Ting Expenses

How do I manage unexpected expenses within my budget ?

Unexpected expenses can be managed within your budget by establishing an emergency fund, reviewing and adjusting your budget, prioritizing expenses, considering short-term solutions, negotiating and seeking assistance, avoiding taking on debt, planning for future expenses, and staying vigilant with your budget. Start small with saving for emergencies, identify non-essential expenses to cut back on, prioritize essential expenses, consider side hustles or selling unused items for extra income, negotiate bills and seek assistance when needed, avoid high-interest loans, learn from past experiences to anticipate future expenses, and regularly review and adjust your budget as circumstances change.

Is it possible to lower my monthly utility expenses without sacrificing comfort ?

Yes, it is definitely possible to reduce your monthly utility expenses without compromising your comfort. Here are some tips and strategies that you can implement: - **Energy-efficient appliances**: Replace old appliances with energy-efficient models to save on electricity bills. - **Thermostat settings**: Adjust your thermostat settings to save money on heating and cooling. - **Lighting**: Use LED bulbs to use less energy and last longer than traditional incandescent bulbs. - **Water usage**: Fix leaks to save on your water bill. - **Insulation**: Improve insulation to keep your home warm in winter and cool in summer, reducing the need for heating and cooling. - **Unplug electronics**: Unplug electronics when not in use to save on your electricity bill. - **Shop around**: Shop around for better deals on your utilities. - **Be mindful of usage**: Be aware of how much water, gas, and electricity you're using to identify areas where you can cut back.

How do I allocate funds for different educational needs in my budget plan ?

Education is crucial for personal growth, and budgeting for it is essential. Here's how to allocate funds effectively: determine goals, assess finances, create an education fund, prioritize expenses, use a budgeting tool, cut unnecessary expenses, seek financial aid, consider part-time work, and reevaluate regularly.

What are the key factors to consider when designing an energy storage system for a specific application ?

When designing an energy storage system (ESS) for a specific application, key factors to consider include capacity (power and energy requirements, discharge rate), efficiency (round-trip efficiency, self-discharge rate), reliability (cycle life, safety), cost (capital expenses, operating expenses), environmental impact (sustainability, emissions), and scalability (modular design, flexibility). These considerations will ensure the ESS meets application needs while operating efficiently, reliably, and sustainably.

What are some tips for managing an education budget effectively ?

The article provides effective tips for managing an education budget, including creating a budget plan, tracking spending, looking for scholarships and grants, considering part-time work or freelancing, reducing unnecessary expenses, and planning ahead for future expenses. It emphasizes the importance of staying organized, prioritizing expenses, and seeking out funding opportunities to ensure that students have the resources they need to succeed in their academic pursuits.

How much does it cost to go to an idol concert ?

Attending an idol concert can be costly due to various factors such as ticket prices, travel expenses, merchandise costs, and additional fees. To manage these expenses, it's recommended to set a budget, compare prices, take advantage of group discounts, bring your own snacks, and consider the resale market for tickets.

How can I create an effective education budget plan ?

Creating an effective education budget plan involves identifying educational goals, determining expenses, evaluating financial resources, creating a budget timeline, tracking spending, and reviewing and revising the budget regularly. This process helps ensure that you have the necessary funds to cover your educational expenses while achieving your academic objectives responsibly.

How can I prioritize my educational expenses within my budget plan ?

To effectively prioritize educational expenses within a budget plan, start by identifying clear educational goals and assessing available resources such as scholarships and savings. Create a detailed budget outlining all expected costs, including tuition, books, and transportation. Evaluate each expense based on its cost versus the benefits it provides towards your goals. If necessary, set up a savings plan to cover any shortfalls in your budget. Regularly track your spending and adjust your budget as needed to stay on track financially while achieving your educational objectives.

What are the tax implications of receiving a scholarship ?

Receiving a scholarship can offset higher education costs, but understanding the tax implications is crucial. Scholarships for tuition, fees, and educational expenses are typically non-taxable, but those covering personal expenses may be taxed. Accurate record-keeping, separating expenses, consulting tax professionals, and planning ahead are key to managing these implications effectively.

Are there alternatives to taking out a student loan for college expenses ?

There are several alternatives to student loans for covering college expenses, including scholarships and grants, work-study programs, employer tuition assistance, military benefits, and crowdfunding and community support. Scholarships and grants are typically awarded based on academic merit or financial need, while work-study programs allow students to earn money through part-time jobs. Employer tuition assistance programs may cover all or a portion of tuition costs, and serving in the military can provide access to educational benefits like the GI Bill. Crowdfunding platforms and community organizations can also provide financial support for students in need.

What is zero-based budgeting and how does it work ?

Zero-based budgeting (ZBB) is a method that requires justification for all expenses and revenues each period, starting from zero. It involves identifying revenue streams, determining expenses, prioritizing them, allocating funds, and monitoring/adjusting the budget. Advantages include increased efficiency, improved cost control, and enhanced planning. Disadvantages are its time-consuming nature, complexity, and potential for underfunding essential programs. Organizations should consider these factors before implementing ZBB.

What are some common pitfalls when creating a household budget ?

When creating a household budget, people often fall intoWhen creating a household budget, people often fall into can lead to financial difficulties and people often fall into common pitfalls that can lead to financial difficulties and make it harder to achieve financial goals. These pitfalls include not tracking expenses, underestimating expenses, ignoring debt repayment, failing to plan for emergencies, and overspending on non-essentials. To avoid these mistakes, people should keep track of all expenses, be realistic when estimating expenses, prioritize paying off high-interest debt, set aside money for emergencies, and limit discretionary spending. By avoiding these pitfalls, people can create a budget that works for them and helps them achieve their financial goals.

How can I stick to my budget without feeling deprived ?

Sticking to a budget is easier when you don't feel deprived. Here's how to do it: 1. **Set Realistic Goals**: Break down your financial goals into smaller, more manageable ones and make them specific and measurable. 2. **Prioritize Your Expenses**: Categorize your expenses into essential and non-essential, and differentiate between needs and wants. 3. **Find Alternatives**: Consider DIY projects and buying used items instead of new ones to save money. 4. **Track Your Spending**: Use budgeting apps or visual aids to monitor your expenses and progress toward your financial goals. 5. **Reward Yourself**: Allow yourself small treats for sticking to your budget and plan larger rewards for achieving long-term financial goals. 6. **Stay Motivated**: Keep reminders of your financial goals visible and share your goals with friends or family members who can provide support.

How much money do I need to save for retirement ?

Planning for retirement is crucial to ensure a comfortable life after stopping work. The amount of money needed depends on factors like age, expected retirement age, lifestyle, and expenses. This guide helps calculate your retirement savings goal by determining your retirement age, assessing your financial situation, estimating retirement expenses, using retirement calculators, considering inflation and investment returns, and creating a savings plan. By doing so, you can work towards a comfortable and secure retirement.

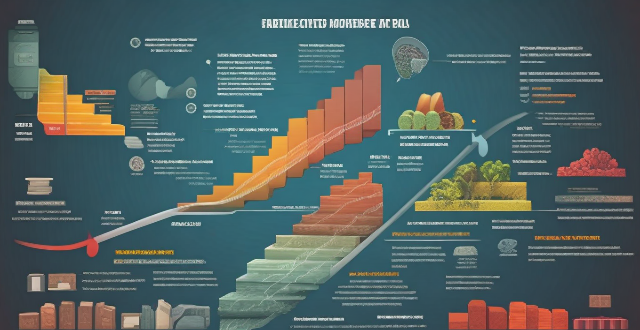

How long does it take to achieve financial freedom ?

Achieving financial freedom is a goal many people strive for, but the time it takes varies based on individual circumstances, habits, and market conditions. Factors influencing the journey include initial financial standing, income level and consistency, lifestyle and expenses, investment choices and returns, and economic and market conditions. Strategies to potentially shorten the timeline include increasing income, reducing expenses, investing wisely, managing debt, and planning for retirement. The path to financial freedom is unique for each person, but understanding the factors and using effective strategies can help anyone work towards achieving financial independence more efficiently.

What are the closing costs associated with a mortgage ?

Closing costs are fees and expenses associated with finalizing a real estate transaction. These costs vary based on location, property type, and lender requirements. Common closing costs for buyers include loan origination fees, appraisal fees, credit report fees, title search and insurance fees, attorney fees, recording fees, prepaid interest, homeowner's insurance premium, property taxes, and other miscellaneous fees. It is important to budget for these expenses in advance and review all closing documents carefully to avoid any financial surprises during the home-buying process.

How do I manage debt effectively and pay it off quickly ?

Managing debt effectively and paying it off quickly requires a combination of discipline, strategy, and sometimes professional advice. Here are some steps you can take to get started: ### Assess Your Debt Situation - **Understand Your Debts**: List all your debts and identify high-interest debts. - **Determine Your Budget**: Calculate your monthly income and evaluate your expenses. ### Create a Debt Repayment Plan - **Choose a Repayment Method**: Avalanche or Snowball method. - **Make a Budget and Stick to It**: Allocate more funds to debt repayment and adjust as needed. - **Consider Refinancing Options**: Consolidate debts or negotiate with creditors. ### Implement Additional Strategies - **Increase Your Income**: Take on additional work or sell unwanted items. - **Reduce Your Expenses**: Cut out luxury spending and shop smarter. - **Improve Your Credit Score**: Pay on time and monitor your credit report. ### Seek Professional Advice if Needed - **Consult a Financial Advisor**: Personalized advice and debt management plans. - **Consider Debt Counseling**: Nonprofit credit counseling and beware of scams. Consistency and perseverance are key in paying off debt quickly.

How do I create a budget plan for my small business ?

This guide provides a step-by-step approach to creating a budget plan for small businesses, emphasizing the importance of defining business goals, analyzing financial data, categorizing expenses, setting realistic revenue projections, determining break-even points, and allocating funds accordingly. It also stresses the need for regular monitoring and adjustments to the budget, along with tips for effective budget management such as staying flexible, using budgeting tools, seeking professional advice, communicating with the team, and reviewing past budgets.

How much would it cost to implement geoengineering on a large scale ?

The text discusses the financial implications of implementing large-scale geoengineering projects to counteract global warming. Key points include research and development costs, initial implementation expenses, ongoing operational costs, uncertainty and risk management expenses, and legal and regulatory compliance costs. The analysis suggests that large-scale geoengineering would require significant funding and resources.

What role does investing play in achieving financial freedom ?

Investing plays a crucial role in achieving financial freedom by growing wealth, diversifying portfolios, and protecting against inflation. Strategies include starting early, making consistent contributions, adopting a long-term perspective, and managing risk effectively.

Can you explain the process of budgeting for non-profit organizations ?

The budgeting process for non-profit organizations involves several steps: setting goals, estimating revenue and expenses, creating a budget plan, monitoring and adjusting the budget throughout the year, and evaluating the budget at the end of the fiscal year. This process helps non-profits manage their finances effectively and make informed financial decisions that support their long-term success.

What role does budgeting play in financial planning ?

Budgeting is crucial for financial planning, helpingBudgeting is crucial for financial planning, helping-term goals by tracking income helping individuals and businesses achieve long-term goals by tracking income, expenses, and savings. It aids in setting goals, tracking expenses to cut back on spending, allocating resources effectively, managing cash flow, and reducing financial stress. By creating a realistic budget and sticking to it, individuals and businesses can maintain a healthy financial status and achieve their short-term and long-term objectives.

How much does it typically cost to outfit a home with smart gadgets ?

This topic summary provides a comprehensive overview of the costs associated with outfitting a home with smart gadgets. It discusses key factors impacting cost, such as home size, scope of automation, brand choices, and installation fees. The text also breaks down typical smart gadgets and their price ranges, including lighting, thermostats, security systems, entertainment devices, and power solutions. Additional considerations like hubs, connectivity, and subscription services are addressed. Finally, it offers estimated total costs for basic, mid-range, and advanced smart home configurations, emphasizing the importance of planning and budgeting to create a smart home that aligns with individual needs and financial constraints.

What are the requirements for a tourist visa ?

The article provides a comprehensive list of general requirements for obtaining a tourist visa, which include having a valid passport, completing a visa application form, providing recent photographs, presenting a detailed travel itinerary, demonstrating financial stability, possessing health insurance, submitting an invitation letter if applicable, explaining the purpose of visit, and possibly offering a police clearance certificate. It emphasizes the importance of checking with the embassy or consulate of the destination country for specific instructions due to variations in requirements among different nations.

How do I maintain my scholarship eligibility ?

Maintaining scholarship eligibility is crucial for students who rely on financial aid to fund their education. To keep your scholarship, it is important to focus on academic performance, GPA maintenance, community involvement, and financial responsibility. Some tips include attending all classes, participating actively, managing time effectively, seeking help when needed, monitoring grades, staying organized, studying consistently, getting involved in campus organizations, showing leadership skills, giving back to the community, budgeting wisely, seeking additional funding, avoiding debt, and saving for emergencies. By following these tips, you can maintain your scholarship eligibility and continue receiving financial aid for your education.

What are the economic costs and benefits of adapting to climate change ?

The text discusses the economic costs and benefits of adapting to climate change, which include direct costs such as infrastructure upgrading and water management systems, indirect costs like economic disruptions and resource reallocation, direct benefits including increased resilience and improved efficiency, and indirect benefits such as job creation and technological innovation. The conclusion states that the long-term benefits of adapting to climate change outweigh the costs, leading to more resilient economies.

What are the economic benefits of transitioning to a low-carbon workforce ?

The transition to a low-carbon workforce is crucial for mitigating climate change and offers significant economic benefits. These include job creation, innovation, cost savings, improved competitiveness, risk mitigation, and long-term economic growth. By adopting sustainable practices, businesses can reduce operating costs, enhance their brand image, and gain a competitive edge in markets where eco-friendliness is valued. Additionally, the shift to low-carbon operations fosters resilience against climate-related risks and supports the development of sustainable economic models. Overall, embracing a low-carbon economy is not only environmentally responsible but also a smart economic strategy for individuals, businesses, and nations.

How can I create a budget that works for me ?

Creating a budget that works for you is crucial to achieving your financial goals. Here are some steps to help you create a budget that suits your needs: Step 1: Determine Your Income The first step in creating a budget is to determine your income, including your salary, bonuses or commissions, and any other sources of income. Step 2: List Your Expenses Next, make a list of all your expenses, including fixed expenses such as rent/mortgage, car payments, insurance premiums, and utilities, as well as variable expenses such as groceries, entertainment, and clothing. Step 3: Categorize Your Expenses Once you have listed all your expenses, categorize them into different categories such as housing, transportation, food, entertainment, etc. This will help you see where your money is going and identify areas where you can cut back on spending. Step 4: Set Financial Goals Before creating a budget, it's important to set financial goals. These goals could be short-term, such as saving for a vacation, or long-term, such as saving for retirement. Having clear financial goals will help you prioritize your spending and stay motivated to stick to your budget. Step 5: Allocate Your Money Now that you have determined your income, listed your expenses, categorized them, and set financial goals, it's time to allocate your money. Start by subtracting your total monthly expenses from your total monthly income. The remaining amount is what you have left to save or spend on discretionary items. Make sure to allocate money towards your financial goals first, then prioritize your other expenses based on their importance. Step 6: Track Your Spending Finally, tracking your spending is essential to making sure you stick to your budget. Use a budgeting app or spreadsheet to track your income and expenses each month. This will help you see where you may be overspending and adjust your budget accordingly. Remember, creating a budget that works for you takes time and effort. Be patient and persistent, and don't be afraid to adjust your budget as needed to achieve your financial goals.