Sentiment analysis is a crucial tool in predicting stock market trends by analyzing opinions and emotions from various sources. It involves data collection, preprocessing, feature extraction, model training, evaluation, and deployment. Sentiment analysis improves decision making, allows for real-time monitoring, identifies sentiment shifts, and aids in diversification of investment portfolios. However, challenges such as noise in data, sarcasm and irony, language variations, and evolving language usage must be addressed to maintain accuracy.

The Role of Sentiment Analysis in Predicting Stock Market Trends

Introduction

Sentiment analysis, also known as opinion mining, is a subfield of data mining that uses natural language processing (NLP), text analysis, and computational linguistics to identify and extract subjective information from source materials. In the context of predicting stock market trends, sentiment analysis plays a crucial role by analyzing the opinions and emotions expressed in various sources of information such as news articles, social media posts, and financial reports.

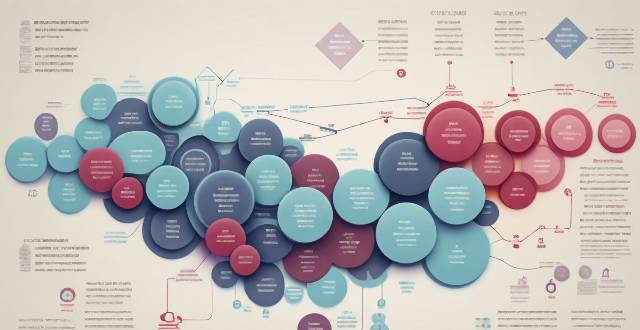

How Sentiment Analysis Works?

Sentiment analysis works by classifying the given text into three categories: positive, negative, or neutral. It uses machine learning algorithms to analyze the text and determine the overall sentiment. The output of sentiment analysis can be used to predict the future trends of the stock market.

Steps involved in sentiment analysis:

1. Data Collection: Gathering relevant data from various sources such as news articles, social media posts, and financial reports.

2. Preprocessing: Cleaning the data by removing irrelevant information, stop words, and punctuation marks.

3. Feature Extraction: Identifying important features such as keywords, phrases, and patterns that contribute to the sentiment.

4. Model Training: Training a machine learning model on the preprocessed data to classify the sentiment as positive, negative, or neutral.

5. Evaluation: Testing the accuracy of the model on a separate dataset.

6. Deployment: Using the trained model to analyze new data and predict stock market trends.

Benefits of Sentiment Analysis in Predicting Stock Market Trends

Improved Decision Making

Sentiment analysis provides valuable insights into the market sentiment, which helps investors make informed decisions. By analyzing the opinions and emotions expressed in various sources of information, investors can better understand the market trends and make more accurate predictions about the future performance of stocks.

Real-Time Analysis

Sentiment analysis allows for real-time monitoring of market sentiment, enabling investors to quickly adapt to changing market conditions. This is particularly useful during times of high volatility when rapid changes in sentiment can significantly impact stock prices.

Identifying Market Sentiment Shifts

Sentiment analysis can help identify shifts in market sentiment before they become apparent through traditional analysis methods. This early detection can give investors a competitive advantage by allowing them to adjust their strategies before significant price movements occur.

Diversification of Investment Portfolios

By analyzing sentiment across multiple industries and sectors, investors can diversify their portfolios based on the overall market sentiment. This can help mitigate risks associated with investing in a single industry or sector that may be negatively impacted by changes in sentiment.

Challenges Faced in Sentiment Analysis

Noise in Data

The presence of irrelevant information, spam, and bot-generated content can introduce noise into the data, making it difficult for sentiment analysis models to accurately classify the sentiment.

Sarcasm and Irony

Sentiment analysis models often struggle to correctly interpret sarcasm and irony, leading to incorrect classifications of sentiment. This is particularly challenging in informal communication channels such as social media platforms.

Language Variations

Different languages and dialects can pose challenges for sentiment analysis models, especially when dealing with non-English languages or regional variations within English.

Evolving Language Usage

Language usage evolves over time, introducing new terms and expressions that sentiment analysis models may not be trained to recognize. Continuous updating and retraining of models are necessary to maintain accuracy.

Conclusion

Sentiment analysis plays a vital role in predicting stock market trends by providing valuable insights into market sentiment. It enables investors to make informed decisions, adapt to changing market conditions, and identify shifts in sentiment before they become apparent through traditional analysis methods. However, challenges such as noise in data, sarcasm and irony, language variations, and evolving language usage must be addressed to maintain the accuracy and effectiveness of sentiment analysis models.