Plan Assets

How do I create a comprehensive estate plan ?

Creating a comprehensive estate plan is essential to ensure your assets are distributed according to your wishes after you pass away. Here are some steps to help you create a comprehensive estate plan: 1. Determine your goals and objectives, such as who you want to inherit your assets and how you want them distributed. 2. Gather information about all your assets, including real estate, bank accounts, investments, life insurance policies, and personal property. 3. Choose beneficiaries for your assets, including individuals, charities, or trusts. 4. Consider tax implications, such as federal and state estate taxes, gift taxes, and generation-skipping transfer taxes. 5. Create legal documents such as a will, power of attorney, healthcare proxy, and living will to ensure your wishes are carried out in case of incapacity or death. 6. Set up trusts to manage your assets during your lifetime and distribute them after your death. 7. Review and update your plan regularly to ensure it remains current with changes in your life. Working with a qualified professional can help ensure that your estate plan meets your needs and achieves your desired outcomes.

Do I need a lawyer to create an estate plan ?

Estate planning is important for ensuring that your assets are distributed according to your wishes after you pass away. While it is possible to create an estate plan without a lawyer, working with a legal professional can provide numerous benefits such as legal expertise, customized plans, and peace of mind. However, if you have a simple estate with few assets and no complicated family dynamics, creating a basic estate plan using online tools or templates may be sufficient. It is still important to consult with a lawyer to ensure that your plan meets all legal requirements and addresses any potential issues.

What documents are typically included in an estate plan ?

An estate plan is a collection of legal documents that outline how an individual's assets and property will be distributed after their death. These documents can include various types of legal instruments, each serving a specific purpose in the estate planning process. Here are some of the most common documents included in an estate plan: - Last Will and Testament: A legal document that states how a person's property and assets will be distributed after their death. - Durable Power of Attorney: A legal document that grants authority to another individual (agent) to act on behalf of the principal in financial matters. - Healthcare Power of Attorney: A legal document that designates someone to make healthcare decisions on behalf of the principal if they are unable to do so. - Living Will: A document that provides instructions about your wishes for medical treatment and end-of-life care. - Trusts: A legal entity that holds and manages assets for the benefit of one or more individuals (beneficiaries). - Beneficiary Designations: The process of naming who receives the proceeds of a bank account, retirement account, or life insurance policy upon the account holder's death. - Letter of Intent: A non-legal document that provides additional information about personal wishes, sentimental items, and instructions for final arrangements.

What is the process for distributing assets after someone dies ?

The process for distributing assets after someone dies is known as probate. It involves filing the will, notifying beneficiaries and heirs, inventorying assets, paying off debts and taxes, and then distributing the remaining assets according to the terms of the will or state law if there is no will. The executor or administrator is responsible for managing the deceased person's estate and all potential beneficiaries and heirs must be notified of their rights and responsibilities.

How can I protect my assets from creditors or lawsuits ?

When it comes to protecting your assets from creditors or lawsuits, there are several strategies you can consider. These strategies aim to safeguard your wealth and ensure that you have financial security in case of legal actions against you. Here are some key steps to take: ### 1. **Create a Trust** A trust is a legal entity that allows you to transfer assets into it for the benefit of a third party, known as the beneficiary. By placing your assets into a trust, they are no longer directly owned by you, making them less vulnerable to creditors or lawsuits. There are different types of trusts, such as: - Revocable Living Trust: You can modify or revoke this type of trust during your lifetime. - Irrevocable Trust: Once created, you cannot change or cancel this type of trust. - Special Needs Trust: Designed for individuals with special needs, this trust helps them qualify for government benefits while still having access to funds for other expenses. ### 2. **Establish Limited Liability Entities** Forming limited liability companies (LLCs) or corporations can help protect your personal assets from business-related debts and lawsuits. These entities act as separate legal entities, meaning that their liabilities do not extend to your personal finances. Examples include: - Single Member LLC: Suitable for sole proprietors looking to limit their personal liability. - Multi-Member LLC: Ideal for partnerships where multiple members contribute to the business. - S Corporation: Offers pass-through taxation and limits shareholder liability to their investment in the company. ### 3. **Purchase Insurance** Having adequate insurance coverage is essential in protecting your assets from unexpected events. Make sure you have the following types of insurance policies: - Liability Insurance: Covers damages or injuries caused by you or your property. - Umbrella Policy: Provides additional liability coverage beyond your standard policies. - Homeowner's Insurance: Protects your home and belongings from damage or loss due to various perils. - Auto Insurance: Covers damages and injuries related to vehicle accidents. ### 4. **Diversify Your Assets** Spreading your wealth across different asset classes can help minimize the impact of any single lawsuit or creditor claim. Consider investing in: - Real Estate Investment Trusts (REITs): Allows you to invest in real estate without owning physical property. - Stocks and Bonds: Diversify your portfolio with various securities to reduce risk. - Precious Metals and Cryptocurrencies: Non-traditional assets that may offer protection against market volatility. ### 5. **Consult with Professionals** Before implementing any asset protection strategy, it's crucial to consult with professionals who specialize in this area, such as attorneys, financial advisors, and accountants. They can guide you through the process, ensuring that you comply with all legal requirements and maximize the effectiveness of your chosen strategies.

How do I ensure that my digital assets are handled after my death ?

Managing digital assets after death requires careful planning and regular updates to keep pace with technological changes. This guide outlines steps to take to ensure your online presence is handled according to your wishes, including inventorying assets, choosing a digital executor, including assets in your will, using digital legacy services, setting up access and instructions, and reviewing and updating plans regularly. By following these steps, you can protect your online legacy and provide clarity for your loved ones.

Can I include charitable giving in my estate plan ?

Including charitable giving in your estate plan is a way to support causes you care about, with potential tax benefits and the creation of a lasting legacy. You can include charitable giving through bequests in your will, charitable trusts, donor-advised funds, life insurance policies, retirement accounts, and donating appreciated stocks. It's important to consult professionals, understand tax implications, and regularly update your plan.

How can women protect their assets and ensure long-term financial security ?

The article provides a list of strategies that women can employ to ensure their financial security over the long term. These include building an emergency fund, investing in retirement accounts, purchasing life insurance, creating a will, considering long-term care insurance, educating oneself about finance, working with a financial advisor, and prioritizing career development. Each of these steps is crucial in its own way for safeguarding one's assets and ensuring financial stability.

Why is it important to have an estate plan ?

Having an estate plan is crucial for ensuring your wishes are honored, minimizing family disputes, and providing clarity on handling affairs.

How often should I review and update my estate plan ?

Estate planning is crucial for managing assets post-demise. It requires regular updates due to life changes, laws, and preferences. Major life events necessitate immediate attention. Annual reviews ensure documents are current and reflect personal relationship changes. Every three to five years, review to accommodate tax law changes and reassess beneficiaries. Law changes may also prompt updates. Regular reviews ensure your estate plan aligns with life's dynamics.

How can I minimize estate taxes in my estate plan ?

The text discusses strategies to minimize estate taxes in one's estate plan. These include understanding the basics of estate taxes, utilizing the lifetime exclusion, establishing trusts like irrevocable trusts and spousal lifetime access trust (SLAT), gifting to family and charities, life insurance planning through irrevocable life insurance trust (ILIT), using family limited partnerships or LLCs, seeking professional guidance, and staying informed about changes in tax laws.

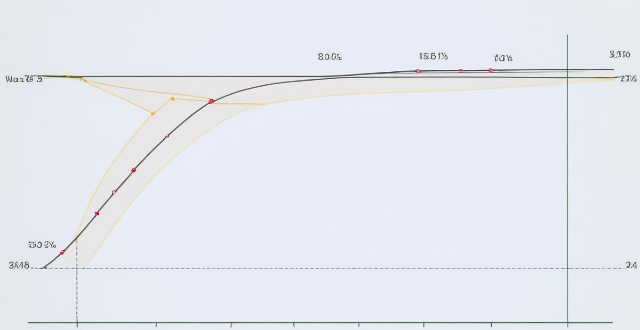

How do economists evaluate the effectiveness of a particular economic stimulus plan ?

Economists evaluate the effectiveness of economic stimulus plans by considering factors such as GDP growth rate, inflation rate, unemployment rate, job creation, government spending, deficit and debt levels, personal consumption expenditures, consumer confidence, sectoral analysis, regional impact, sustainability, and legacy. These evaluations help determine whether the plan has achieved its intended goals and guide future policy decisions.

What are the benefits of using a prepaid vs postpaid plan with a mobile operator ?

Prepaid mobile plans offer control over spending, no credit checks, easy setup and flexibility. Postpaid plans provide more features, better customer service, easier billing management and potential discounts for bundling services.

What is an economic stimulus plan ?

An economic stimulus plan is a government policy aimed at boosting a country's economy during times of slow growth or recession. The primary goal of such plans is to increase consumer spending, encourage business investments, and create jobs, thereby stimulating economic activity and promoting overall growth. Key features of an economic stimulus plan include tax cuts and rebates, government spending on infrastructure projects, monetary policy adjustments, direct assistance to businesses and individuals, and incentives for investment. Benefits of an economic stimulus plan include increased economic growth, job creation, long-term gains, and reduced poverty rates. However, potential downsides of an economic stimulus plan include national debt, inflation risks, crowding out effect, and short-term vs long-term effects. In conclusion, an economic stimulus plan is a multifaceted approach employed by governments to revive flagging economies. While these plans can have significant positive impacts on growth, employment, and overall well-being, they must be carefully designed and implemented to minimize potential drawbacks such as increased national debt and inflation risks.

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

What is the difference between a will and a trust ?

The text discusses the differences between wills and trusts in estate planning, highlighting key areas where they diverge. A will is a legal document outlining distribution wishes for assets after death, requiring witnesses and taking effect posthumously. It allows control over assets during one's lifetime and goes through probate, a public process. Wills are flexible and generally less costly to create but offer no tax benefits. Conversely, a trust involves transferring property to a trustee for beneficiaries, with creation and effectiveness varying. Trusts can avoid probate, offering privacy and potential tax benefits but at a higher initial cost and less flexibility, especially if irrevocable. Choosing between them depends on individual needs and preferences.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

How can I plan a food-themed travel itinerary ?

How to plan a food-themed travel itinerary: determine your food interests and preferences, research destinations with strong food cultures, create a list of must-try dishes and restaurants, plan your itinerary around food experiences, book accommodations near food hubs, pack appropriately for food adventures, and be open to new experiences and embrace local customs.

How do I know if I need an unlimited data plan for my smartphone usage ?

Do you need an unlimited data plan for your smartphone usage? Consider factors such as data usage, cost, network coverage, and family plans to make an informed decision.

What are some good sources of protein for a fitness meal plan ?

Including protein-rich foods like chicken breast, salmon, eggs, Greek yogurt, and quinoa in a fitness meal plan can support muscle building and fat loss goals.

What is probate, and how can I avoid it ?

This text discusses probate, the legal process of transferring a deceased person's assets to their heirs or beneficiaries. It explains why many choose to avoid probate, which can be time-consuming and costly, and outlines various methods for doing so, such as creating a revocable living trust, joint tenancy with right of survivorship, pay-on-death accounts, transfer-on-death designations, gifting assets during one's lifetime, designating beneficiaries on retirement accounts and life insurance policies, using a will with a probate avoidance clause, and considering state-specific strategies. The text emphasizes the importance of careful planning and consulting professionals to ensure assets are distributed according to one's wishes without court interference.

How do I create an effective study plan ?

Creating an effective study plan is crucial for academic success. Here are some steps to help you create a successful study plan: 1. Set clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). 2. Assess your time and determine how much you can realistically dedicate to studying each day/week. 3. Allocate time for each subject based on difficulty level and proficiency. 4. Create a schedule using a calendar or planner and stick to it as much as possible. 5. Incorporate short breaks during study sessions to avoid burnout and maintain focus. 6. Regularly review progress and adjust the study plan accordingly. 7. Eliminate distractions by finding a quiet place to study and turning off unnecessary devices. 8. Stay motivated by reminding yourself of goals and celebrating small achievements. 9. Seek help when needed from teachers, tutors, or classmates. By following these steps, you can create an effective study plan that will help you achieve academic success while managing your time efficiently. Remember to stay flexible and adjust your plan as needed to accommodate changes in your schedule or priorities.

How do I provide for minor children in my estate plan ?

When it comes to estate planning, one of the most important considerations is how to provide for your minor children. Here are some steps you can take to ensure that your children are taken care of financially and emotionally after you're gone: Create a will or trust, name a guardian, establish a trust fund, consider life insurance, and make sure your beneficiaries are up-to-date.

What are the hidden fees associated with my mobile operator's plan ?

Mobile operators often have hidden fees that can add up over time and significantly increase the cost of your mobile plan. These fees include activation fees, early termination fees, upgrade fees, overage charges, international roaming charges, and administrative fees. To avoid these fees, it is important to read the fine print of your mobile operator's contract carefully before signing up and consider using a prepaid plan or paying for your phone outright.

How do I plan for retirement and ensure financial security in my golden years ?

Planning for retirement is crucial and requires setting clear goals, saving early, investing wisely, planning for healthcare costs, considering downsizing or relocating, creating a retirement timeline, and having a contingency plan. This ensures financial security in your golden years.

In what circumstances is an economic stimulus plan most necessary ?

An economic stimulus plan is most necessary during times of recession, slow economic growth, high unemployment rates, or financial crisis. These plans can help to boost economic activity, create jobs, and stabilize the financial system by implementing policies such as increasing government spending, reducing taxes, providing subsidies to businesses, encouraging investment in new technologies, expanding access to credit, investing in infrastructure projects, offering tax incentives for hiring new employees, and implementing regulatory reforms.

How can I create a balanced fitness meal plan ?

To create a balanced fitness meal plan, start by determining your caloric needs and focus on nutrient-dense foods. Include lean protein, whole grains, fruits, vegetables, and healthy fats in your meals. Balance your macronutrients (carbs, protein, and fats) and plan your meals and snacks ahead of time to ensure you're getting the right balance of nutrients throughout the day. Stay hydrated and be mindful of portion sizes to support your health and fitness goals.

What are the benefits of implementing an economic stimulus plan ?

An economic stimulus plan is a set of policies designed to boost a country's economy during times of slow growth or recession. These plans are typically implemented by governments and can have a range of benefits, including increased economic activity, improved employment rates, stimulated investment, reduced inflation risk, and improved public services. By taking steps to boost the economy during times of slow growth or recession, governments can help to create a more stable and prosperous future for all citizens.

What should be included in a sports career plan ?

A comprehensive sports career plan should include personal information, career objectives, skill development, education & training, competition history, sponsorship & funding, off-field activities, health & wellness, post-retirement planning, and a conclusion. It serves as a roadmap to guide athletes through their journey in sports, ensuring they are well-prepared for every stage of their career.

How do I measure progress in my sports training plan ?

Measuring progress is crucial for athletes to track development and adjust their training plans. Set SMART goals, track performance, evaluate technique, monitor body composition, assess fitness level, and reflect on mental state to measure progress effectively.