Carbon Practice

What are some effective ways to practice social distancing in daily life ?

Effective ways to practice social distancing include staying at home as much as possible, keeping a safe distance from others, wearing a mask or face covering in public, washing hands frequently, cleaning and disinfecting high-touch surfaces, and following respiratory etiquette. These practices can help slow the spread of infectious diseases and protect individuals and communities.

What is the best way to practice speaking a new language ?

The article provides a summary of the best ways to practice speaking a new language, which include immersing oneself in the language, speaking frequently and without fear of making mistakes, practicing regularly, focusing on pronunciation and fluency, and learning through real-life conversations. Consistency and practice are emphasized as key factors in improving language skills.

What is the best time of day to practice yoga poses ?

Yoga offers numerous benefits for both the body and mind. The best time of day to practice yoga poses varies from person to person, depending on individual schedules, preferences, and needs. Morning sessions can kickstart metabolism and improve mental clarity, midday practices can relieve stress and rejuvenate the body, while evening yoga can help relax and prepare for sleep. Consistency is key in any yoga practice, so find what works best for you and maintain regularity for optimal results.

How do professional athletes train and practice ?

Professional athletes engage in comprehensive training and practice routines to excel in their sports. Their regimens include physical conditioning through cardiovascular exercises, strength training, and flexibility practices. They also focus on technical skill development through repetitive drills, scrimmages, video analysis, and virtual reality training. Mental preparation is equally important, involving visualization techniques and sports psychology consultations. Recovery and regeneration strategies encompass proper nutrition, sleep habits, and active recovery methods like light exercise and massage therapy. These components all work together to ensure athletes reach peak performance while minimizing the risk of injury.

How often should I practice easy yoga poses to see results ?

The article discusses how often one should practice easy yoga poses to see results. Consistency is crucial, and beginners should aim for two to three times per week while intermediate practitioners can increase frequency to four or five times per week. Advanced practitioners may benefit from practicing six or seven times per week but should listen to their body and rest when needed. Quality is more important than quantity, and tips for maximizing your yoga practice include mixing up poses, using props, staying present, and practicing mindfulness.

How often should I practice to see improvement in my golf skills ?

Golf improvement requires consistent practice, and the frequencyGolf improvement requires consistent practice, and the frequency your skill level, goals, and the frequency of your sessions depends on your skill level, goals, and availability. Assess your current skill level and set realistic goals to create a practice plan that includes both on-course and off-course activities. Beginners should aim for at least three practice sessions per week, while intermediates can do two to three and advanced players one or two. Make each session count by focusing on specific goals and tracking progress. Consistency is key, so stick to your practice plan and adjust it as needed based on your progress.

Can sports be considered a form of worship or spiritual practice ?

The provided text discusses the possibility of considering sports as a form of worship or spiritual practice. It explores the psychological and emotional benefits, community building, and mindfulness aspects of sports, suggesting that they offer experiences similar to those found in traditional spiritual practices. While sports may not be seen as a conventional form of worship, they can serve as a secular equivalent of spiritual practice, offering personal growth, connection, and inner peace.

How effective is a carbon tax in reducing greenhouse gas emissions ?

A carbon tax is a fee on burning carbon-based fuels aimed at reducing greenhouse gas emissions. It creates economic incentives for behavior change, technology innovation, and revenue generation. The effectiveness depends on rate setting, equity concerns, compliance, political feasibility, and international coordination.

How many times a week should I practice yoga poses to see results ?

Practicing yoga poses is an excellent way to improve your flexibility, strength, and overall well-being. However, the frequency of your practice can greatly impact the results you achieve. In this article, we will discuss how many times a week you should practice yoga poses to see noticeable improvements in your physical and mental health. Before determining the ideal number of yoga sessions per week, it's essential to consider several key factors: your current fitness level and experience with yoga, the amount of time you can dedicate to each session, and your specific goals (e.g., increased flexibility, stress relief, muscle building). By taking these factors into account, you can create a personalized yoga routine that suits your needs and helps you achieve your desired outcomes. For beginners, starting with two or three sessions per week is generally recommended. This allows your body to gradually adapt to the postures and prevents overexertion or injury. As you become more comfortable with the practice, you can gradually increase the frequency of your sessions. Once you have established a consistent yoga practice and gained some experience, increasing the frequency of your sessions can help you continue to see progress. For intermediate practitioners, aiming for four to five sessions per week is often beneficial. This allows you to maintain your current level of flexibility and strength while also challenging yourself to try more advanced postures and sequences. Advanced yogis who have been practicing for several years may choose to practice daily or even multiple times per day. This level of commitment requires a significant amount of time, discipline, and dedication but can lead to profound transformations in both physical ability and mental clarity. Regardless of how frequently you choose to practice yoga poses, there are several tips that can help you maximize the benefits of your sessions: set clear goals, mix up your routine, stay hydrated, and listen to your body. By following these guidelines and adjusting your frequency based on your individual needs and goals, you can create a yoga practice that leads to lasting improvements in both your physical and mental well-being.

How important is hands-on practice in personal safety training compared to theoretical knowledge ?

In today's world, personal safety training is crucial to ensure individuals can protect themselves from potential threats and risks. While theoretical knowledge provides a foundation for understanding these risks, hands-on practice is essential for effective training. Hands-on practice provides a realistic experience that allows individuals to apply what they have learned in real-life situations. It also helps develop skills that can be applied across various scenarios, reinforces learning, and builds confidence. Therefore, incorporating hands-on practice into personal safety training programs is crucial for individuals to develop the skills needed to respond appropriately to threats and risks in real-life situations.

Can environmental subsidy policies help reduce carbon emissions ?

Environmental subsidy policies can help reduce carbon emissions by promoting renewable energy, enhancing energy efficiency, supporting waste reduction initiatives, and funding research and development of carbon capture and storage technologies. However, these policies must be carefully designed and adequately funded to avoid market distortions and ensure long-term sustainability without creating dependence on government support.

How can a carbon tax be designed to minimize negative impacts on businesses ?

A carbon tax is a fee on burning carbon-based fuels to reduce emissions and promote clean energy. To minimize its negative impact on businesses, consider gradual implementation, incentives for innovation, clear policy, revenue neutrality, support for affected industries, collaboration, and monitoring. This balances environmental goals with economic realities for sustainable development.

How effective are reforestation efforts in offsetting carbon emissions ?

Reforestation efforts can effectively offset carbon emissions by sequestering carbon dioxide through photosynthesis. Factors influencing its effectiveness include the type of trees planted, location and soil quality, management practices, and timescale. Challenges such as saturation points, land availability, biodiversity concerns, and water resources impact also need to be considered. A balanced approach combining reforestation with other strategies is necessary for meaningful climate change mitigation.

How do carbon credits differ from carbon taxes ?

Carbon credits and carbon taxes are two distinct mechanisms that aim to reduce greenhouse gas emissions and mitigate climate change. While both strategies involve a financial incentive to encourage companies and individuals to reduce their carbon footprint, they operate differently in terms of their structure, implementation, and impact. Carbon credits represent a certificate or a tradable allowance proving that a specific amount of carbon dioxide (or its equivalent in other greenhouse gases) has been reduced, avoided, or sequestered by an emission-reducing project. Companies or countries can earn carbon credits by investing in projects that reduce emissions below a certain baseline, such as renewable energy projects or reforestation efforts. These credits can then be sold to entities that are looking to offset their own emissions or meet regulatory requirements. The price of carbon credits is determined by supply and demand in markets where they are traded. On the other hand, a carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas) that are responsible for greenhouse gas emissions. Governments set a tax rate per ton of CO2 emitted, which is paid by companies and sometimes individuals using fossil fuels. The goal is to make polluting activities more expensive, thereby encouraging a shift towards cleaner alternatives. Carbon taxes are typically implemented at a national level through legislation. The revenue generated from the tax can be used to fund environmental initiatives or be returned to taxpayers in various ways. Key differences between carbon credits and carbon taxes include their regulatory vs. voluntary nature, direct vs. indirect incentives, and price certainty vs. market fluctuation. Carbon taxes offer price certainty for businesses when planning expenses, while carbon credit prices can fluctuate based on market demand and the success of emission reduction projects. In summary, both carbon credits and carbon taxes serve important roles in addressing climate change, but they do so through different means and with different outcomes.

Are zinc-carbon batteries safe to use ?

Zinc-carbon batteries are a common type of battery used in many household devices, such as flashlights, remote controls, and toys. While they are generally safe to use, there are some precautions that should be taken to ensure their proper handling and disposal. These include avoiding short circuits by keeping the terminals from touching each other or any metal objects, storing them in a cool, dry place away from extreme temperatures and out of reach of children and pets, and disposing of them properly at a recycling center or store that accepts used batteries. Despite these precautions, zinc-carbon batteries offer several benefits, including being cost-effective, widely available, and having a long shelf life.

What are the benefits of carbon sequestration in reducing global warming ?

Carbon sequestration helps to reduce greenhouse gas emissions and stabilize climate conditions, leading to improved air quality and public health. It also promotes sustainable development by supporting renewable energy sources and creating green infrastructure. Additionally, carbon sequestration creates job opportunities and stimulates innovation in various industries. In the long term, it preserves biodiversity and prevents extreme weather events caused by climate change.

How can a carbon tax be implemented fairly ?

The text discusses the implementation of a fair carbon tax, which is a fee on burning carbon-based fuels to reduce emissions contributing to global warming. It suggests methods such as progressive taxation, revenue neutrality, renewable energy incentives, public education, phased implementation, and international cooperation to ensure the tax does not disproportionately affect low-income households or certain industries.

What countries have successfully implemented a carbon tax ?

Countries that have successfully implemented a carbon tax include Canada, Sweden, Finland, Norway, Switzerland, and the UK. These countries have set different rates for their carbon taxes and have seen varying degrees of success in reducing greenhouse gas emissions. While there are challenges associated with implementing such a tax, these countries demonstrate that it can be an effective tool for achieving environmental goals.

What are the economic implications of pursuing carbon neutrality for a country ?

Pursuing carbon neutrality has both positive and negative economic implications for a country, including job creation, innovation, energy independence, short-term costs, impacts on traditional industries, and potential carbon leakage.

Does a carbon tax lead to "carbon leakage" where companies move to areas without the tax ?

The article discusses the potential for "carbon leakage," where companies might relocate to regions without a carbon tax to avoid additional costs. It highlights economic impacts, geographical considerations, industry-specific impacts, and mitigating factors that could affect the outcome of implementing a carbon tax. The potential negative outcomes include job losses and environmental displacement, while positive outcomes could be innovation and efficiency improvements. The conclusion emphasizes the need for coordinated international efforts and support for affected industries to minimize leakage and promote sustainable practices.

How do zinc-carbon batteries work ?

Zinc-carbon batteries are primary, single-use batteries that generate electricity through a chemical reaction involving zinc and carbon. Their construction includes an anode of zinc, a cathode of manganese dioxide mixed with carbon, an electrolyte, a separator, and a container. When in use, zinc is oxidized at the anode, releasing electrons and zinc ions, while the cathode accepts electrons and reduces manganese dioxide. This flow of electrons creates an electrical current. Over time, the battery discharges as the materials are used up, requiring replacement. Proper disposal is crucial to prevent environmental pollution from their heavy metal components.

What are the ethical considerations surrounding the use of carbon capture technology ?

Carbon capture technology is a method used to reduce carbon dioxide emissions, but it raises ethical concerns such as cost and accessibility, potential environmental impact, long-term effects, and accountability. It is important to ensure that the technology is implemented responsibly and equitably.

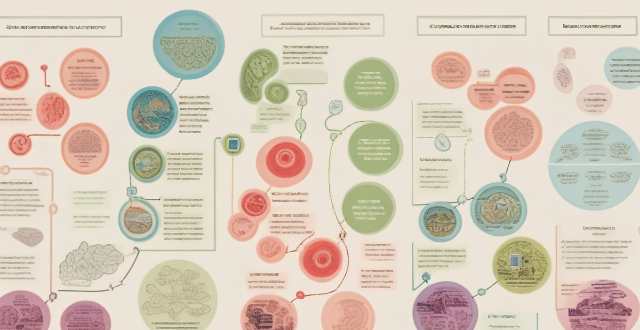

What are the challenges faced by carbon credit systems ?

Carbon credit systems face challenges including lack of standardization, quality control issues, limited scope, market dynamics, inequity and accessibility, and ethical considerations. These factors affect the effectiveness and credibility of carbon offsetting efforts. Addressing these challenges is essential for improving the system's performance and trustworthiness.

How does carbon offsetting work ?

Carbon offsetting works by assessing emissions, identifying suitable offsetting projects like renewable energy or reforestation, purchasing carbon credits from these projects, and continuously monitoring their effectiveness. This process helps reduce the overall carbon footprint of individuals or organizations while contributing to global efforts to combat climate change.

What is carbon offsetting ?

Carbon offsetting is a strategy aimed at counteracting the carbon emissions that contribute to global warming by funding projects that reduce or remove an equivalent amount of CO2 from the atmosphere. These projects can range from renewable energy development and reforestation to carbon capture and storage. The process involves calculating one's carbon footprint, choosing an offset project, funding it, and ensuring its effectiveness through monitoring and verification. While carbon offsetting can raise environmental awareness and support sustainable projects, it also faces criticism for potential quality control issues and the risk of being seen as a justification for not directly reducing emissions.

Are there any drawbacks or criticisms associated with carbon credits ?

Carbon credits are a tool used in the fight against climate change, allowing companies or individuals to offset their carbon emissions by investing in projects that reduce greenhouse gases. However, there are drawbacks and criticisms associated with carbon credits, including lack of standardization across different programs, ineffectiveness of some projects, high costs, potential for abuse, and limited scope. Addressing these issues is essential to ensure that carbon credits can play a meaningful role in mitigating the effects of climate change.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

How does a carbon tax compare to other methods of reducing carbon emissions ?

The article discusses the comparison of a carbon tax to other methods of reducing carbon emissions. It explains what a carbon tax is and lists other methods such as renewable energy sources, energy efficiency, carbon capture and storage, and forest management. The article then compares these methods in terms of cost-effectiveness, implementation speed, public acceptance, and environmental impact. It concludes that while a carbon tax is effective, it should be part of a broader strategy including investments in renewable energy, energy efficiency measures, CCS technology, and forest management for the best results in combating climate change.