Risk Bonds

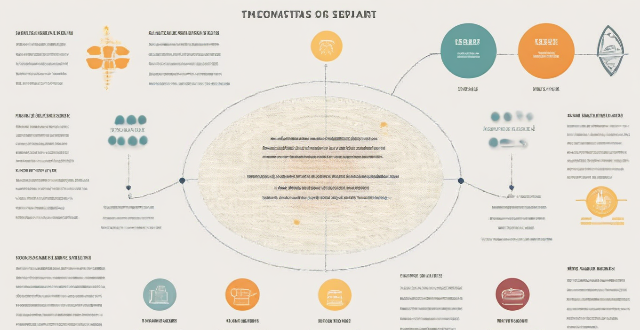

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

Is it better to invest in stocks or bonds for retirement ?

The article discusses the advantages and disadvantages of investing in stocks and bonds for retirement. Stocks offer higher potential returns, diversification, and can serve as an inflation hedge, but come with higher risks and no guaranteed income. Bonds provide lower risk, predictable income streams, and diversification, but offer lower potential returns and are sensitive to interest rate changes. The key is finding the right balance between risk and reward based on individual circumstances and investment goals, and consulting with a financial advisor to create a customized retirement plan.

Are green bonds a profitable investment compared to traditional bonds ?

Green bonds are a type of fixed-income security designed to finance environmentally friendly projects. While their risk and return profile can be similar to traditional bonds, green bonds offer potential diversification benefits, alignment with sustainability goals, and possibly tax benefits. However, their long-term performance relative to traditional bonds depends on various factors such as interest rate changes and market sentiment. Green bonds often come with more rigorous reporting requirements to ensure the proceeds are used for environmentally friendly projects. Whether green bonds are more profitable than traditional bonds cannot be definitively answered without considering individual investment goals and market conditions.

What are the different types of bonds available for investment ?

This text discusses the different types of bonds available for investment. It explains the characteristics and subtypes of corporate, municipal, government, mortgage-backed securities, asset-backed securities, zero-coupon, floating rate, inflation-protected, perpetual, international, taxable vs. tax-exempt, secured vs. unsecured, callable vs. non-callable, registered vs. bearer, fixed rate vs. floating rate, strip, synthetic, private placement, structured, green, and supranational bonds.

How does the issuance of green bonds benefit environmental projects ?

Green bonds are financial instruments designed to fund environmentally friendly projects, offering benefits such as increased funding opportunities, improved project visibility, long-term financing, risk mitigation, market growth and innovation, policy and regulatory support, and community and environmental impact. These bonds not only benefit the specific environmental projects they aim to fund but also contribute to a broader shift towards sustainable finance and environmental stewardship.

What role do governments play in promoting the use of green bonds ?

Governments play a crucial role in promoting the use of green bonds by providing incentives for issuance, establishing regulations and disclosure requirements, issuing their own green bonds, and promoting education and awareness campaigns. These actions help accelerate the transition to a more sustainable economy and address pressing environmental challenges facing our planet.

Can green bonds help fight climate change effectively ?

Green bonds, a type of fixed-income instrument, are issued to fund environmentally friendly projects that aim to reduce greenhouse gas emissions and promote sustainable development. They can effectively contribute to the fight against climate change by incentivizing renewable energy projects, supporting energy efficiency and conservation, investing in low-carbon infrastructure, promoting sustainable agriculture and forestry, and advancing research and development. However, challenges such as ensuring transparency and accountability, achieving scale and impact, integrating with broader climate strategies, and engaging diverse investors must be addressed to fully realize their potential. As the market for green bonds grows, they remain an important tool in combating climate change effectively.

How can green bonds help finance climate-friendly projects ?

Green bonds are financial instruments that raise capital specifically for climate and environmental projects. They offer increased funding opportunities by attracting a diverse investor base interested in sustainable investing, aligning with ESG criteria, and providing attractive returns. Transparency and accountability are ensured through rigorous certification processes, third-party reviews, and reporting requirements. Green bonds also catalyze climate action by incentivizing sustainable practices and supporting innovation in clean technology. Furthermore, they encourage wider market participation through investor education, public awareness campaigns, policy support, and international collaboration. Overall, green bonds are crucial for financing climate-friendly projects and accelerating the transition to a more sustainable economy.

How can I diversify my portfolio with bond investments ?

Diversifying your portfolio with bond investments can reduce investment risk and provide a steady stream of income. There are several types of bonds, including government, corporate, municipal, and foreign bonds, each with its own characteristics and risks. Bond mutual funds and ETFs offer automatic diversification across multiple issuers and types of bonds. When investing in bonds, consider factors such as credit quality, interest rate risk, inflation risk, and liquidity. To effectively diversify your portfolio with bonds, allocate a portion of your portfolio to bonds, invest in different types of bonds, consider bond maturities, and rebalance regularly. Consulting with a financial advisor can help determine the best bond strategies for your individual financial goals and risk tolerance.

Are there any risks associated with investing in green bonds that investors should be aware of ?

Investing in green bonds comes with certain risks that investors should be aware of, including credit risk, interest rate risk, inflation risk, liquidity risk, reputational risk, legal and regulatory risk, project risk, climate risk, and ESG (environmental, social, and governance) risk. These risks can impact the returns on investment and the overall success of the investment strategy. It is important to carefully evaluate each green bond investment opportunity and consult with financial advisors before making any investment decisions.

Are there any low-risk investment options that still offer wealth growth potential ?

Investing always comes with a certain level of risk, but there are some investment options that are considered to be relatively low-risk while still offering the potential for wealth growth. These include savings accounts and certificates of deposit (CDs), bonds, mutual funds and exchange-traded funds (ETFs), and real estate investment trusts (REITs). It's important to do your research and understand the risks involved before making any investment decisions.

How do I determine the appropriate level of risk for my investment strategy ?

Investing is a crucial step towards achieving financial goals, but it's essential to determine the appropriate level of risk that aligns with your investment strategy and objectives. The first step is understanding your risk tolerance by assessing your comfort level with potential losses and volatility. Your investment objectives play a crucial role in determining your risk tolerance. Once you have a clear understanding of your risk tolerance and investment objectives, evaluate different investment options such as stocks, bonds, mutual funds, ETFs, and real estate. Finally, monitor your portfolio regularly and make adjustments as needed to maintain your desired asset allocation and manage risks effectively.

How do I get started with bond investing ?

Bond investing is a popular way to diversify your portfolio and earn a steady income. Here are some steps to help you get started: 1. Understand the basics of bonds. 2. Determine your investment objectives. 3. Choose the right type of bond for you. 4. Consider the duration of the bond. 5. Research and select brokers or intermediaries. 6. Diversify your portfolio by investing in various types of bonds issued by different entities. 7. Monitor your investments regularly and adjust your portfolio as needed based on changing market conditions or personal circumstances.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

How do I adjust my investment strategy during economic downturns ?

Adjusting Investment Strategy During Economic Downturns: - **Diversify Your Portfolio**: Allocate across stocks, bonds, and cash equivalents; invest in different sectors and international markets. - **Rebalance Your Portfolio**: Monitor performance and composition regularly; rebalance to maintain diversification. - **Focus on Quality Stocks**: Choose companies with strong financials, stable earnings, and resilient business models. - **Consider Bonds and Other Fixed Income Securities**: Invest in government, corporate, or municipal bonds for stability and potential returns. - **Stay Disciplined and Avoid Emotional Decisions**: Stay calm, focus on long-term goals, and avoid herd mentality.

What role do insurers play in climate risk management ?

Insurers play a crucial role in climate risk management by providing financial protection against losses and damages caused by climate-related events. They help manage exposure to climate risks through insurance policies, risk assessments, and risk transfer tools. Insurers contribute to climate risk management by assessing risks, offering insurance policies, utilizing risk transfer tools, investing in resilience and adaptation, collaborating with governments and stakeholders, raising awareness, and conducting research and development.

How can I invest in stocks with a minimal risk ?

How to Invest in Stocks with Minimal Risk Investing in stocks can be risky, but there are strategies to minimize these risks. Diversification across stocks, sectors, and asset classes is crucial. Dollar-cost averaging helps smooth market fluctuations. Stop-loss orders limit potential losses. Long-term investing allows for market recoveries. Understanding the companies you invest in reduces unknown risks. Start small and learn as you go, staying informed about financial news. Working with a financial advisor can provide personalized guidance. Remember, no investment is completely risk-free, so assess your comfort level before making decisions.

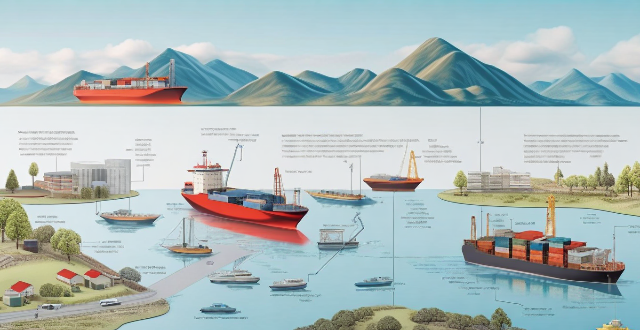

What role do green bonds and other financial products play in climate financing ?

Green bonds and other financial products are crucial for climate financing, enabling investors to support environmentally friendly projects. These instruments fund renewable energy, energy efficiency, waste management, biodiversity conservation, and other eco-friendly initiatives, contributing to climate change mitigation and sustainable development. Key features of green bonds include transparency and verification, offering benefits such as attracting capital and pricing advantages but facing challenges like standardization and secondary market liquidity. Other financial products include climate-themed investment funds, CERs, green loans, and credit facilities, which directly finance green projects and stimulate innovation in sustainable practices. By aligning financial returns with environmental benefits, these instruments play a vital role in mobilizing private capital towards climate action, helping to bridge the funding gap for sustainable projects and mitigate climate change.

Why are green bonds important for sustainable development ?

Green bonds are crucial for sustainable development as they provide funding for environmental projects, broaden investor base, support environmental standards, stimulate innovation, advance global SDGs, and raise awareness about sustainability in finance.

How can green bonds help finance environmentally friendly projects ?

Green bonds are a type of financial instrument designed to raise capital for environmentally friendly projects. They offer dedicated funding sources, attract sustainability-focused investors, enhance corporate reputation, and potentially lower borrowing costs. Examples of projects funded by green bonds include renewable energy development, energy efficiency upgrades, sustainable water management, clean transportation, and waste management. As awareness of climate change grows, the use of green bonds is expected to expand, driving progress towards a more sustainable future.

How can climate risk management help mitigate financial losses due to extreme weather events ?

Climate risk management is crucial for reducing financial losses from extreme weather. It involves identifying, assessing, and prioritizing climate-related risks, and developing strategies to manage and adapt to these risks. Organizations can reduce their exposure to high-risk areas, enhance resilience and preparedness, diversify risks, and invest in insurance and contingent finance mechanisms. By implementing effective climate risk management practices, organizations can mitigate the impact of extreme weather events on their operations and finances.

What are the key components of a successful disaster risk management plan ?

Key Components of a Successful Disaster Risk Management Plan include: 1. Risk Assessment 2. Prevention and Mitigation Strategies 3. Preparedness Activities 4. Response Mechanisms 5. Recovery and Rehabilitation 6. Continuous Improvement

What role does the insurance industry play in mitigating climate change ?

The insurance industry plays a crucial role in mitigating climate change through various mechanisms. They assess and price risks associated with climate change, providing financial incentives for mitigation, invest in sustainable projects, apply stricter underwriting criteria for high-emission industries, collaborate on research efforts, innovate insurance products, educate clients about climate risks, lobby for climate policies, and support reinsurance to share risks globally and back catastrophe bonds. By integrating climate considerations into their business models, insurers can drive progress toward a more sustainable future.

Why is it important to conduct a climate risk assessment ?

Climate risk assessment is crucial for understanding the potential impacts of climate change on different sectors and systems, identifying vulnerabilities and risks, developing adaptation strategies and policies, enhancing resilience and reducing losses, and supporting decision making. It helps in building a more resilient and sustainable future for all.

How can governments implement climate risk management policies to protect their citizens and infrastructure ?

Governments can implement climate risk management policies by assessing the risks, developing a comprehensive plan, investing in resilience and adaptation measures, engaging stakeholders and building public awareness, and monitoring and evaluating progress.

What is disaster risk management ?

Disaster risk management (DRM) is a comprehensive approach aimed at reducing the impact of natural and human-made disasters on communities. It involves understanding, assessing, and reducing risks through prevention, preparedness, response, and recovery strategies. The goal is to ensure that people's lives and livelihoods are not compromised by disaster events. Key components include risk assessment, hazard mitigation, early warning systems, emergency planning, community education, immediate action, coordination, rehabilitation, reconstruction, and sustainable development. Best practices involve multi-stakeholder collaboration, gender sensitivity, use of technology, inclusive planning, and regular review and updating. Challenges include limited resources, political will, information gaps, and cultural differences. Effective DRM requires a multifaceted approach that considers social, economic, and environmental factors.

What is climate risk assessment ?

Climate risk assessment is a systematic process that identifies, evaluates, and prioritizes the potential impacts of climate change on a specific region or sector. It involves analyzing the likelihood and severity of various climate-related risks, such as extreme weather events, sea level rise, and changes in temperature and precipitation patterns. The goal of climate risk assessment is to inform decision-makers about the risks associated with climate change and help them develop strategies to manage and adapt to these risks. Key components of climate risk assessment include identifying potential risks, evaluating their potential impacts, prioritizing them based on severity and likelihood of occurrence, and developing adaptation strategies to reduce potential impacts. By implementing these strategies, decision-makers can help ensure that their communities are better prepared for the challenges posed by climate change.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

What role do scientists play in climate risk assessments ?

Scientists are crucial in climate risk assessments, analyzing data, developing models, and providing recommendations for mitigating risks. They collect data from multiple sources and use statistical methods to identify trends, create computer models to predict impacts, develop strategies to mitigate risks, and communicate their findings to build support for policies and actions.