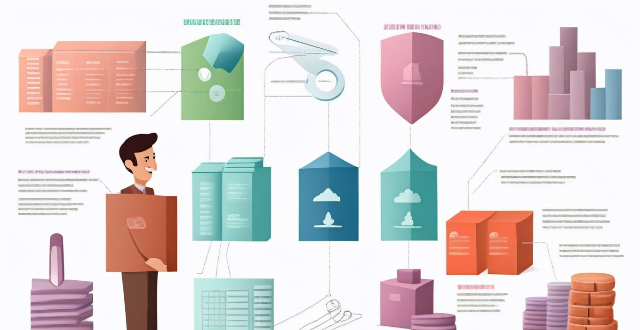

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

What is Cross-Border Payment?

Cross-border payment refers to the transfer of money from one country to another. It involves the exchange of currencies and the use of various payment methods to complete the transaction. Cross-border payments are essential for businesses that operate in multiple countries, as they allow them to receive and make payments in different currencies.

Key Features of Cross-Border Payments:

- Currency Exchange: Cross-border payments involve the conversion of one currency into another, which can be done through banks or specialized financial institutions.

- Payment Methods: There are various payment methods available for cross-border transactions, including wire transfers, credit cards, e-wallets, and digital currencies.

- Regulations: Cross-border payments are subject to regulations and compliance requirements imposed by both the sending and receiving countries. These regulations may include anti-money laundering (AML) and know your customer (KYC) policies.

- Fees and Charges: Cross-border payments often come with fees and charges, such as transfer fees, foreign transaction fees, and currency conversion fees. These costs can vary depending on the payment method and the amount being transferred.

- Timeframes: The time it takes for a cross-border payment to be processed can vary depending on the payment method and the countries involved. Some transactions can be completed within a few hours, while others may take several days.

Benefits of Cross-Border Payments:

- Global Expansion: Cross-border payments enable businesses to expand their operations globally by allowing them to receive and make payments in different currencies.

- Increased Sales: By accepting payments in multiple currencies, businesses can attract more customers from around the world, leading to increased sales and revenue.

- Reduced Costs: Some cross-border payment methods offer lower fees and better exchange rates than traditional bank transfers, which can help businesses save money on international transactions.

- Improved Cash Flow: Faster cross-border payment methods can help businesses improve their cash flow by reducing the time it takes to receive payments from overseas customers.

In conclusion, cross-border payments play a crucial role in facilitating international trade and business expansion. By understanding the key features, benefits, and potential challenges associated with cross-border payments, businesses can make informed decisions about which payment methods to use and how to manage their international transactions effectively.