Plan Term

How can I make sure my fitness meal plan is sustainable long-term ?

A sustainable fitness meal plan is essential for achieving long-term health and wellness goals. To make it work, set realistic goals, plan ahead, incorporate variety, make it enjoyable, stay flexible, and seek professional advice.

What are some long-term saving strategies ?

Saving for the long term requires a disciplined approach and a solid plan. Here are some strategies to help you save effectively over the years: 1. Set clear financial goals: short-term, medium-term, and long-term. 2. Create a budget and stick to it by tracking expenses, cutting unnecessary costs, and automating savings. 3. Build an emergency fund that is easily accessible and covers at least 3-6 months' worth of living expenses. 4. Take advantage of employer matches and maximize contributions to retirement accounts like 401(k)s and IRAs. 5. Invest wisely with diversification, risk management, and a long-term perspective. 6. Manage debt by paying off high-interest debts first and considering refinancing options. 7. Regularly review and adjust your financial plan, adapting to life changes as needed. 8. Plan for taxes by choosing tax-efficient investments and being strategic about withdrawals and contributions. 9. Consider estate planning with wills, trusts, and life insurance to protect your family's financial wellbeing. 10. Continuously learn and seek advice from financial professionals when needed. By consistently implementing these strategies, you can build a strong financial foundation for your future.

How can I ensure that my education budget plan is sustainable in the long term ?

Proper planning and management of an education budget are crucial for ensuring its long-term sustainability. Here's how you can achieve that: * Establish clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). * Conduct a thorough analysis of your current financial situation, projected costs, and sources of funding. * Create a comprehensive plan that includes budget allocation, revenue streams, and expense tracking. * Review and adjust the plan periodically to adapt to changes in personal circumstances, market conditions, or educational requirements. * Seek professional advice from financial advisors and education counselors to ensure the best outcomes.

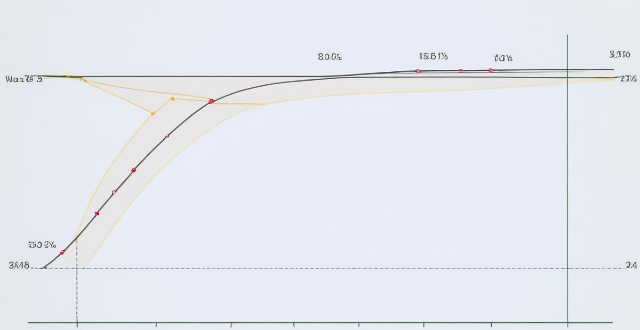

How long does it typically take for an economic stimulus plan to have a noticeable impact on the economy ?

## Summary Economic stimulus plans are sets of measures taken by governments to boost the economy during slow growth or recession. The time it takes for these plans to have a noticeable impact on the economy depends on several factors, including the plan's size and scope, targeted sectors, implementation efficiency, and current economic conditions. Generally, short-term effects can be seen within weeks, mid-term effects within three to six months, and long-term effects after one to two years. However, these timelines are not fixed and can vary based on the specific circumstances of each plan.

What is an economic stimulus plan ?

An economic stimulus plan is a government policy aimed at boosting a country's economy during times of slow growth or recession. The primary goal of such plans is to increase consumer spending, encourage business investments, and create jobs, thereby stimulating economic activity and promoting overall growth. Key features of an economic stimulus plan include tax cuts and rebates, government spending on infrastructure projects, monetary policy adjustments, direct assistance to businesses and individuals, and incentives for investment. Benefits of an economic stimulus plan include increased economic growth, job creation, long-term gains, and reduced poverty rates. However, potential downsides of an economic stimulus plan include national debt, inflation risks, crowding out effect, and short-term vs long-term effects. In conclusion, an economic stimulus plan is a multifaceted approach employed by governments to revive flagging economies. While these plans can have significant positive impacts on growth, employment, and overall well-being, they must be carefully designed and implemented to minimize potential drawbacks such as increased national debt and inflation risks.

How do economists evaluate the effectiveness of a particular economic stimulus plan ?

Economists evaluate the effectiveness of economic stimulus plans by considering factors such as GDP growth rate, inflation rate, unemployment rate, job creation, government spending, deficit and debt levels, personal consumption expenditures, consumer confidence, sectoral analysis, regional impact, sustainability, and legacy. These evaluations help determine whether the plan has achieved its intended goals and guide future policy decisions.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

What are some proven strategies for long-term wealth accumulation ?

Long-term wealth accumulation is a goal for many individuals, and there are several proven strategies that can help achieve this objective. Here are some of the most effective approaches: 1\. Start Early: The earlier you start saving and investing, the more time your money has to grow through compound interest. 2\. Live Below Your Means: Spend less than you earn and save the difference. 3\. Invest Wisely: Choose investments that align with your goals, risk tolerance, and time horizon. Diversify your portfolio to spread risk and maximize returns. 4\. Pay Off High-Interest Debt: High-interest debt like credit card balances can be a significant obstacle to wealth accumulation. Paying off these debts should be a priority. 5\. Increase Your Income: Increasing your income can provide more resources for saving and investing, which can help accelerate wealth accumulation. 6\. Plan for Retirement: Retirement planning is an essential component of long-term wealth accumulation, ensuring you have enough funds to support yourself during your golden years. 7\. Protect Your Wealth: Ensure that your hard-earned wealth is protected against unexpected events like lawsuits, accidents, or health issues.

How can women protect their assets and ensure long-term financial security ?

The article provides a list of strategies that women can employ to ensure their financial security over the long term. These include building an emergency fund, investing in retirement accounts, purchasing life insurance, creating a will, considering long-term care insurance, educating oneself about finance, working with a financial advisor, and prioritizing career development. Each of these steps is crucial in its own way for safeguarding one's assets and ensuring financial stability.

What should be included in a sports career plan ?

A comprehensive sports career plan should include personal information, career objectives, skill development, education & training, competition history, sponsorship & funding, off-field activities, health & wellness, post-retirement planning, and a conclusion. It serves as a roadmap to guide athletes through their journey in sports, ensuring they are well-prepared for every stage of their career.

How often should I review my study plan to ensure its effectiveness ?

To ensure the effectiveness of your study plan, it's crucial to review it regularly. Weekly reviews help assess progress, adjust timelines, identify challenges, celebrate successes, and make necessary changes. Monthly reviews involve evaluating overall goals, reflecting on learning style, considering external factors, setting new goals, and updating the plan. Quarterly reviews analyze long-term progress, revisit motivation, assess habits and routines, seek feedback, and create a new plan. Being flexible and open to making changes is key.

What role does self-discipline play in following a study plan ?

Self-discipline is crucial in following a study plan effectively. It involves setting goals, prioritizing tasks, maintaining focus on objectives, and avoiding distractions. By breaking down long-term goals into smaller, manageable tasks and allocating time wisely, self-disciplined individuals can maximize productivity and achieve academic success efficiently. Consistency, overcoming procrastination, and staying motivated are also key factors in sticking to a study plan. Developing strong self-discipline skills can help students reach their full potential.

In what circumstances is an economic stimulus plan most necessary ?

An economic stimulus plan is most necessary during times of recession, slow economic growth, high unemployment rates, or financial crisis. These plans can help to boost economic activity, create jobs, and stabilize the financial system by implementing policies such as increasing government spending, reducing taxes, providing subsidies to businesses, encouraging investment in new technologies, expanding access to credit, investing in infrastructure projects, offering tax incentives for hiring new employees, and implementing regulatory reforms.

What are the hidden fees associated with my mobile operator's plan ?

Mobile operators often have hidden fees that can add up over time and significantly increase the cost of your mobile plan. These fees include activation fees, early termination fees, upgrade fees, overage charges, international roaming charges, and administrative fees. To avoid these fees, it is important to read the fine print of your mobile operator's contract carefully before signing up and consider using a prepaid plan or paying for your phone outright.

How can I create a personalized sports training plan for myself ?

Creating a personalized sports training plan is important for achieving fitness goals. Here's how to create one: assess your fitness level, set clear goals, choose appropriate training methods, develop a weekly routine, and monitor progress & make adjustments.

How can I create a sustainable workout plan to enhance my personal health ?

Creating a sustainable workout plan is crucial for enhancing personal health. To do so, start by setting realistic goals that are specific, measurable, attainable, relevant, and time-bound (SMART). Choose activities you enjoy and mix up your routine with different types of workouts to avoid boredom. Start slowly and gradually increase intensity while incorporating rest days to prevent injury and burnout. Track your progress using a journal or fitness app and stay consistent and accountable by finding support from an accountability partner or fitness community. By following these steps, you can create a sustainable workout plan that enhances your personal health while keeping you motivated and engaged in the long term.

What is the significance of setting short-term versus long-term climate targets ?

The article emphasizes the importance of setting both short-term and long-term climate targets to effectively address climate change. Short-term targets focus on immediate actions, creating urgency, measurable progress, immediate benefits, and building momentum for more ambitious goals. Long-term targets ensure sustainability, deep decarbonization, adaptation, and global cooperation. Achieving these goals is crucial for mitigating the worst effects of climate change and creating a more resilient future.

Is there a difference between short-term and long-term memory in scientific terms ?

Short-term memory and long-term memory are two different types of memory with distinct characteristics. Short-term memory has a limited capacity, typically able to hold around seven items for a brief period, while long-term memory has a large capacity, virtually unlimited, and can store vast amounts of information for an extended period. Short-term memory lasts only for a few seconds unless it is repeatedly rehearsed or transferred to long-term memory, while long-term memory can last for minutes, hours, days, years, or even a lifetime. Short-term memory acts as a temporary holding place for new information, processing it before transferring it to long-term memory, while long-term memory stores information for future use, including facts, experiences, skills, and knowledge. Short-term memory has a faster retrieval speed since the information is readily available in the mind, while long-term memory has a slower retrieval speed as it requires more effort to recall the information from the vast storage. Short-term memory is more susceptible to interference and forgetting due to its transient nature, while long-term memory is more stable and less prone to interference, making it easier to retain information over time. Short-term memory requires rehearsal or encoding processes to transfer information to long-term memory, while long-term memory involves consolidation processes that strengthen neural connections and make the memory more durable.

What are the benefits of implementing an economic stimulus plan ?

An economic stimulus plan is a set of policies designed to boost a country's economy during times of slow growth or recession. These plans are typically implemented by governments and can have a range of benefits, including increased economic activity, improved employment rates, stimulated investment, reduced inflation risk, and improved public services. By taking steps to boost the economy during times of slow growth or recession, governments can help to create a more stable and prosperous future for all citizens.

What are the benefits of using a prepaid vs postpaid plan with a mobile operator ?

Prepaid mobile plans offer control over spending, no credit checks, easy setup and flexibility. Postpaid plans provide more features, better customer service, easier billing management and potential discounts for bundling services.

What is the importance of long-term climate data analysis ?

Long-term climate data analysis is crucial for understanding the Earth's climate system and its changes over time. It provides valuable insights into past climate patterns and trends, which are critical for predicting future climate conditions and developing effective adaptation strategies. By continuing to collect and analyze long-term climate data, we can better prepare ourselves for the challenges posed by a changing climate and work towards a sustainable future.

What are the benefits of using a personalized nutrition plan from a health management app ?

Using a personalized nutrition plan from a health management app offers benefits such as improved nutritional intake, weight management, reduced risk of chronic diseases, better mental health, increased variety in diet, convenience, and accountability.

How do I invest my money wisely for long-term growth ?

Investing wisely for long-term growth involves setting financial goals, creating a diversified portfolio, considering risk tolerance, investing for the long-term, and monitoring investments regularly.

How accurate are long-term climate predictions ?

Long-term climate predictions are essential for understanding potential future changes in the environment, but their accuracy is often questioned due to the complexity of the climate system. Factors that influence the accuracy of these predictions include uncertainty in emission scenarios, natural variability, and model limitations. However, advancements in climate modeling, such as higher-resolution models, ensemble modeling, and data assimilation techniques, have significantly improved our ability to make accurate predictions about future climate changes. By continuing to invest in research and development, we can further enhance the precision and reliability of long-term climate predictions, providing critical information for decision-makers and the public alike.

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

Can I include charitable giving in my estate plan ?

Including charitable giving in your estate plan is a way to support causes you care about, with potential tax benefits and the creation of a lasting legacy. You can include charitable giving through bequests in your will, charitable trusts, donor-advised funds, life insurance policies, retirement accounts, and donating appreciated stocks. It's important to consult professionals, understand tax implications, and regularly update your plan.

How can I plan a food-themed travel itinerary ?

How to plan a food-themed travel itinerary: determine your food interests and preferences, research destinations with strong food cultures, create a list of must-try dishes and restaurants, plan your itinerary around food experiences, book accommodations near food hubs, pack appropriately for food adventures, and be open to new experiences and embrace local customs.

How do I know if I need an unlimited data plan for my smartphone usage ?

Do you need an unlimited data plan for your smartphone usage? Consider factors such as data usage, cost, network coverage, and family plans to make an informed decision.

What are some good sources of protein for a fitness meal plan ?

Including protein-rich foods like chicken breast, salmon, eggs, Greek yogurt, and quinoa in a fitness meal plan can support muscle building and fat loss goals.

How do I create a comprehensive estate plan ?

Creating a comprehensive estate plan is essential to ensure your assets are distributed according to your wishes after you pass away. Here are some steps to help you create a comprehensive estate plan: 1. Determine your goals and objectives, such as who you want to inherit your assets and how you want them distributed. 2. Gather information about all your assets, including real estate, bank accounts, investments, life insurance policies, and personal property. 3. Choose beneficiaries for your assets, including individuals, charities, or trusts. 4. Consider tax implications, such as federal and state estate taxes, gift taxes, and generation-skipping transfer taxes. 5. Create legal documents such as a will, power of attorney, healthcare proxy, and living will to ensure your wishes are carried out in case of incapacity or death. 6. Set up trusts to manage your assets during your lifetime and distribute them after your death. 7. Review and update your plan regularly to ensure it remains current with changes in your life. Working with a qualified professional can help ensure that your estate plan meets your needs and achieves your desired outcomes.