Plan Stick

What are some strategies for getting the best deals at a brand sale event ?

Strategies for Getting the Best Deals at a Brand Sale Event 1. Do Your Research: Familiarize yourself with the brand's regular prices and product lines, check out previous sale events to get an idea of typical discounts, and follow social media accounts for announcements and early access. 2. Plan Ahead: Create a list of items you want to purchase, prioritize your list based on importance and budget, determine how much you are willing to spend beforehand, and stick to your budget to avoid overspending. 3. Be Prepared: Log in to your account ahead of time and update any necessary information, have your payment method ready to go, download the brand's app for faster access, and be online or in-store when the sale starts to grab the best deals quickly. 4. Act Fast: Use multiple devices if possible to increase your chances of success, resist the urge to browse aimlessly; stick to your wish list, and stay focused on your plan. 5. Take Advantage of Extra Discounts: Look for coupon codes that can be stacked with sale prices, apply these codes at checkout to save even more, use rewards programs to earn points or cash back, and earn bonus points during sales events. 6. Know When to Stop: Avoid impulse buys, stick to your plan and only purchase what's on your list, check the return policy before making a purchase, and keep receipts and packaging in case you need to return or exchange an item.

How do I create an effective study plan ?

Creating an effective study plan is crucial for academic success. Here are some steps to help you create a successful study plan: 1. Set clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). 2. Assess your time and determine how much you can realistically dedicate to studying each day/week. 3. Allocate time for each subject based on difficulty level and proficiency. 4. Create a schedule using a calendar or planner and stick to it as much as possible. 5. Incorporate short breaks during study sessions to avoid burnout and maintain focus. 6. Regularly review progress and adjust the study plan accordingly. 7. Eliminate distractions by finding a quiet place to study and turning off unnecessary devices. 8. Stay motivated by reminding yourself of goals and celebrating small achievements. 9. Seek help when needed from teachers, tutors, or classmates. By following these steps, you can create an effective study plan that will help you achieve academic success while managing your time efficiently. Remember to stay flexible and adjust your plan as needed to accommodate changes in your schedule or priorities.

How can I make sure my fitness meal plan is sustainable long-term ?

A sustainable fitness meal plan is essential for achieving long-term health and wellness goals. To make it work, set realistic goals, plan ahead, incorporate variety, make it enjoyable, stay flexible, and seek professional advice.

What role does self-discipline play in following a study plan ?

Self-discipline is crucial in following a study plan effectively. It involves setting goals, prioritizing tasks, maintaining focus on objectives, and avoiding distractions. By breaking down long-term goals into smaller, manageable tasks and allocating time wisely, self-disciplined individuals can maximize productivity and achieve academic success efficiently. Consistency, overcoming procrastination, and staying motivated are also key factors in sticking to a study plan. Developing strong self-discipline skills can help students reach their full potential.

How can I create a sustainable workout plan to enhance my personal health ?

Creating a sustainable workout plan is crucial for enhancing personal health. To do so, start by setting realistic goals that are specific, measurable, attainable, relevant, and time-bound (SMART). Choose activities you enjoy and mix up your routine with different types of workouts to avoid boredom. Start slowly and gradually increase intensity while incorporating rest days to prevent injury and burnout. Track your progress using a journal or fitness app and stay consistent and accountable by finding support from an accountability partner or fitness community. By following these steps, you can create a sustainable workout plan that enhances your personal health while keeping you motivated and engaged in the long term.

What are the benefits of using a personalized nutrition plan from a health management app ?

Using a personalized nutrition plan from a health management app offers benefits such as improved nutritional intake, weight management, reduced risk of chronic diseases, better mental health, increased variety in diet, convenience, and accountability.

How can I stick to my budget without feeling deprived ?

Sticking to a budget is easier when you don't feel deprived. Here's how to do it: 1. **Set Realistic Goals**: Break down your financial goals into smaller, more manageable ones and make them specific and measurable. 2. **Prioritize Your Expenses**: Categorize your expenses into essential and non-essential, and differentiate between needs and wants. 3. **Find Alternatives**: Consider DIY projects and buying used items instead of new ones to save money. 4. **Track Your Spending**: Use budgeting apps or visual aids to monitor your expenses and progress toward your financial goals. 5. **Reward Yourself**: Allow yourself small treats for sticking to your budget and plan larger rewards for achieving long-term financial goals. 6. **Stay Motivated**: Keep reminders of your financial goals visible and share your goals with friends or family members who can provide support.

How can I avoid impulse buying and stick to my budget ?

Impulse buying is a common problem for many people, but there are strategies you can use to avoid it and stick to your budget. Creating a budget, setting financial goals, using cash instead of credit cards, avoiding temptation, and practicing mindful spending are all effective ways to control your spending and achieve your financial objectives. By implementing these strategies, you can take control of your finances and make progress towards your long-term goals.

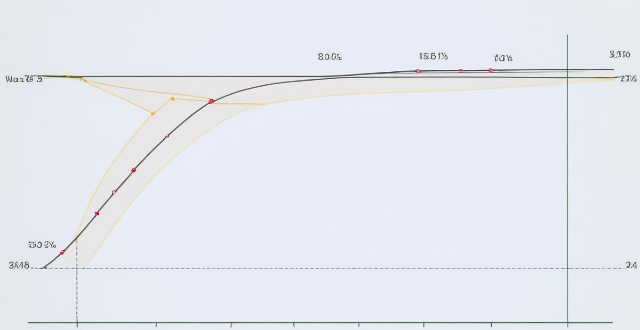

How do economists evaluate the effectiveness of a particular economic stimulus plan ?

Economists evaluate the effectiveness of economic stimulus plans by considering factors such as GDP growth rate, inflation rate, unemployment rate, job creation, government spending, deficit and debt levels, personal consumption expenditures, consumer confidence, sectoral analysis, regional impact, sustainability, and legacy. These evaluations help determine whether the plan has achieved its intended goals and guide future policy decisions.

What are the benefits of using a prepaid vs postpaid plan with a mobile operator ?

Prepaid mobile plans offer control over spending, no credit checks, easy setup and flexibility. Postpaid plans provide more features, better customer service, easier billing management and potential discounts for bundling services.

What is an economic stimulus plan ?

An economic stimulus plan is a government policy aimed at boosting a country's economy during times of slow growth or recession. The primary goal of such plans is to increase consumer spending, encourage business investments, and create jobs, thereby stimulating economic activity and promoting overall growth. Key features of an economic stimulus plan include tax cuts and rebates, government spending on infrastructure projects, monetary policy adjustments, direct assistance to businesses and individuals, and incentives for investment. Benefits of an economic stimulus plan include increased economic growth, job creation, long-term gains, and reduced poverty rates. However, potential downsides of an economic stimulus plan include national debt, inflation risks, crowding out effect, and short-term vs long-term effects. In conclusion, an economic stimulus plan is a multifaceted approach employed by governments to revive flagging economies. While these plans can have significant positive impacts on growth, employment, and overall well-being, they must be carefully designed and implemented to minimize potential drawbacks such as increased national debt and inflation risks.

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

Can I include charitable giving in my estate plan ?

Including charitable giving in your estate plan is a way to support causes you care about, with potential tax benefits and the creation of a lasting legacy. You can include charitable giving through bequests in your will, charitable trusts, donor-advised funds, life insurance policies, retirement accounts, and donating appreciated stocks. It's important to consult professionals, understand tax implications, and regularly update your plan.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

How can I plan a food-themed travel itinerary ?

How to plan a food-themed travel itinerary: determine your food interests and preferences, research destinations with strong food cultures, create a list of must-try dishes and restaurants, plan your itinerary around food experiences, book accommodations near food hubs, pack appropriately for food adventures, and be open to new experiences and embrace local customs.

How do I know if I need an unlimited data plan for my smartphone usage ?

Do you need an unlimited data plan for your smartphone usage? Consider factors such as data usage, cost, network coverage, and family plans to make an informed decision.

What are some good sources of protein for a fitness meal plan ?

Including protein-rich foods like chicken breast, salmon, eggs, Greek yogurt, and quinoa in a fitness meal plan can support muscle building and fat loss goals.

How do I create a comprehensive estate plan ?

Creating a comprehensive estate plan is essential to ensure your assets are distributed according to your wishes after you pass away. Here are some steps to help you create a comprehensive estate plan: 1. Determine your goals and objectives, such as who you want to inherit your assets and how you want them distributed. 2. Gather information about all your assets, including real estate, bank accounts, investments, life insurance policies, and personal property. 3. Choose beneficiaries for your assets, including individuals, charities, or trusts. 4. Consider tax implications, such as federal and state estate taxes, gift taxes, and generation-skipping transfer taxes. 5. Create legal documents such as a will, power of attorney, healthcare proxy, and living will to ensure your wishes are carried out in case of incapacity or death. 6. Set up trusts to manage your assets during your lifetime and distribute them after your death. 7. Review and update your plan regularly to ensure it remains current with changes in your life. Working with a qualified professional can help ensure that your estate plan meets your needs and achieves your desired outcomes.

What are the hidden fees associated with my mobile operator's plan ?

Mobile operators often have hidden fees that can add up over time and significantly increase the cost of your mobile plan. These fees include activation fees, early termination fees, upgrade fees, overage charges, international roaming charges, and administrative fees. To avoid these fees, it is important to read the fine print of your mobile operator's contract carefully before signing up and consider using a prepaid plan or paying for your phone outright.

In what circumstances is an economic stimulus plan most necessary ?

An economic stimulus plan is most necessary during times of recession, slow economic growth, high unemployment rates, or financial crisis. These plans can help to boost economic activity, create jobs, and stabilize the financial system by implementing policies such as increasing government spending, reducing taxes, providing subsidies to businesses, encouraging investment in new technologies, expanding access to credit, investing in infrastructure projects, offering tax incentives for hiring new employees, and implementing regulatory reforms.

How can I create a balanced fitness meal plan ?

To create a balanced fitness meal plan, start by determining your caloric needs and focus on nutrient-dense foods. Include lean protein, whole grains, fruits, vegetables, and healthy fats in your meals. Balance your macronutrients (carbs, protein, and fats) and plan your meals and snacks ahead of time to ensure you're getting the right balance of nutrients throughout the day. Stay hydrated and be mindful of portion sizes to support your health and fitness goals.

Do I need a lawyer to create an estate plan ?

Estate planning is important for ensuring that your assets are distributed according to your wishes after you pass away. While it is possible to create an estate plan without a lawyer, working with a legal professional can provide numerous benefits such as legal expertise, customized plans, and peace of mind. However, if you have a simple estate with few assets and no complicated family dynamics, creating a basic estate plan using online tools or templates may be sufficient. It is still important to consult with a lawyer to ensure that your plan meets all legal requirements and addresses any potential issues.

How can I prepare for Black Friday shopping ?

Black Friday, the day after Thanksgiving, is knownBlack Friday, the day after Thanksgiving, is known discounts on a wide range of To make the most of this shopping extravaganza, it's essential to prepare in advance. Here's how you can get ready for Black Friday shopping: 1. **Make a List** - Think ahead and prioritize your needs into essentials and non-essentials. - Set a budget and stick to it to maintain financial stability. 2. **Research Deals in Advance** - Sign up for newsletters and follow retailers on social media for updates. - Use price tracking tools to compare prices across retailers. 3. **Plan Your Shopping Strategy** - Decide whether to shop online or in-store, considering crowds and queues. - Plan your timing to catch early bird and late-night deals. 4. **Be Tech-Ready** - Ensure a stable and fast internet connection with a backup plan. - Have multiple payment methods ready for quick transactions. 5. **Stay Updated on Return Policies** - Familiarize yourself with return policies and keep receipts safe. By following these steps, you'll be well-prepared for Black Friday shopping. The key is planning ahead and staying organized for a successful shopping experience.

What are the benefits of implementing an economic stimulus plan ?

An economic stimulus plan is a set of policies designed to boost a country's economy during times of slow growth or recession. These plans are typically implemented by governments and can have a range of benefits, including increased economic activity, improved employment rates, stimulated investment, reduced inflation risk, and improved public services. By taking steps to boost the economy during times of slow growth or recession, governments can help to create a more stable and prosperous future for all citizens.

What should be included in a sports career plan ?

A comprehensive sports career plan should include personal information, career objectives, skill development, education & training, competition history, sponsorship & funding, off-field activities, health & wellness, post-retirement planning, and a conclusion. It serves as a roadmap to guide athletes through their journey in sports, ensuring they are well-prepared for every stage of their career.

How do I measure progress in my sports training plan ?

Measuring progress is crucial for athletes to track development and adjust their training plans. Set SMART goals, track performance, evaluate technique, monitor body composition, assess fitness level, and reflect on mental state to measure progress effectively.

Can I share my unlimited data plan with family members or friends ?

Sharing your unlimited data plan with family members or friends can be a great way to save money and ensure that everyone has access to the internet. Before you start sharing your data plan, there are a few things you should consider. Firstly, it's important to understand what your data plan includes. Most unlimited data plans come with certain restrictions, such as throttling after a certain amount of data usage or slower speeds during peak hours. Make sure you know the details of your plan so that you can accurately communicate them to anyone you choose to share with. Secondly, not all carriers allow for data plan sharing, so it's important to check with your carrier before making any decisions. Some carriers may have specific rules about who can share your data plan and how much data they can use. Others may charge additional fees for each person added to your plan. Be sure to read the fine print and understand any potential costs or restrictions associated with sharing your data plan. Thirdly, if your carrier allows for data plan sharing, adding family members or friends to your plan is usually a straightforward process. You'll need to contact your carrier and provide them with the necessary information for each person you want to add to your plan. Once they're added to your plan, they'll be able to use your data just like you do. Lastly, when sharing your unlimited data plan, it's important to keep track of how much data each person is using. This will help you avoid unexpected overage charges and ensure that everyone has enough data to meet their needs. You can usually monitor data usage through your carrier's website or mobile app. If someone on your plan starts using more data than expected, you may need to talk to them about reducing their usage or consider upgrading to a larger data plan.

How do I avoid impulse buying and stick to my shopping list ?

The text provides tips on how to avoid impulse buying and stick to a shopping list. It emphasizes the importance of identifying needs, categorizing the list, setting a budget, not shopping when hungry, using cash instead of cards, avoiding window shopping, and practicing self-control. By following these steps, one can make conscious decisions about purchases and avoid overspending and clutter in the home.

How can I create an emergency evacuation plan for my family ?

Creating an emergency evacuation plan is crucial for the safety of your family during unexpected events such as natural disasters, fires, or other emergencies. Here are some steps to help you create a comprehensive emergency evacuation plan: 1. Identify potential risks that could affect your home and community. 2. Gather important information including contact information, medical information, insurance information, and financial information. 3. Determine the best evacuation routes from your home in case of an emergency. 4. Choose a meeting place outside of your home where your family can regroup in case of an emergency. 5. Practice your emergency evacuation plan with your family on a regular basis. 6. Stay informed about potential risks and updates from local authorities.

How do I adapt my study plan if it's not working as expected ?

If your study plan is not working as expected, it's important to identify the root cause of the problem and make adjustments accordingly. Here are some tips on how to adapt your study plan: ### Identify the Problem 1. Assess your progress 2. Identify potential roadblocks 3. Reflect on your study habits ### Make Adjustments to Your Study Plan #### Change Your Study Environment - Find a quiet space - Create a comfortable study area #### Improve Your Time Management Skills - Create a schedule - Prioritize tasks - Use time-management tools #### Adjust Your Study Methods - Try different study techniques - Break down complex topics - Take breaks #### Seek Help When Needed - Ask for clarification - Join a study group - Consider hiring a tutor By identifying the problem and making adjustments to your study plan, you can improve your chances of success and achieve your academic goals. Remember to be patient and persistent in your efforts, and don't be afraid to seek help when needed.