Risk Return

Which financial product offers the highest return on investment ?

Investing in financial products is a popular way to grow wealth, but with many options, it's hard to determine which offers the highest return on investment (ROI). This article explores popular financial products and their potential returns. The stock market offers high potential returns but also significant risks. Real estate can provide rental income and property appreciation, but comes with its own set of risks. Mutual funds offer professional management and diversification, but fees and expenses can impact returns. Cryptocurrencies have gained popularity as an alternative investment option, but are highly volatile and speculative, making them unsuitable for most investors seeking stable returns. Determining which financial product offers the highest return on investment depends on various factors, including risk tolerance, investment goals, and market conditions. Diversification across different asset classes and investment vehicles can help minimize risks and maximize returns over time.

What is the average return on investment for private equity ?

Private equity (PE) investments can offer attractive returns, but these are influenced by several factors. The success of the companies in which PE firms invest, market conditions, investment strategy, and timing all play a role. Historically, PE has delivered average annualized returns of 12-15%, though these can be volatile. It's important for investors to understand the J-curve effect, fees, and the benefits of diversification when considering PE investments.

Is it necessary to have a return ticket for a tourist visa application ?

The text discusses the importance of a return ticket for a tourist visa application. It states that a return ticket is necessary to ensure the traveler has plans to return to their home country after the completion of their trip. Other documents required for a tourist visa application include a valid passport, hotel reservation, travel itinerary, financial evidence, invitation letter, travel insurance, application form, and photo. The return ticket is considered important as it shows the embassy or consulate that the traveler plans to return to their home country after their trip, reduces the chances of overstaying their visa period, assures the authorities of departure arrangements, and maintains the integrity of visa policies. If a traveler cannot provide a return ticket at the time of application, there is a high probability of visa rejection. However, an onward journey ticket can be provided as an alternative. Alternatives to a return ticket include one-way tickets, open-ended tickets, refundable tickets, and onward journey tickets. To ensure the availability of a return ticket, travelers should book in advance, choose flexible dates, opt for refundable tickets, and check with airlines about their policies. Not providing a return ticket can lead to visa rejection, blacklisting, impact future applications, and financial losses. Travel agents can assist in getting a return ticket or suggesting alternatives but may charge additional fees.

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

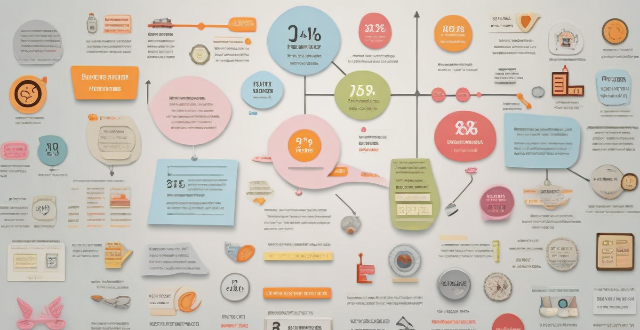

How often do I need to file my personal income tax return ?

Filing personal income tax returns is a crucial financial responsibility for individuals. The frequency of filing depends on various factors such as your residency, employment status, and income level. In this article, we will discuss the different scenarios that determine how often you need to file your personal income tax return. Personal income tax returns are filed annually in most countries. However, there are certain situations where you may need to file more frequently or less frequently. Your residency status plays a significant role in determining how often you need to file your personal income tax return. If you are a resident of a country, you are required to file your tax return annually, regardless of your employment status or income level. If you are employed and receive a regular salary, your employer is responsible for withholding taxes from your paycheck and remitting them to the government. In this case, you are still required to file your personal income tax return annually to report your total income and ensure that the correct amount of taxes has been withheld. The frequency of filing your personal income tax return also depends on your income level. If you have a low income and do not exceed the minimum threshold set by the government, you may not be required to file a tax return. However, it is always advisable to check with the tax authorities to confirm if you are exempt from filing. Self-employed individuals who earn an income from their business activities are required to file their personal income tax return annually. This is because self-employed individuals are responsible for paying their own taxes and reporting their income to the government. Freelance workers who earn an income from providing services to clients are also required to file their personal income tax return annually. This ensures that they report their earnings accurately and pay the appropriate taxes. If you own rental properties and earn rental income, you are required to file your personal income tax return annually. This is because rental income is considered part of your overall income and must be reported to the government. Retirees who receive pensions or other forms of retirement income are generally required to file their personal income tax return annually. However, if their income falls below the minimum threshold set by the government, they may be exempt from filing. In conclusion, the frequency of filing your personal income tax return depends on various factors such as your residency status, employment status, and income level. It is important to understand these factors and consult with the tax authorities to ensure that you comply with the requirements for filing your tax return. By doing so, you can avoid penalties and ensure that you pay the correct amount of taxes.

What is the return policy for items purchased during a limited-time promotion ?

When you purchase items during a limited-time promotion, it is important to understand the return policy associated with those purchases. The return policy for items purchased during a limited-time promotion may vary depending on the retailer or brand. Most retailers have a specified time limit for returns, which is usually stated in their return policy. The item must be returned in its original condition, including any packaging and accessories that were included with the purchase. Refunds are typically issued using the same method of payment as the original purchase. There are some exceptions to the general return policy for items purchased during a limited-time promotion, such as final sale items, customized items, and shipping and handling fees. To ensure a smooth return process, keep receipts and packaging, check the return policy before purchasing, and contact customer service if unsure.

Can I return or exchange items purchased through团购优惠 (tuan gou youhui) ?

This text discusses the concept of Tuan Gou Youhui, a popular online shopping method in China that allows customers to purchase products at discounted rates in large group sizes. It then explores the return and exchange policies for items purchased through this method, noting that these policies vary depending on the specific merchant and product but most merchants offer some form of return or exchange policy. The text provides general guidelines for understanding return and exchange policies and steps to return or exchange an item, emphasizing the importance of contacting customer service, providing necessary information, packaging the product carefully, shipping it according to instructions, waiting for refund or exchange, and confirming receipt of refund or exchanged product. Finally, it concludes that by understanding these policies and following appropriate steps, customers can ensure a smooth and hassle-free experience when shopping through Tuan Gou Youhui.

Is it better to invest in stocks or bonds for retirement ?

The article discusses the advantages and disadvantages of investing in stocks and bonds for retirement. Stocks offer higher potential returns, diversification, and can serve as an inflation hedge, but come with higher risks and no guaranteed income. Bonds provide lower risk, predictable income streams, and diversification, but offer lower potential returns and are sensitive to interest rate changes. The key is finding the right balance between risk and reward based on individual circumstances and investment goals, and consulting with a financial advisor to create a customized retirement plan.

Are there any low-risk investment options that still offer wealth growth potential ?

Investing always comes with a certain level of risk, but there are some investment options that are considered to be relatively low-risk while still offering the potential for wealth growth. These include savings accounts and certificates of deposit (CDs), bonds, mutual funds and exchange-traded funds (ETFs), and real estate investment trusts (REITs). It's important to do your research and understand the risks involved before making any investment decisions.

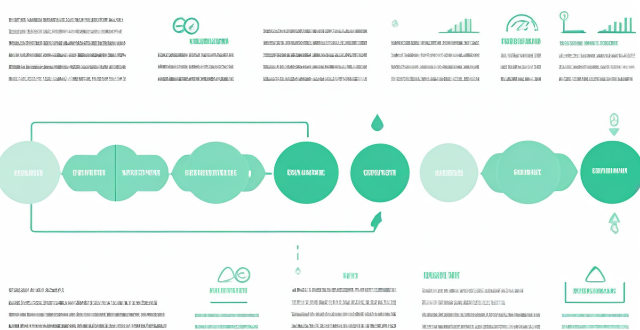

How does disaster risk management help in reducing the impact of natural calamities ?

Disaster risk management is crucial for reducing the impact of natural calamities. It involves risk assessment, reduction, emergency preparedness, and response and recovery efforts. Effective disaster risk management can save lives, protect property, maintain economic stability, and enhance community resilience. It reduces the impact of natural calamities through early warning systems, structural improvements, education and awareness programs, emergency response plans, and recovery efforts. By implementing these components, we can build more resilient societies capable of withstanding natural disasters.

How do bond yields affect my investment returns ?

Bond yields significantly impact investment returns, particularly for bond and bond-related security investors. Yields represent the interest rate paid by bond issuers to holders and are crucial for expected returns. Higher yields generally result in increased interest income but can also cause price volatility. Inflation affects real returns, and lower yields may increase opportunity costs. Strategies like diversification, duration management, active management, and staying informed can help maximize returns amidst changing bond yield environments.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

What is the process of returning a product in global shopping ?

### Summary: Returning a product purchased through global shopping involves several steps, including checking the return policy, initiating the return process, preparing and shipping the item back, monitoring your refund, documenting the process, and considering international factors such as customs and currency exchange rates. It's important to stay organized, use trackable shipping methods, and keep records of all communications with the seller to ensure a smooth and effective return.

What are the key components of a successful disaster risk management plan ?

Key Components of a Successful Disaster Risk Management Plan include: 1. Risk Assessment 2. Prevention and Mitigation Strategies 3. Preparedness Activities 4. Response Mechanisms 5. Recovery and Rehabilitation 6. Continuous Improvement

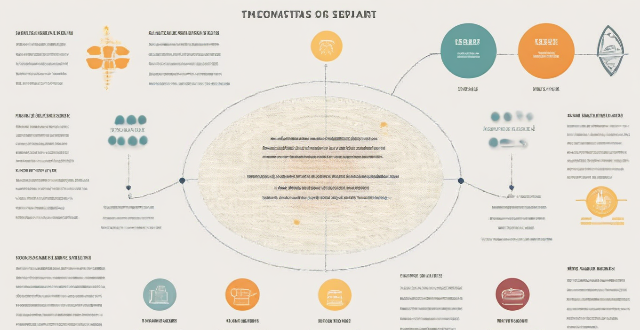

Why is it important to conduct a climate risk assessment ?

Climate risk assessment is crucial for understanding the potential impacts of climate change on different sectors and systems, identifying vulnerabilities and risks, developing adaptation strategies and policies, enhancing resilience and reducing losses, and supporting decision making. It helps in building a more resilient and sustainable future for all.

How can governments implement climate risk management policies to protect their citizens and infrastructure ?

Governments can implement climate risk management policies by assessing the risks, developing a comprehensive plan, investing in resilience and adaptation measures, engaging stakeholders and building public awareness, and monitoring and evaluating progress.

What is disaster risk management ?

Disaster risk management (DRM) is a comprehensive approach aimed at reducing the impact of natural and human-made disasters on communities. It involves understanding, assessing, and reducing risks through prevention, preparedness, response, and recovery strategies. The goal is to ensure that people's lives and livelihoods are not compromised by disaster events. Key components include risk assessment, hazard mitigation, early warning systems, emergency planning, community education, immediate action, coordination, rehabilitation, reconstruction, and sustainable development. Best practices involve multi-stakeholder collaboration, gender sensitivity, use of technology, inclusive planning, and regular review and updating. Challenges include limited resources, political will, information gaps, and cultural differences. Effective DRM requires a multifaceted approach that considers social, economic, and environmental factors.

What is climate risk assessment ?

Climate risk assessment is a systematic process that identifies, evaluates, and prioritizes the potential impacts of climate change on a specific region or sector. It involves analyzing the likelihood and severity of various climate-related risks, such as extreme weather events, sea level rise, and changes in temperature and precipitation patterns. The goal of climate risk assessment is to inform decision-makers about the risks associated with climate change and help them develop strategies to manage and adapt to these risks. Key components of climate risk assessment include identifying potential risks, evaluating their potential impacts, prioritizing them based on severity and likelihood of occurrence, and developing adaptation strategies to reduce potential impacts. By implementing these strategies, decision-makers can help ensure that their communities are better prepared for the challenges posed by climate change.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

What role do scientists play in climate risk assessments ?

Scientists are crucial in climate risk assessments, analyzing data, developing models, and providing recommendations for mitigating risks. They collect data from multiple sources and use statistical methods to identify trends, create computer models to predict impacts, develop strategies to mitigate risks, and communicate their findings to build support for policies and actions.

How can organizations create a culture of risk awareness among employees ?

Organizations can create a culture of risk awareness among employees by implementing strategies such as leadership buy-in, training and education, open communication channels, integrating risk management into daily operations, recognizing and rewarding risk awareness, and continuous improvement. These efforts will help employees proactively identify, assess, and manage risks more effectively.

How can companies implement effective risk management strategies ?

Effective Risk Management Strategies for Companies Risk management is a critical aspect of any business operation. It involves identifying, assessing, and prioritizing potential risks that could impact the company's objectives. Here are some effective risk management strategies that companies can implement: 1. Identify Potential Risks: The first step in implementing effective risk management is to identify potential risks. This involves analyzing the company's operations and processes to determine what could go wrong. Some common types of risks include financial risks, operational risks, strategic risks, and compliance risks. 2. Assess and Prioritize Risks: Once potential risks have been identified, they need to be assessed and prioritized based on their likelihood and potential impact. This involves assigning each risk a score based on its severity and probability of occurrence. The risks can then be ranked in order of priority, with the most significant risks being addressed first. 3. Develop Risk Mitigation Plans: For each identified risk, a mitigation plan should be developed. This plan should outline the steps that will be taken to reduce or eliminate the risk. Mitigation plans can include avoidance, reduction, transfer, or acceptance. 4. Monitor and Review Risks Regularly: Risk management is an ongoing process, and companies should regularly monitor and review their risks. This involves tracking changes in the business environment and updating risk assessments accordingly. It also involves evaluating the effectiveness of risk mitigation plans and making adjustments as needed. In conclusion, effective risk management strategies involve identifying potential risks, assessing and prioritizing them, developing mitigation plans, and regularly monitoring and reviewing them. By implementing these strategies, companies can reduce their exposure to risks and protect their operations and bottom line.

What are some common tools and techniques used in risk management ?

Risk management is a process that involves identifying, assessing, and prioritizing potential risks. There are various tools and techniques used in risk management, including brainstorming, Delphi method, checklists, qualitative and quantitative assessment, risk matrix, cost-benefit analysis, avoidance, reduction, transference, acceptance, continuous monitoring, and audits. These tools and techniques help organizations and individuals manage risks effectively and make informed decisions.

How can climate risk management help reduce the impact of climate change on the environment ?

Climate risk management is a multi-step approach that helps mitigate the effects of climate change on the environment. It involves identifying and assessing risks, prioritizing them, developing adaptation strategies, implementing mitigation efforts, fostering collaboration, and continuously monitoring outcomes. This proactive method aims to protect natural systems from adverse climate impacts, promote sustainable practices, and reduce greenhouse gas emissions. By adopting these measures, we can build resilience against climate-related risks and contribute to a more sustainable future for all.

What is risk management and why is it important ?

Risk management is a systematic approach used by organizations to identify, assess, and prioritize potential risks that may impact their objectives. It involves implementing strategies to monitor and control these risks effectively. The goal of risk management is to minimize the probability and impact of negative events and maximize the opportunities for positive outcomes. The importance of risk management includes mitigating uncertainty, enhancing decision-making, compliance and regulatory requirements, protection of reputation, financial performance, and promoting innovation. Effective risk management is crucial for any organization looking to sustain its operations, protect its assets, enhance decision-making, maintain compliance, preserve its reputation, and improve its financial performance. It enables companies to navigate challenges proactively and capitalize on opportunities while minimizing the impact of potential threats.

What role do insurers play in climate risk management ?

Insurers play a crucial role in climate risk management by providing financial protection against losses and damages caused by climate-related events. They help manage exposure to climate risks through insurance policies, risk assessments, and risk transfer tools. Insurers contribute to climate risk management by assessing risks, offering insurance policies, utilizing risk transfer tools, investing in resilience and adaptation, collaborating with governments and stakeholders, raising awareness, and conducting research and development.

How can climate data analysis help in disaster risk reduction and management ?

Climate data analysis is crucial for disaster risk reduction and management. It helps identify high-risk areas, predict future weather patterns, develop mitigation strategies, and enhance disaster response and recovery efforts. By analyzing past and current climate data, we can better prepare for and respond to natural disasters such as floods, hurricanes, wildfires, and droughts.

What are the risks associated with green finance investments ?

The article discusses the various risks associated with green finance investments, including market risk, credit risk, operational risk, environmental risk, reputational risk, and legal and regulatory risk. It emphasizes the importance of understanding these risks before making investment decisions in order to achieve desired levels of risk and return.

How does climate change affect disaster risk management strategies ?

The article discusses how climate change affects disaster risk management strategies. It explains that as the Earth's climate warms, extreme weather events such as hurricanes, floods, and wildfires are becoming more frequent and severe. This means that disaster risk management strategies must be adapted to address these new challenges. The article explores the increased frequency of extreme weather events, changes in agriculture and food security, and impacts on human health. It suggests that disaster risk management strategies should focus on improved forecasting, infrastructure improvements, evacuation planning, sustainable farming practices, crop diversification, food storage and distribution systems, healthcare infrastructure, public health education, and disease surveillance. By taking these steps, we can better prepare for and respond to natural disasters in a changing climate.