Plan Loan

How can I manage my student loan repayment after graduation ?

## Summary of Managing Student Loan Repayment After Graduation After graduation, managing student loan repayment can be a significant challenge. However, by following these steps, you can effectively manage your loans and avoid unnecessary fees or damage to your credit score: 1. **Understand Your Loan Terms**: Before starting any repayment plan, it's crucial to understand the terms of your student loans, including interest rates, monthly payments, and grace periods. 2. **Create a Budget**: A budget helps prioritize expenses and determine how much money can be allocated towards student loan repayment each month. Include all necessary expenses in your budget. 3. **Make Payments On Time**: Late payments can lead to fees and negatively impact your credit score. Set up automatic payments or make manual payments on time to avoid penalties. 4. **Consider Consolidation or Refinancing**: If you have multiple loans with different terms, consolidating them into one payment or refinancing at a lower rate may simplify repayment and save money. 5. **Explore Repayment Options**: Federal student loans offer various repayment plans, such as income-driven plans that adjust your payments based on your income and family size. Discuss the best plan with your loan servicer. 6. **Seek Help if Needed**: If struggling to make payments, don't hesitate to reach out for assistance. Many loan servicers offer forbearance or deferment options, and there are also government programs that can provide support for student loan repayment.

Are there any programs that help with student loan forgiveness or relief ?

There are several programs available to help with student loan forgiveness or relief, including Public Service Loan Forgiveness (PSLF), Income-Driven Repayment Plans (IDRs), Teacher Loan Forgiveness Program, Disability Discharge, Closed School Discharge, and Borrower Defense to Repayment. These programs vary by country and eligibility requirements, but they all aim to make student loan payments more affordable or forgivable based on certain criteria such as employment in public service, income level, teaching at a low-income school, disability status, school closure, or being misled or defrauded by a college or university. It's important to research each option thoroughly and determine which one best fits your individual circumstances and needs.

How do I qualify for a mortgage loan ?

This article provides a detailed guide on how to qualify for a mortgage loan, highlighting key factors that lenders consider such as income, credit score, debt-to-income ratio, employment history, and assets and liabilities. It also outlines steps to take in order to increase chances of success including checking your credit score, calculating your DTI, gathering financial documents, shopping around for lenders, getting pre-approved for a loan, finding a home within budget range, making an offer, and completing the closing process.

How do I apply for a student loan ?

This text provides a comprehensive guide on how to apply for a student loan. It outlines nine steps, including determining needs, researching loan options, checking eligibility requirements, gathering documents, completing and submitting the application form, waiting for approval, signing promissory notes and loan agreements, and receiving disbursement of loan funds. The guide emphasizes the importance of understanding different loan options and their terms and conditions before applying. It also highlights the need to gather all necessary documents and provide accurate information in the application form. Overall, this text is an essential resource for students seeking financial assistance for their education.

What factors determine the amount of a student loan ?

The amount of a student loan is determined by several key factors, including eligibility criteria set by the lender, the cost of attendance at the chosen school, the student's financial need, and the type of loan (federal or private). Other influential factors include repayment options, school choice, and the availability of other financial aid. Students should consider all these elements and explore all possible funding options before taking out a loan.

How does defaulting on a student loan affect future borrowing ?

Defaulting on a student loan can severely impact your financial future, including your ability to borrow money. Here's what happens when you default and how it affects future borrowing: 1. **Consequences of Defaulting**: When you fail to make payments on your student loan for an extended period (typically 270 days), it's declared in default. The loan servicer then takes measures like wage garnishment, tax refund offset, and charging collection fees. Your credit score also takes a significant hit. 2. **Impact on Future Borrowing**: - **Difficulty Obtaining New Loans**: Lenders see you as a high-risk borrower, making it hard to get mortgages, car loans, or personal loans. - **Higher Interest Rates**: Even if approved, you face higher interest rates due to your damaged credit score. - **Limited Borrowing Options**: You may only qualify for secured or co-signed loans. - **Trouble Renting Property**: Some landlords check credit scores, and a defaulted loan can hinder your rental applications. - **Impact on Employment Opportunities**: While less common, some employers might check your credit report, affecting job prospects in industries where financial responsibility is crucial. 3. **Recovering from Default**: - **Rehabilitation Programs**: Many lenders offer these to help you make affordable payments over time, removing the default status. - **Consolidation Loans**: You can consolidate your defaulted loan into a new Direct Consolidation Loan through the federal government, making it easier to manage your debt. However, this doesn't remove the default status from your credit report. - **Paying Off the Debt**: If possible, paying off the loan in full removes the default status and improves your borrowing prospects. Negotiating a settlement with your lender or seeking assistance from a nonprofit credit counseling agency are other options.

What should I consider when choosing a private vs federal student loan ?

When choosing between a private and federal student loan, consider interest rates, repayment options, forgiveness programs, eligibility requirements, and the application process. Federal loans usually have lower interest rates and more lenient eligibility requirements, while private loans may offer more flexibility in repayment options but typically have higher interest rates. Weigh these factors against your individual circumstances and financial goals to make an informed decision about which type of loan is best for you.

How do interest rates on student loans work ?

Interest rates on student loans are the percentage of the loan amount that borrowers must pay in addition to the principal balance. The interest rate is determined by the lender and can vary based on factors such as creditworthiness, type of loan, and repayment term. There are two main types of student loans: federal and private. Federal student loans have fixed interest rates that are set by Congress each year, while private student loans have variable or fixed interest rates that are determined by the lender. Interest on student loans begins to accrue as soon as the loan is disbursed, and there are several repayment options available for student loans. By choosing the right type of loan and repayment plan, you can minimize your interest costs and pay off your student loans more efficiently.

Can you consolidate multiple student loans into one payment ?

Consolidating multiple student loans into one payment simplifies monthly expenses and can reduce overall interest rates. The process involves taking out a new loan to pay off existing ones, resulting in a single fixed interest rate and monthly payment. Benefits include lower monthly payments and easier management, but potential drawbacks such as longer repayment periods and loss of lender benefits should be considered. Successful consolidation requires evaluating current loans, comparing offers, and understanding all terms before committing.

How does a home equity loan work in relation to my mortgage ?

A home equity loan allows homeowners to borrow against the equity in their property, serving as a second mortgage without requiring refinancing. It offers advantages such as lower interest rates and potential tax deductions but also presents risks like foreclosure and additional debt. Understanding how it works in relation to your primary mortgage is crucial for making an informed financial decision.

Can I get a mortgage with bad credit ?

Getting a mortgage with bad credit is possible but may be more challenging and come with less favorable loan terms. To increase your chances, check your credit score, work on improving it, shop around for lenders, consider alternative options like FHA or VA loans, and be prepared to make a larger down payment.

What are the pros and cons of taking out a student loan ?

Student loans can help students afford college, but also come with long-term debt and limited job opportunities.

What are the current mortgage rates for first-time homebuyers ?

The text discusses the current mortgage rates for first-time homebuyers, detailing the various types of loans available, such as Federal Housing Administration (FHA) Loans, Conventional Loans, and Adjustable-Rate Mortgages (ARMs), and providing key points for each type. It also offers tips for first-time homebuyers to consider when looking at mortgage rates, including improving credit scores, saving for a down payment, comparing lenders, considering all costs, and consulting a professional. The text emphasizes the importance of shopping around and comparing offers from multiple lenders to find the best rates and terms for individual financial situations.

What is private mortgage insurance (PMI) and do I need it ?

Private Mortgage Insurance (PMI) is a type of insurance that protects the lender, not the borrower, in case of default on a mortgage loan. It is typically required when a homebuyer makes a down payment of less than 20% of the home's purchase price. Whether you need PMI depends on factors such as your down payment, credit score, loan-to-value ratio, and type of loan. Consider the cost of PMI and alternatives before deciding to obtain it.

How does a co-signer affect my mortgage application ?

A co-signer is a person who signs a loan application along with the primary borrower. The co-signer agrees to take on the responsibility of repaying the loan if the primary borrower fails to do so. In this article, we will discuss how a co-signer affects your mortgage application. The credit score of both the primary borrower and the co-signer plays a significant role in determining the eligibility for a mortgage loan. A co-signer with a good credit score can improve the chances of getting approved for a mortgage loan. However, if the co-signer has a poor credit score, it may negatively impact the loan approval process. The income and debt-to-income ratio (DTI) of both the primary borrower and the co-signer are also important factors that lenders consider when evaluating a mortgage application. If the co-signer has a high income and low DTI, it can help strengthen the application and increase the chances of approval. On the other hand, if the co-signer has a low income or high DTI, it may negatively impact the loan approval process. Lenders also consider the employment history of both the primary borrower and the co-signer when evaluating a mortgage application. A stable employment history can demonstrate financial stability and reliability, which can positively impact the loan approval process. If the co-signer has a stable employment history, it can help strengthen the application and increase the chances of approval. The assets and liabilities of both the primary borrower and the co-signer are also taken into consideration by lenders when evaluating a mortgage application. If the co-signer has significant assets and few liabilities, it can help strengthen the application and increase the chances of approval. However, if the co-signer has significant liabilities or limited assets, it may negatively impact the loan approval process. In conclusion, a co-signer can have a significant impact on your mortgage application. Their credit score, income and DTI, employment history, assets, and liabilities are all factors that lenders consider when evaluating a mortgage application. It is important to choose a co-signer who has a good credit score, stable employment history, and low DTI to increase the chances of getting approved for a mortgage loan.

How long does it take to get approved for a mortgage ?

Getting approved for a mortgage is an essential step in the home buying process. The time it takes to get approved can vary depending on several factors, including your financial situation, the type of loan you are applying for, and the lender you choose. In this article, we will discuss the different stages of the mortgage approval process and provide an estimate of how long each stage typically takes. ## Stage 1: Pre-approval Pre-approval is the initial step in the mortgage approval process. During this stage, you will need to submit various documents to your lender, such as pay stubs, tax returns, and bank statements. Your lender will then review your financial information to determine if you qualify for a mortgage and what size loan you can afford. This stage typically takes around 1-3 business days. ### Documents needed for pre-approval: - Pay stubs from the past two months - W2 forms or tax returns from the past two years - Bank statements from the past two months - Credit report ## Stage 2: Underwriting Once you have been pre-approved, your lender will begin the underwriting process. During this stage, your lender will verify the information you provided during pre-approval and ensure that you meet all of their lending requirements. This stage typically takes around 5-7 business days. ### Tasks performed during underwriting: - Verifying employment and income - Checking credit history and scores - Evaluating assets and liabilities - Assessing property value and condition ## Stage 3: Closing If your lender approves your loan application, you will move on to the closing stage. During this stage, you will sign all of the necessary paperwork to finalize your loan. This stage typically takes around 3-5 business days. ### Tasks performed during closing: - Reviewing final loan documents - Signing loan agreements and disclosures - Paying closing costs and fees - Receiving keys to your new home ## Estimated Timeline for Mortgage Approval In summary, the estimated timeline for getting approved for a mortgage is as follows: 1. Pre-approval: 1-3 business days 2. Underwriting: 5-7 business days 3. Closing: 3-5 business days Overall, it typically takes around 9-15 business days to get approved for a mortgage. However, keep in mind that this timeline can vary depending on factors such as your financial situation, the lender you choose, and any potential delays or issues that may arise during the process.

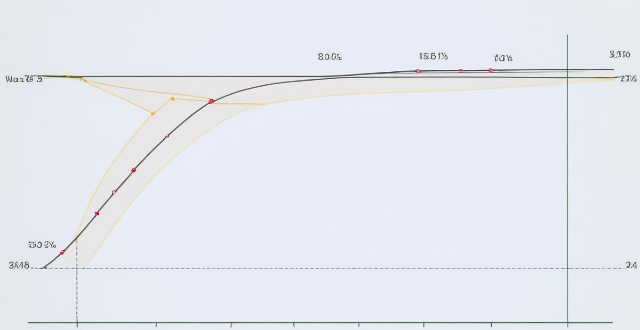

How do economists evaluate the effectiveness of a particular economic stimulus plan ?

Economists evaluate the effectiveness of economic stimulus plans by considering factors such as GDP growth rate, inflation rate, unemployment rate, job creation, government spending, deficit and debt levels, personal consumption expenditures, consumer confidence, sectoral analysis, regional impact, sustainability, and legacy. These evaluations help determine whether the plan has achieved its intended goals and guide future policy decisions.

What are the benefits of using a prepaid vs postpaid plan with a mobile operator ?

Prepaid mobile plans offer control over spending, no credit checks, easy setup and flexibility. Postpaid plans provide more features, better customer service, easier billing management and potential discounts for bundling services.

What is credit management ?

Credit management is the process of managing and controlling the use of credit by individuals or businesses. It involves evaluating borrowers' creditworthiness, determining the amount of credit to extend, monitoring loan repayment, and taking action for late payments. Key components include credit analysis, evaluation, loan monitoring, collections management, risk management, and customer relationship management. Effective credit management benefits include reduced default risk, improved cash flow, increased customer satisfaction, and enhanced reputation.

What is an economic stimulus plan ?

An economic stimulus plan is a government policy aimed at boosting a country's economy during times of slow growth or recession. The primary goal of such plans is to increase consumer spending, encourage business investments, and create jobs, thereby stimulating economic activity and promoting overall growth. Key features of an economic stimulus plan include tax cuts and rebates, government spending on infrastructure projects, monetary policy adjustments, direct assistance to businesses and individuals, and incentives for investment. Benefits of an economic stimulus plan include increased economic growth, job creation, long-term gains, and reduced poverty rates. However, potential downsides of an economic stimulus plan include national debt, inflation risks, crowding out effect, and short-term vs long-term effects. In conclusion, an economic stimulus plan is a multifaceted approach employed by governments to revive flagging economies. While these plans can have significant positive impacts on growth, employment, and overall well-being, they must be carefully designed and implemented to minimize potential drawbacks such as increased national debt and inflation risks.

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

Can I include charitable giving in my estate plan ?

Including charitable giving in your estate plan is a way to support causes you care about, with potential tax benefits and the creation of a lasting legacy. You can include charitable giving through bequests in your will, charitable trusts, donor-advised funds, life insurance policies, retirement accounts, and donating appreciated stocks. It's important to consult professionals, understand tax implications, and regularly update your plan.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

How can I plan a food-themed travel itinerary ?

How to plan a food-themed travel itinerary: determine your food interests and preferences, research destinations with strong food cultures, create a list of must-try dishes and restaurants, plan your itinerary around food experiences, book accommodations near food hubs, pack appropriately for food adventures, and be open to new experiences and embrace local customs.

How do I know if I need an unlimited data plan for my smartphone usage ?

Do you need an unlimited data plan for your smartphone usage? Consider factors such as data usage, cost, network coverage, and family plans to make an informed decision.

What are some good sources of protein for a fitness meal plan ?

Including protein-rich foods like chicken breast, salmon, eggs, Greek yogurt, and quinoa in a fitness meal plan can support muscle building and fat loss goals.

How do I create a comprehensive estate plan ?

Creating a comprehensive estate plan is essential to ensure your assets are distributed according to your wishes after you pass away. Here are some steps to help you create a comprehensive estate plan: 1. Determine your goals and objectives, such as who you want to inherit your assets and how you want them distributed. 2. Gather information about all your assets, including real estate, bank accounts, investments, life insurance policies, and personal property. 3. Choose beneficiaries for your assets, including individuals, charities, or trusts. 4. Consider tax implications, such as federal and state estate taxes, gift taxes, and generation-skipping transfer taxes. 5. Create legal documents such as a will, power of attorney, healthcare proxy, and living will to ensure your wishes are carried out in case of incapacity or death. 6. Set up trusts to manage your assets during your lifetime and distribute them after your death. 7. Review and update your plan regularly to ensure it remains current with changes in your life. Working with a qualified professional can help ensure that your estate plan meets your needs and achieves your desired outcomes.

How do I create an effective study plan ?

Creating an effective study plan is crucial for academic success. Here are some steps to help you create a successful study plan: 1. Set clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). 2. Assess your time and determine how much you can realistically dedicate to studying each day/week. 3. Allocate time for each subject based on difficulty level and proficiency. 4. Create a schedule using a calendar or planner and stick to it as much as possible. 5. Incorporate short breaks during study sessions to avoid burnout and maintain focus. 6. Regularly review progress and adjust the study plan accordingly. 7. Eliminate distractions by finding a quiet place to study and turning off unnecessary devices. 8. Stay motivated by reminding yourself of goals and celebrating small achievements. 9. Seek help when needed from teachers, tutors, or classmates. By following these steps, you can create an effective study plan that will help you achieve academic success while managing your time efficiently. Remember to stay flexible and adjust your plan as needed to accommodate changes in your schedule or priorities.

What are the hidden fees associated with my mobile operator's plan ?

Mobile operators often have hidden fees that can add up over time and significantly increase the cost of your mobile plan. These fees include activation fees, early termination fees, upgrade fees, overage charges, international roaming charges, and administrative fees. To avoid these fees, it is important to read the fine print of your mobile operator's contract carefully before signing up and consider using a prepaid plan or paying for your phone outright.

In what circumstances is an economic stimulus plan most necessary ?

An economic stimulus plan is most necessary during times of recession, slow economic growth, high unemployment rates, or financial crisis. These plans can help to boost economic activity, create jobs, and stabilize the financial system by implementing policies such as increasing government spending, reducing taxes, providing subsidies to businesses, encouraging investment in new technologies, expanding access to credit, investing in infrastructure projects, offering tax incentives for hiring new employees, and implementing regulatory reforms.