Private House

What are some of the most extravagant celebrity mansions ?

The most extravagant celebrity mansions are a testament to their wealth and fame. From Oprah Winfrey's Montecito Estate to Bill Gates' Xanadu 2.0, these sprawling estates and luxurious penthouses boast impressive features like multiple buildings, gourmet kitchens, tennis courts, gyms, tea houses, garages that can hold up to 23 cars, tram systems, libraries with domed roofs, reception halls with walls of glass overlooking lakes, state-of-the-art recording studios, pool houses with full kitchens, basketball courts, private movie theaters, hot tubs on outdoor decks, and private beaches on the Atlantic Ocean.

How much down payment do I need to buy a house ?

This article discusses the factors affecting the down payment amount for buying a house, including credit score, type of mortgage, and price of the house. It also provides common down payment requirements for different types of mortgages and tips for saving for a down payment.

What are the benefits of investing in private equity ?

Investing in private equity offers higher potential returns, diversification benefits, active management and control, access to unique opportunities, tax efficiency, and a disciplined approach to investing. However, it also comes with risks such as illiquidity, high entry barriers, and the need for specialized knowledge. Proper due diligence and consideration of one's overall investment objectives and risk tolerance are essential before committing capital to private equity.

How has private investment impacted the development of space technology ?

Private investment has significantly impacted space technology development by increasing research and development funding, reducing costs, improving efficiency, and driving innovation. Private companies like SpaceX and Blue Origin have made advancements in reusable rockets, satellite communications, and lunar exploration. These investments have also enabled new business models and increased accessibility to space for smaller organizations.

How does private equity affect corporate governance ?

Private equity (PE) plays a significant role in shaping the governance of companies. It can have both positive and negative impacts on corporate governance, depending on various factors such as the PE firm's strategy, the nature of the investment, and the target company's existing governance structure. This article will explore the ways in which private equity affects corporate governance. ### Positive Impacts of Private Equity on Corporate Governance - **Improved Decision-Making Processes**: Private equity firms often bring fresh perspectives and expertise to the decision-making processes within a company. They may introduce new management practices or technologies that enhance efficiency and productivity. This can lead to better strategic planning and more informed decisions being made by the board of directors. - **Greater Transparency and Accountability**: Private equity investors typically demand greater transparency and accountability from the companies they invest in. This can result in improved financial reporting, regular board meetings, and increased communication between management and shareholders. Such measures help to ensure that all stakeholders are kept informed about the company's performance and future plans. - **Increased Focus on Long-Term Value Creation**: Private equity firms generally have a long-term investment horizon, which means they are more likely to focus on creating value over the long term rather than pursuing short-term gains. This can lead to a greater emphasis on sustainable growth, innovation, and responsible business practices. ### Negative Impacts of Private Equity on Corporate Governance - **Potential Conflicts of Interest**: Private equity investors may have conflicts of interest with other stakeholders, such as employees, customers, or suppliers. For example, a PE firm might push for cost-cutting measures that negatively impact employee morale or customer satisfaction. These conflicts can undermine good governance practices and harm the company's reputation. - **Pressure for Short-Term Profits**: While some private equity firms focus on long-term value creation, others may prioritize short-term profits at the expense of long-term sustainability. This can lead to excessive risk-taking, aggressive financial engineering, or even fraudulent activities aimed at boosting short-term earnings. Such behaviors can ultimately damage the company's reputation and financial health. - **Lack of Diversity in Board Composition**: Private equity firms often control a majority of the seats on a company's board of directors. This can limit diversity in terms of gender, ethnicity, and professional background among board members. A lack of diversity can lead to groupthink and reduce the effectiveness of the board in providing independent oversight and guidance to management. In conclusion, private equity has both positive and negative effects on corporate governance. The key is for PE firms to balance their pursuit of profit with a commitment to ethical business practices and responsible stewardship of the companies they invest in. By doing so, they can help build stronger, more sustainable businesses that benefit all stakeholders.

Where are some of the most famous celebrity mansions located ?

Celebrities often live in lavish, awe-inspiring homes that capture the attention of fans and the media alike. These mansions are not only architectural marvels but also symbols of success and luxury. Here's a list of some of the most famous celebrity mansions and their locations: 1. Oprah Winfrey's Montecito Estate - Situated on 23 acres, this estate features a main house with 7 bedrooms and 14 bathrooms. It includes an orchard, a tea house, a barn, and a tennis court. 2. George Clooney's Villa Oleandra - This stunning property overlooks Lake Como and comes with a swimming pool, a gym, and a home theater. It was originally a simple farmhouse but has been renovated into a luxurious villa. 3. Jay-Z and Beyoncé's Bel Air Mansion - This contemporary mansion spans 19,000 square feet and boasts 8 bedrooms, 11 bathrooms, a basketball court, and a music studio. The couple purchased it for approximately $88 million. 4. Taylor Swift's Rhode Island Estate - This coastal retreat is known for its stunning ocean views and includes multiple houses on the property. There's also a private beach and a pier. 5. Kim Kardashian and Kanye West's Hidden Hills Home - This minimalist mansion has 4 bedrooms and features a gym, a movie theater, and a hair salon. It also has a unique all-white color scheme throughout. 6. Howard Stern's Penthouse Suite - This apartment takes up three floors of a building and includes a massive master bedroom suite, a recording studio, and panoramic city views from its numerous terraces. 7. Tom Brady and Gisele Bündchen's Brookline Mansion - This expansive estate sits on 5 acres of land and includes a moat, a gas lighting system, and a 6,600-square-foot mansion with 12 bedrooms. 8. Simon Cowell's Malibu Beach House - Overlooking the Pacific Ocean, this beachfront property features floor-to-ceiling windows offering unobstructed ocean views, a large outdoor patio, and direct beach access. 9. Elon Musk's Bel Air Estate - This modern mansion is equipped with a two-story library, a smart home system, and an underground garage that can hold up to 100 cars. It was previously owned by Gene Wilder. 10. Michael Jordan's Chicago Estate - This sprawling estate includes a basketball court, a putting green, a regulation-size tennis court, and a separate guest house. It also has an infinity pool with views of Lake Michigan.

What are some notable private equity firms ?

Private equity firms are investment companies that pool funds from various investors to acquire and manage private companies, typically investing in undervalued or distressed businesses, restructuring them, and selling them at a profit. Some of the most notable private equity firms include Blackstone Group, The Carlyle Group, Kohlberg Kravis Roberts & Co. (KKR), TPG Capital, and Warburg Pincus. These firms have diverse portfolios and investment strategies, with assets under management ranging from $600 billion to $79 billion as of 2022.

How does private equity differ from public equity ?

Private equity and public equity are two different types of investment vehicles that offer distinct characteristics, benefits, and risks. Private equity refers to investments in companies that are not publicly traded on stock exchanges, while public equity refers to investments in companies that are publicly traded on stock exchanges. Key differences between private equity and public equity include accessibility, liquidity, regulation, investment horizon, and returns. Private equity investments are typically only available to accredited investors, such as institutional investors, high net worth individuals, and family offices. Public equity investments are more accessible to a wider range of investors, as anyone can buy shares of publicly traded companies on stock exchanges. Private equity investments are generally illiquid, meaning it can be difficult to sell your stake in a company if you need to exit the investment. Public equity investments are highly liquid, as shares of publicly traded companies can be easily bought and sold on stock exchanges. Private equity firms are not subject to the same level of regulation as publicly traded companies. This allows them greater flexibility in managing their investments and making strategic decisions without the scrutiny of public markets. Publicly traded companies are subject to strict regulations and reporting requirements set by regulatory bodies such as the Securities and Exchange Commission (SEC). Private equity investments typically have a longer investment horizon than public equity investments. This is because private equity firms focus on long-term growth and value creation within the companies they invest in. Public equity investments can be held for shorter periods of time, as investors can easily buy and sell shares on stock exchanges based on market conditions and personal financial goals. Private equity investments often aim for higher returns than public equity investments, as they involve higher levels of risk and illiquidity. However, these returns are not guaranteed and depend on the success of the companies being invested in. Public equity investments may offer more stable returns over time, as publicly traded companies tend to be more established and have a proven track record of financial performance. In conclusion, private equity and public equity offer different advantages and disadvantages depending on an investor's goals, risk tolerance, and investment horizon. It is important for investors to carefully consider their investment objectives and risk profile before choosing between private equity and public equity investments.

Can private sector investments play a significant role in climate financing ?

The article discusses the potential of private sector investments in climate financing, highlighting their current involvement and potential impact on various aspects such as access to larger pools of capital, innovation, risk management, and scaling up successful approaches. It also addresses challenges and considerations like alignment with public goals, transparency, inclusivity, and regulatory frameworks. The conclusion emphasizes the importance of collaboration between public and private sectors for effective utilization of private capital in climate action.

What are the risks associated with private equity investments ?

Private equity investments are a type of investment where an investor puts money into a private company, typically with the expectation of high returns. While these investments can offer substantial rewards, they also come with significant risks such as illiquidity, lack of transparency, high volatility, management risk, exit strategy uncertainty, valuation challenges, economic cycles, and legal and regulatory changes. Proper research, diversification, and patience are key to navigating the challenges associated with private equity investments.

What is the future outlook for private equity ?

Private equity (PE) is a dynamic sector of the financial industry that involves investing in or acquiring companies, typically with the aim of improving their operations and selling them at a profit within a few years. The future outlook for private equity is influenced by various factors such as economic conditions, technological advancements, regulatory changes, and market trends. Here's a detailed analysis of what the future might hold for private equity: Economic Influences: Global Economic Growth, Interest Rates, Market Volatility Technological Advancements: Digitization, Artificial Intelligence and Machine Learning, Blockchain Regulatory Changes: Stricter Regulations, Tax Laws Market Trends: ESG Investing, Diversification, Exit Strategies Industry Evolution: Consolidation, Secondary Markets, Direct Investments Challenges and Opportunities: Competition, Talent Retention, Innovation In conclusion, the future of private equity looks promising but not without its challenges. The industry is set to evolve with changing economic conditions, technological advancements, regulatory shifts, and market trends. PE firms that adapt and innovate will be well-positioned to thrive in this dynamic environment.

How can policymakers encourage private sector involvement in climate adaptation ?

To encourage private sector involvement in climate adaptation, policyTo encourage private sector involvement in climate adaptation, policy as creating incentives like tax policymakers can implement strategies such as creating incentives like tax breaks and subsidies, establishing clear regulations with compliance enforcement, facilitating information sharing through open data access and collaborative platforms, promoting public-private partnerships with joint projects and long-term commitments, enhancing capacity building via training programs and technical assistance, and recognizing and showcasing success stories through awards and media coverage. These steps will foster a collaborative environment where the private sector actively seeks opportunities to contribute to resilient and sustainable solutions for climate change challenges.

What is the difference between private and public Wi-Fi ?

Private and public Wi-Fi networks differ in terms of security, accessibility, and management. Understanding the distinctions between these two types of networks is crucial for ensuring that your internet connection is secure and optimized for your specific needs. Private Wi-Fi networks are typically password-protected, ensuring that only authorized users can connect, adding a layer of security. They offer more control over network settings and user management, allowing administrators to monitor connected devices and create network usage policies. Private networks are ideal for activities requiring secure connections, such as online banking or accessing sensitive information. Public Wi-Fi networks, on the other hand, are open or use a simpler connection method, often requiring no password or providing a generic one for all users. This ease of access makes them vulnerable to security threats such as data interception or unauthorized access to connected devices. Public networks lack robust management features and may not provide the same level of control over network settings or user activity. They are better suited for general browsing, checking emails, or using social media where the need for secure transactions is minimal. In conclusion, the choice between private and public Wi-Fi depends on your priorities regarding security, accessibility, and intended use. For secure transactions and controlled environments, private Wi-Fi is the preferred option. Conversely, public Wi-Fi offers convenience and widespread availability but requires more caution regarding security and potentially lower performance in high-traffic areas. Always consider the nature of your online activities and the importance of security when choosing between these two types of networks.

What role do private companies play in building and operating EV charging networks ?

Private companies play a pivotal role in the development and operation of electric vehicle (EV) charging networks, contributing to infrastructure development, network operation, partnerships and collaboration, and data analysis and optimization. They are involved in planning, design, construction, technology innovation, maintenance, management, customer service, pricing strategies, public-private partnerships, industry alliances, community engagement, performance tracking, and market research. Their efforts ensure that EV charging infrastructure is developed efficiently, innovatively, and with the end-user in mind.

What is the role of private companies in space exploration ?

Private companies have become key players in space exploration, driving technological advancements, reducing costs, and fostering innovation. They are at the forefront of developing new technologies such as reusable rockets, advanced propulsion systems, and robotic explorers. Private companies often operate with leaner budgets and more streamlined processes than government agencies, allowing them to deliver space missions at a lower cost. This cost-effectiveness is crucial for making space exploration more accessible and sustainable over the long term. Private companies are known for taking risks and pursuing innovative ideas that might not be considered by government agencies due to budget constraints or strategic priorities. Their involvement has made space missions more accessible and sustainable while opening up new possibilities for exploring our solar system and beyond.

What should I consider when choosing a private vs federal student loan ?

When choosing between a private and federal student loan, consider interest rates, repayment options, forgiveness programs, eligibility requirements, and the application process. Federal loans usually have lower interest rates and more lenient eligibility requirements, while private loans may offer more flexibility in repayment options but typically have higher interest rates. Weigh these factors against your individual circumstances and financial goals to make an informed decision about which type of loan is best for you.

How has the involvement of the private sector influenced the strategies for global climate governance ?

The influence of the private sector on global climate governance strategies is evident in innovation, finance, and policy-making. Private companies invest in research and development of new technologies that can reduce greenhouse gas emissions and commercialize these technologies for widespread use. They lead the way in developing renewable energy sources and improving energy efficiency. In terms of finance, private companies issue green bonds and venture capitalists invest in startups focused on climate solutions. They also participate in carbon markets and create carbon offset programs. In policy-making, private companies engage in advocacy and lobbying efforts to shape government policies related to climate change and integrate corporate social responsibility into their business models. They collaborate with governments and international organizations in public-private partnerships and multi-stakeholder initiatives. Overall, the involvement of the private sector has significantly influenced global climate governance strategies by driving innovation, providing financial resources, and shaping policy decisions.

What is private equity ?

Private equity (PE) is an investment strategy where funds pool capital from institutional investors to directly invest in companies. This involves buying out existing shareholders or providing growth capital, with the aim of improving operations and selling at a profit. Key features include long-term investments, active ownership, diverse strategies, and a clear exit strategy. Types of PE include leveraged buyouts, venture capital, growth equity, mezzanine financing, and secondaries. Private equity firms play roles in due diligence, deal structuring, operational improvement, financial management, and exit planning. Benefits of PE include economic growth, job creation, and operational expertise, while criticisms include high debt loads, short-term focus, and potential negative labor impacts.

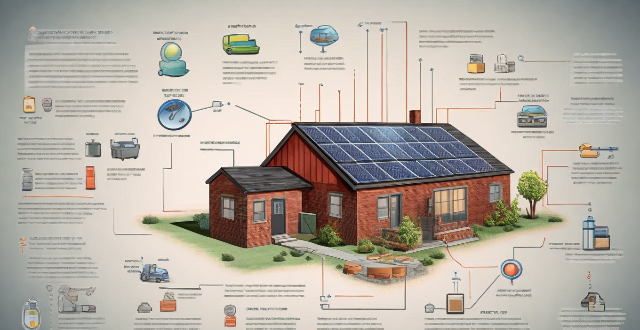

Is it possible to run my entire house on solar power alone ?

The possibility of powering an entire household with solar energy alone is influenced by various factors, including energy consumption habits, geographic location, available roof space, and system efficiency. Financial considerations, net metering policies, and maintenance requirements also play a role in determining the feasibility of such a setup. Homeowners should assess these elements and consider professional consultation to ascertain if their home can run solely on solar power.

What questions should I ask during a school visit or open house ?

Visiting a school or attending an open house is a valuable opportunity to gather information about the educational environment and culture of the institution. To make the most of your visit, it's important to ask thoughtful questions that will help you understand the school's philosophy, curriculum, and community. Key questions to consider include those related to school culture and philosophy, academics and curriculum, extracurricular activities and facilities, teachers and staff, student support and services, parental involvement and communication, safety and health, and closing questions to clarify next steps. By asking these questions, you can gain a comprehensive understanding of the school and be better equipped to make an informed decision about your child's education.

How do private equity firms value companies ?

Private equity firms value companies using various methods, includingPrivate equity firms value companies using various methods, including, discounted cash flow ( These approaches help them assess the company's financial health, market position, growth potential, and risks to make informed investment decisions.

What is the regulatory environment for private equity ?

Private equity firms are subject to various regulatory requirements, including disclosure, anti-money laundering and know your customer regulations, securities laws, and tax laws. The specific regulations vary across different regions and countries, with the United States being regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), Europe by the Alternative Investment Fund Managers Directive (AIFMD), and Asia having widely varying regulations across different countries. Despite these regional variations, key principles such as transparency, disclosure, and compliance with securities and tax laws are common across all jurisdictions.

How do private equity firms make money ?

Private equity firms generate profits through various strategies, includingPrivate equity firms generate profits through various strategies, includingLBOs), growth capital including leveraged buyouts (LBOs), growth capital investments, and venture capital investments. LBOs involve acquiring companies with debt and equity financing to improve their value for a higher sale price or public offering. Growth capital investments provide funding to established companies with growth potential but not ready for an LBO or public offering. Venture capital investments target early-stage startups with high growth potential but limited track records. Private equity firms manage risk by diversifying across industries and geographies, conducting thorough due diligence, actively involving portfolio company management, and monitoring financial performance metrics. By balancing risk and reward, they can achieve consistent returns over time while minimizing losses from individual investments.

Can you name a few celebrities known for their lavish homes ?

Kim Kardashian and Kanye West, Oprah Winfrey, Taylor Swift, George Clooney, Jay-Z and Beyonce are celebrities known for their lavish homes.

How can private sector participate in climate financing ?

Private sector participation in climate financing can take various forms, including direct investments in renewable energy projects, issuing green bonds or sustainable investment funds, carbon credit trading, R&D for innovative climate solutions, forming partnerships, adopting circular economy models, implementing eco-friendly business practices, maintaining transparency in environmental impact reporting, providing philanthropic support, and engaging employees in sustainability efforts. These actions not only mitigate climate change but also often improve corporate reputation and open new markets.

What is the relationship between private equity and venture capital ?

Private equity and venture capital are investment strategies with similarities but distinct differences in focus, stage of investment, and type of companies they invest in. Private equity firms typically invest in established companies looking to expand or restructure, often in industries such as healthcare, technology, and real estate. Venture capitalists primarily invest in startups and early-stage companies with high growth potential, often in innovative technologies and new business models. Private equity investments are usually made in later stages of a company's development, while venture capital investments are made at earlier stages. Private equity firms tend to invest in larger, more mature companies with established revenue streams and proven business models, while venture capitalists invest in smaller, younger companies with high growth potential but also higher risks due to their unproven business models. It is important for investors to understand these differences when considering which type of investment strategy aligns with their goals and risk tolerance.

How do private equity firms identify potential investment opportunities ?

Private equity firms use various methods to identify potential investment opportunities, including networking and relationship building, direct outreach, industry analysis, competitive intelligence, financial analysis, deal sourcing platforms, strategic partnerships, tracking M&A activity, and event-driven opportunities. These methods involve a mix of qualitative assessments and quantitative analysis to ensure a comprehensive approach to identifying viable targets for private equity investment.

How does private equity compare to other forms of alternative investments ?

Private equity is a type of investment where funds are invested directly in companies that are not publicly traded. It differs from other forms of alternative investments in terms of illiquidity, risk level, return potential, and accessibility. Private equity investments are typically illiquid, carry a high level of risk, have the potential for high returns, and are only available to accredited investors. Other forms of alternative investments, such as real estate, commodities, hedge funds, derivatives, venture capital, and angel investing, may offer more liquidity, diversification, hedging strategies, and accessibility to a wider range of investors. It is important for investors to carefully consider their investment goals, risk tolerance, and liquidity needs before investing in any type of alternative investment.