about exchange rates or bank fees. Paying for Online Shopping: Many online retailers offer international shipping, allowing you to purchase goods from other countries. When paying for these purchases, you can use a cross-border payment system to ensure that your payment is processed securely and efficiently. Travel Expenses: When traveling abroad, you may need to pay for expenses such as accommodation, transportation, or food. Cross-border payment systems can be useful in these situations, as they allow you to make payments in local currencies without having to carry large amounts of cash. To make the most of cross-border payment systems for personal transactions, consider the following tips: Choose the Right Provider: Not all cross-border payment systems are created equal. Some may offer better exchange rates or lower fees than others. Research different providers before choosing one to ensure that you get the best deal possible. Understand Fees and Exchange Rates: Before making any cross-border payment, be sure to understand the fees and exchange rates involved. Some providers may charge additional fees for certain types of transactions, so it's important to know what you're getting into before sending money. Keep Track of Your Transactions: When using cross-border payment systems for personal transactions, it's important to keep track of your transactions. This will help you stay organized and ensure that you don't overspend or lose track of your finances. Be Aware of Scams: Unfortunately, there are scammers who target people using cross-border payment systems. Be cautious when sharing personal information or sending money to someone you don't know well. If something seems suspicious, trust your instincts and report it to the appropriate authorities. In conclusion, cross-border payment systems can be a convenient and efficient way to handle personal transactions with people in other countries. By choosing the right provider, understanding fees and exchange rates, keeping track of your transactions, and being aware of potential scams, you can make the most of these systems and enjoy smoother international financial interactions.

How can parents use technology to enhance home teaching strategies for their children ?

This text discusses how parents can use technology to enhance their home teaching strategies for their children. It suggests using interactive learning apps, online tutoring services, educational websites, and virtual reality/augmented reality technologies as tools to create a richer and more engaging learning environment. The text emphasizes the benefits of these technologies, including personalized attention, flexibility, access to expert tutors, enhanced engagement, improved retention, and increased accessibility.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

What fees are associated with Cross-Border Payment ?

Cross-border payments are subject to various fees, including transfer fees, exchange rate markups, receiving fees, and intermediary bank fees. Understanding these fees is crucial for cost-effective international money transfers.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How do I track my Cross-Border Payment transaction ?

Cross-border payments can be tracked using various methods such as obtaining key information, utilizing online banking services, contacting the bank directly, using third-party tracking services, staying informed with updates, understanding time frames, confirming receipt with the beneficiary, and monitoring for errors or fraud. It is essential to collect all necessary transaction details before initiating a transfer, including the transaction ID, beneficiary details, date of transfer, amount, and expected delivery date. Most banks provide online services that allow customers to track their transactions, while some financial service providers offer tracking tools specifically designed for cross-border payments. Staying informed with updates through email or SMS notifications is crucial, along with understanding typical time frames for different types of transactions. Confirming receipt with the beneficiary and monitoring for any errors or fraud throughout the process are also important steps to ensure a smooth and secure transaction.

How can cross-contamination be prevented in a kitchen ?

Cross-contamination in kitchens can be prevented through various methods, including maintaining personal hygiene, proper food preparation, using correct cooking techniques, implementing appropriate storage practices, following cleaning routines, and managing waste effectively. These practices are crucial for ensuring food safety and avoiding foodborne illnesses.

What happens if my Cross-Border Payment transaction fails ?

If your cross-border payment transaction fails, itIf your cross-border payment transaction fails, it reasons such as insufficient funds it can be due to several reasons such as insufficient funds, invalid recipient information, transfer limit exceeded, technical issues, or fraud detection. It is important to identify the reason behind it and take appropriate action to resolve the issue and complete the transaction successfully.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

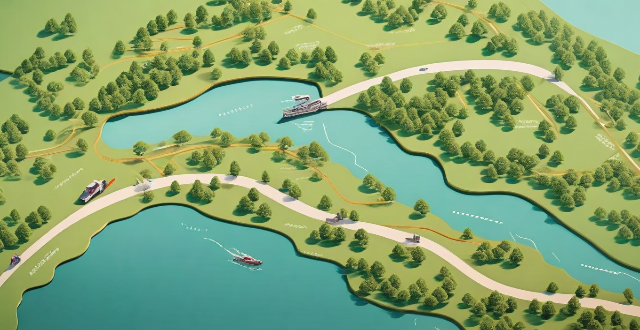

How do I plan a cross-country cycling route ?

Planning a cross-country cycling route involves determining the starting and ending points, choosing a suitable route, planning daily mileage, booking accommodations/campsites, and packing necessary gear. Factors to consider include distance, terrain, weather conditions, safety concerns, travel restrictions, fitness level, budget, and preferences. Tools like Google Maps, Bikely, or Komoot can help customize the route based on distance, elevation gain, and surface type. Aim for 50-70 miles per day if experienced or 30-40 miles if new to long-distance cycling. Pack spare tubes, pump, multi-tool, first aid kit, food, water, and appropriate clothing for expected weather conditions.

How can I make sure my GPS is updated for a cross-country road trip ?

To prepare for a cross-country road trip, it's essential to ensure your GPS is up-to-date. Here are the key steps: 1. **Check Compatibility**: Ensure your device can receive updates. 2. **Connect to the Internet**: Use a reliable connection for downloading updates. 3. **Visit Manufacturer's Website**: Follow instructions to update your GPS. 4. **Download and Install Updates**: Include map updates and software patches. 5. **Verify the Update**: Check that updates have been successfully applied. 6. **Test the Device**: Ensure it functions correctly with the new updates. Additional tips include backing up data, checking for firmware updates, ensuring the device is charged, and planning ahead to avoid last-minute rushes.