Plan Cost

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

How much does it cost to upgrade to 5G network ?

The cost of upgrading to a 5G network varies depending on several factors, including your current plan, the carrier you are using, and the device you have. If you want to take advantage of 5G speeds, you will need a 5G-compatible device which can range from $200 to over $1000. The cost of upgrading to a 5G plan also depends on your carrier, with some offering unlimited data plans starting at around $70 per month. In addition to a new device and plan, you may also need to purchase accessories such as cases or screen protectors that are compatible with your new device. Finally, if you are installing a 5G network in your home or office, there may be additional costs associated with installation fees or equipment rental fees.

How much does it cost to upgrade my broadband service ?

Upgrading your broadband service's cost depends on the plan type, contract terms, installation fees, device rental or purchase, promotions and discounts, taxes and fees. To determine the most cost-effective upgrade, research different providers, assess your needs, contact your current provider, request a breakdown of fees, read the fine print, and finalize your decision.

How do I know if I need an unlimited data plan for my smartphone usage ?

Do you need an unlimited data plan for your smartphone usage? Consider factors such as data usage, cost, network coverage, and family plans to make an informed decision.

What are the benefits of using a prepaid vs postpaid plan with a mobile operator ?

Prepaid mobile plans offer control over spending, no credit checks, easy setup and flexibility. Postpaid plans provide more features, better customer service, easier billing management and potential discounts for bundling services.

What are the hidden fees associated with my mobile operator's plan ?

Mobile operators often have hidden fees that can add up over time and significantly increase the cost of your mobile plan. These fees include activation fees, early termination fees, upgrade fees, overage charges, international roaming charges, and administrative fees. To avoid these fees, it is important to read the fine print of your mobile operator's contract carefully before signing up and consider using a prepaid plan or paying for your phone outright.

How much does a good quality signal booster cost ?

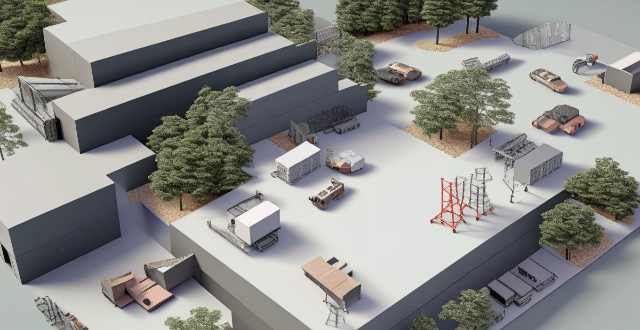

Signal boosters, also known as cell phone signal amplifiers or repeaters, are electronic devices designed to improve the strength and reliability of cellular signals in areas with poor coverage. The cost of a good quality signal booster can vary depending on several factors such as the type of technology used, the frequency bands supported, the coverage area, and the brand. The main types of signal boosters are analog and digital, with analog boosters generally being less expensive but not as clear or strong as digital boosters. The more bands a booster supports, the higher the cost is likely to be. Larger coverage areas require more powerful boosters, which tend to be more expensive. Well-known brands often charge a premium for their products due to their reputation, customer service, and warranty offerings. The cost of a good quality signal booster generally ranges from $200 to $1000 USD. Basic signal boosters suitable for small areas like a single room or vehicle typically cost between $200 and $300 USD. Mid-range signal boosters offer moderate coverage areas suitable for apartments or small offices and generally fall within the $300 to $600 USD price range. High-end signal boosters provide extensive coverage for larger homes, buildings, or outdoor spaces and typically cost between $600 and $1000 USD. When purchasing a signal booster, it's essential to consider installation costs if you plan to hire a professional, as well as any potential shipping fees if buying online. Additionally, look for products that come with a warranty or guarantee to protect your investment over time.

How much does it cost to install a wind turbine ?

Installing a wind turbine can be a significant investment, and the cost varies depending on several factors such as the size of the turbine, location, and installation complexity. Here is a detailed breakdown of the costs involved in installing a wind turbine: 1. **Turbine Cost**: Small Turbines typically used for residential purposes can cost anywhere between $30,000 to $50,000. Large Turbines used for commercial purposes can cost upwards of $1 million. 2. **Site Assessment and Permitting**: Site Assessment involves evaluating the site for wind speed, topography, and other factors that affect the performance of the turbine. The cost can range from $5,000 to $15,000. Depending on the local regulations, obtaining necessary permits can cost between $5,000 to $20,000. 3. **Foundation and Construction**: The foundation needs to be strong enough to support the turbine, and the cost can vary between $10,000 to $30,000. The actual installation of the turbine can cost between $6,000 to $12,000. 4. **Electrical Connections and Grid Interconnection**: This includes setting up the wiring and electrical connections needed to connect the turbine to your home or business. The cost can range from $8,000 to $15,000. If you plan to sell excess electricity back to the grid, you will need to set up a grid interconnection. This can cost between $5,000 to $10,000. 5. **Maintenance and Operational Costs**: Regular maintenance is required to ensure the turbine operates efficiently and safely. Annual maintenance costs can range from $1,000 to $3,000. This includes costs associated with operating the turbine, such as insurance and taxes. The cost can vary depending on the location and size of the turbine. 6. **Total Cost**: The total cost of installing a wind turbine can range from $75,000 to $1.5 million or more, depending on the size and complexity of the project. It is important to consider these costs before deciding to install a wind turbine. In conclusion, installing a wind turbine can be a costly endeavor, but it can also provide long-term benefits in terms of energy savings and reducing carbon footprint. It is essential to carefully evaluate the costs and benefits before making a decision.

How can I ensure that my education budget plan is sustainable in the long term ?

Proper planning and management of an education budget are crucial for ensuring its long-term sustainability. Here's how you can achieve that: * Establish clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). * Conduct a thorough analysis of your current financial situation, projected costs, and sources of funding. * Create a comprehensive plan that includes budget allocation, revenue streams, and expense tracking. * Review and adjust the plan periodically to adapt to changes in personal circumstances, market conditions, or educational requirements. * Seek professional advice from financial advisors and education counselors to ensure the best outcomes.

What is the cost of treatment at a sports rehabilitation center ?

The cost of treatment at a sports rehabilitation center can vary depending on several factors, such as the location, services offered, and the severity of the injury. Here's a breakdown of the potential costs you may encounter: 1. Initial Assessment Fee: This fee covers the initial evaluation by a physical therapist or sports medicine specialist. It typically ranges from $50 to $200, depending on the facility and region. 2. Physical Therapy Sessions: Each session usually lasts between 30 minutes to an hour. The cost per session can range from $75 to $200, again depending on the location and expertise of the therapist. Most insurance plans cover part of this cost, but you may have to pay a copay or coinsurance. 3. Specialized Treatments: Some centers offer specialized treatments like hydrotherapy, ultrasound therapy, or electrical stimulation. These treatments can add an additional $30 to $100 per session. 4. Equipment Rental or Purchase: If your recovery requires the use of special equipment (like crutches, knee braces, etc.), there will be an additional cost. Rental fees can vary widely, while purchasing outright might set you back anywhere from $50 to several hundred dollars. 5. Follow-up Appointments: As your recovery progresses, you might need follow-up appointments to assess your progress and adjust your treatment plan. These can cost anywhere from $50 to $150 each. 6. Total Cost: The total cost of treatment can vary significantly based on the above factors. On average, you might expect to spend anywhere from $1,000 to $5,000 for a moderate to severe injury, assuming regular sessions over several weeks or months. Remember, this is just an estimate; actual costs can be higher or lower depending on individual circumstances.

How do unlimited data plans differ from traditional data plans ?

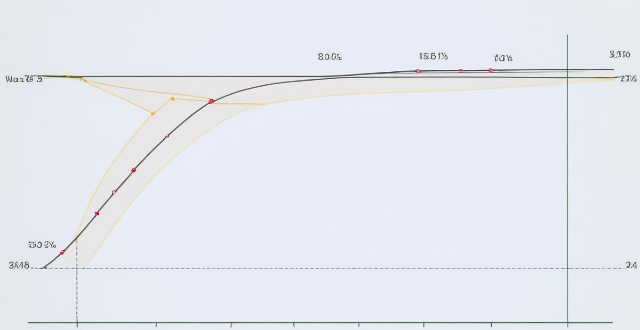

Data plans are essential for internet usage, with unlimited and traditional data plans being the main types. Unlimited plans offer no data limits, predictable costs, and suit heavy users, while traditional plans have data limits, variable costs, and suit light users. The key differences include data limits, cost, and usage scenarios. Choosing the right plan depends on individual needs and usage patterns.

How much does it cost to maintain an electric car ?

Maintaining an electric car is generally more affordable than maintaining a traditional gasoline-powered car. However, the cost can vary depending on several factors such as the make and model of the car, its age, and the specific services required. In this article, we will discuss the different costs associated with maintaining an electric car. The initial cost of purchasing an electric car may be higher than that of a conventional car due to the expensive battery technology. However, the long-term savings in fuel and maintenance costs often outweigh this initial expense. One significant cost associated with owning an electric car is the eventual replacement of the battery pack. The lifespan of an electric car's battery can range from 100,000 miles to 200,000 miles or more, depending on usage and charging habits. When the time comes for a replacement, it can be quite costly. The price varies widely based on the vehicle's make and model, but it typically ranges from $5,000 to $15,000. Electric cars have fewer moving parts than traditional cars, which means they require less maintenance over time. Tire rotation and replacement are necessary for both electric and gasoline-powered vehicles. The cost will depend on the type of tire you choose and your driving habits. Since regenerative braking systems are used in most electric cars, brake pads and rotors last longer than those in traditional cars. Therefore, brake service is less frequent and less expensive for electric cars. Electric cars do not require engine air filters like gasoline-powered cars since they don't have engines that burn fuel. This eliminates the need for regular filter changes and their associated costs. Electric cars do not have engines that require oil changes like gasoline-powered cars do. This eliminates the need for regular oil changes and their associated costs. Electric cars do not have cooling systems like traditional cars do since they don't produce exhaust heat from combustion engines. This eliminates the need for regular coolant system maintenance and its associated costs. There are also other costs associated with owning an electric car that should be considered: If you don't have access to a public charging station near your home or workplace, you may need to install a charging station at your residence or business location. The installation cost can vary widely based on several factors such as the type of station you choose and whether any electrical upgrades are needed. Electricity prices vary by region and provider, so it's essential to research local rates before purchasing an electric car. Additionally, if you plan to charge your car at home overnight when electricity rates are lower, you could save money on energy costs compared to charging during peak hours. In conclusion, while the initial cost of purchasing an electric car may be higher than that of a conventional car due to the expensive battery technology, the long-term savings in fuel and maintenance costs often outweigh this initial expense. Overall, maintaining an electric car is generally more affordable than maintaining a traditional gasoline-powered car due to fewer moving parts and less frequent maintenance requirements.

Do I need a lawyer to create an estate plan ?

Estate planning is important for ensuring that your assets are distributed according to your wishes after you pass away. While it is possible to create an estate plan without a lawyer, working with a legal professional can provide numerous benefits such as legal expertise, customized plans, and peace of mind. However, if you have a simple estate with few assets and no complicated family dynamics, creating a basic estate plan using online tools or templates may be sufficient. It is still important to consult with a lawyer to ensure that your plan meets all legal requirements and addresses any potential issues.

How much does fiber optic broadband cost ?

The cost of fiber optic broadband varies based on provider, location, speed, and additional fees. It is recommended to compare plans from different providers and consider all associated costs before making a decision.

How does age affect the cost of insurance ?

The article discusses how age affects the cost of insurance, with younger drivers typically paying higher premiums than older drivers. It highlights that health insurance costs can increase as people age due to increased risk factors and the need for more frequent medical care. Life insurance rates may also rise with age, while auto insurance rates may decrease for retired drivers who spend less time on the road. Homeowners insurance costs depend on the condition and value of the home, but older homes may require more maintenance and repairs. The article provides tips for managing insurance costs as you age, including reviewing coverage regularly, maintaining a good driving record, staying healthy, and considering long-term care insurance.

How much does a fitness instructor course cost ?

The cost of a fitness instructor course can vary depending on the type of certification, location, duration, and extra costs. It is important to research all potential costs before making a decision to ensure that the course fits both your budget and career goals.

How do economists evaluate the effectiveness of a particular economic stimulus plan ?

Economists evaluate the effectiveness of economic stimulus plans by considering factors such as GDP growth rate, inflation rate, unemployment rate, job creation, government spending, deficit and debt levels, personal consumption expenditures, consumer confidence, sectoral analysis, regional impact, sustainability, and legacy. These evaluations help determine whether the plan has achieved its intended goals and guide future policy decisions.

How much does it typically cost to outfit a home with smart gadgets ?

This topic summary provides a comprehensive overview of the costs associated with outfitting a home with smart gadgets. It discusses key factors impacting cost, such as home size, scope of automation, brand choices, and installation fees. The text also breaks down typical smart gadgets and their price ranges, including lighting, thermostats, security systems, entertainment devices, and power solutions. Additional considerations like hubs, connectivity, and subscription services are addressed. Finally, it offers estimated total costs for basic, mid-range, and advanced smart home configurations, emphasizing the importance of planning and budgeting to create a smart home that aligns with individual needs and financial constraints.

How much does Apple Music cost ?

Apple Music offers several pricing plans, including individual, family, and student options, with varying costs and features.

What is an economic stimulus plan ?

An economic stimulus plan is a government policy aimed at boosting a country's economy during times of slow growth or recession. The primary goal of such plans is to increase consumer spending, encourage business investments, and create jobs, thereby stimulating economic activity and promoting overall growth. Key features of an economic stimulus plan include tax cuts and rebates, government spending on infrastructure projects, monetary policy adjustments, direct assistance to businesses and individuals, and incentives for investment. Benefits of an economic stimulus plan include increased economic growth, job creation, long-term gains, and reduced poverty rates. However, potential downsides of an economic stimulus plan include national debt, inflation risks, crowding out effect, and short-term vs long-term effects. In conclusion, an economic stimulus plan is a multifaceted approach employed by governments to revive flagging economies. While these plans can have significant positive impacts on growth, employment, and overall well-being, they must be carefully designed and implemented to minimize potential drawbacks such as increased national debt and inflation risks.

What is the average cost of a cruise vacation ?

Cruise vacations offer a mix of relaxation and adventure, but the cost can vary. Factors like cruise length, destination, time of year, cabin type, onboard activities, alcohol, and gratuities affect the price. The average cost per person per day ranges from $50-$100 for budget lines, $150-$300 for mid-range, and $400-$1,000+ for luxury. Total costs for a 7-day cruise are $350-$700 for budget, $1,050-$2,100 for mid-range, and $2,800-$7,000+ for luxury. Tips for saving include booking early, traveling off-peak, choosing interior cabins, all-inclusive options, and looking for deals.

Can I include charitable giving in my estate plan ?

Including charitable giving in your estate plan is a way to support causes you care about, with potential tax benefits and the creation of a lasting legacy. You can include charitable giving through bequests in your will, charitable trusts, donor-advised funds, life insurance policies, retirement accounts, and donating appreciated stocks. It's important to consult professionals, understand tax implications, and regularly update your plan.

How much does sports insurance cost ?

The cost of sports insurance varies based on the type of sport, level of coverage, and individual's age and health status. High-risk sports typically have higher premiums than lower-risk activities. Basic policies may only cover medical expenses and lost wages due to injury, while more comprehensive plans may include additional benefits such as disability coverage and accidental death and dismemberment insurance. Younger athletes may have lower premiums than older ones, and individuals with pre-existing medical conditions or a history of injuries may face higher premiums. Tips for finding the best sports insurance policy include shopping around, considering bundling, and asking about discounts.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

How can I plan a food-themed travel itinerary ?

How to plan a food-themed travel itinerary: determine your food interests and preferences, research destinations with strong food cultures, create a list of must-try dishes and restaurants, plan your itinerary around food experiences, book accommodations near food hubs, pack appropriately for food adventures, and be open to new experiences and embrace local customs.

What are some good sources of protein for a fitness meal plan ?

Including protein-rich foods like chicken breast, salmon, eggs, Greek yogurt, and quinoa in a fitness meal plan can support muscle building and fat loss goals.

How much does it cost to travel to space ?

The cost of traveling to space varies depending on the type of mission, duration of stay, and provider. Suborbital flights are the most affordable option, while lunar and Mars missions are significantly more expensive. Factors such as training, technology, and risk contribute to the high costs. As technology advances and more companies enter the industry, the cost may decrease, but space travel is unlikely to become affordable for the average person in the near future.

How much does the new iPhone model cost ?

The new iPhone model's cost is influenced by storage, color, and carrier. Prices range from $699 for the 128GB iPhone 13 Mini to $1,599 for the 1TB iPhone 13 Pro Max. These prices are for base models without extras, and taxes/shipping may apply.

How do I create a comprehensive estate plan ?

Creating a comprehensive estate plan is essential to ensure your assets are distributed according to your wishes after you pass away. Here are some steps to help you create a comprehensive estate plan: 1. Determine your goals and objectives, such as who you want to inherit your assets and how you want them distributed. 2. Gather information about all your assets, including real estate, bank accounts, investments, life insurance policies, and personal property. 3. Choose beneficiaries for your assets, including individuals, charities, or trusts. 4. Consider tax implications, such as federal and state estate taxes, gift taxes, and generation-skipping transfer taxes. 5. Create legal documents such as a will, power of attorney, healthcare proxy, and living will to ensure your wishes are carried out in case of incapacity or death. 6. Set up trusts to manage your assets during your lifetime and distribute them after your death. 7. Review and update your plan regularly to ensure it remains current with changes in your life. Working with a qualified professional can help ensure that your estate plan meets your needs and achieves your desired outcomes.

How do I create an effective study plan ?

Creating an effective study plan is crucial for academic success. Here are some steps to help you create a successful study plan: 1. Set clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). 2. Assess your time and determine how much you can realistically dedicate to studying each day/week. 3. Allocate time for each subject based on difficulty level and proficiency. 4. Create a schedule using a calendar or planner and stick to it as much as possible. 5. Incorporate short breaks during study sessions to avoid burnout and maintain focus. 6. Regularly review progress and adjust the study plan accordingly. 7. Eliminate distractions by finding a quiet place to study and turning off unnecessary devices. 8. Stay motivated by reminding yourself of goals and celebrating small achievements. 9. Seek help when needed from teachers, tutors, or classmates. By following these steps, you can create an effective study plan that will help you achieve academic success while managing your time efficiently. Remember to stay flexible and adjust your plan as needed to accommodate changes in your schedule or priorities.