Market System

What are the best home security systems available in the market ?

Home security systems have become an essential part of modern homes, providing peace of mind and protection against burglaries, fires, and other emergencies. With the advancements in technology, there are several home security systems available in the market that offer a wide range of features and benefits. In this article, we will discuss some of the best home security systems available in the market.

What are the benefits of implementing a carbon credit system ?

The carbon credit system is a market-based approach to reducing greenhouse gas emissions. It provides economic incentives for emission reduction, promotes innovation and technology adoption, enhances environmental stewardship, and serves as a regulatory and policy tool. By creating a market value for emission reduction, the system encourages businesses to reduce their carbon footprint and fosters global cooperation towards sustainability goals.

How can I invest in the carbon trading market ?

The carbon trading market offers a lucrative investment opportunity for those interested in environmental sustainability and financial gain. To invest successfully, one should understand the basics of carbon trading, research different carbon markets, choose a broker or exchange, determine an investment strategy, and start trading while managing risk.

What are the benefits of implementing an ecological tax system ?

Ecological tax systems aim to internalize the external costs of pollution and resource degradation into market prices, promoting sustainable practices, generating public revenue, decreasing fossil fuel dependence, improving market efficiency, raising environmental awareness, stimulating innovation, fostering international leadership and cooperation, and protecting future generations.

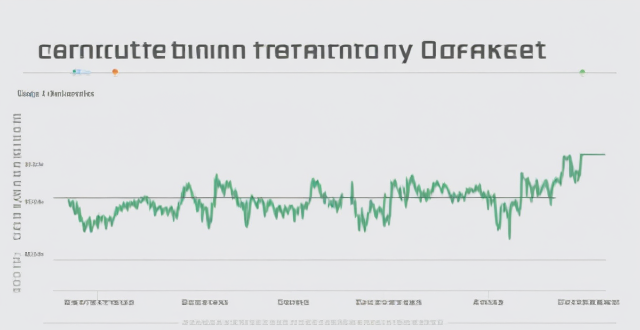

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

What is the current state of the US stock market ?

The US stock market is currently experiencing a mix of positive and negative trends, including strong economic growth and technology sector performance, but also significant market volatility and trade tensions. Factors impacting the market include interest rates, global economic conditions, and geopolitical risks.

What are the best practices for pricing items in a second-hand market ?

When selling items in a second-hand market, it's essential to follow best practices for pricing to maximize profits and ensure a smooth transaction. Key tips include researching market value, considering the item's condition, setting a fair price, being open to negotiations, and updating the listing regularly. By following these guidelines, sellers can attract more potential buyers and increase their chances of making a successful sale.

What are the challenges and opportunities for developing countries in the carbon trading market ?

Challenges and opportunities for developing countries in the carbon trading market include lack of infrastructure, legal and regulatory hurdles, market access and information asymmetry, capacity building needs, economic growth and investment, technology transfer and innovation, environmental sustainability, policy influence and leadership.

How does a carbon credit system work ?

A carbon credit system is a market-based approach that incentivizes companies, organizations, and individuals to reduce their greenhouse gas emissions. It works by setting emission reduction targets, generating carbon credits for verified emission reductions, allowing the trading of these credits, and using them for regulatory compliance or offsetting emissions. This system fosters economic efficiency, flexibility, and innovation while encouraging global cooperation on climate action. However, challenges such as ensuring permanence of reductions and maintaining system integrity must be addressed to ensure its effectiveness.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

How has social distancing impacted the economy and job market ?

Social distancing measures have had a significant impact on the economy and job market, including decreased consumer spending, supply chain disruptions, high unemployment rates, increased demand for remote work, and changes in job seeking behavior.

Who are the main participants in the carbon trading market ?

The carbon trading market is a complex ecosystem involving various stakeholders who play crucial roles in reducing greenhouse gas emissions and promoting sustainable development. These participants include governments and regulatory bodies, companies and businesses, investors and financial institutions, project developers and consulting firms, and NGOs and environmental groups. Governments establish the legal framework and policies that govern the market, while companies are required to hold sufficient allowances to cover their emissions or purchase additional allowances if needed. Investors provide liquidity by buying and selling allowances based on their expectations of future price movements. Project developers design and implement projects that generate credits for sale on the carbon market, working closely with governments, companies, and investors. NGOs and environmental groups advocate for stronger climate policies and support initiatives that promote sustainable development.

How do political events affect the stock market, and how can they be analyzed ?

This comprehensive analysis explores the impact of political events on the stock market, including economic policies, regulatory changes, international relations, and elections. It also provides strategies for analyzing their potential effects, such as staying informed, diversifying your portfolio, using technical and fundamental analysis, and monitoring sentiment indicators.

Can you explain Australia's points-based immigration system ?

Australia's points-based immigration system is a method to select skilled immigrants for permanent residency. The system assigns points based on age, education, work experience, and language proficiency. It aims to attract skilled workers who can contribute to the country's economy and fill labor market gaps. Applicants must meet health and character requirements and are placed into a pool of candidates for selection. The system provides transparency and fairness in the immigration process by using objective criteria to evaluate applicants.

How has the COVID-19 pandemic impacted the stock market, and what insights can be gained from this analysis ?

The COVID-19 pandemic has caused increased volatility and uncertainty in the stock market. Certain industries, such as travel and hospitality, have been negatively impacted while others, like healthcare and technology, have experienced growth. Government interventions aimed at mitigating economic effects have both stabilized markets and created long-term concerns. The rise of remote work and digital transformation has benefitted companies able to adapt quickly. As economies begin to recover with widespread vaccination, investors should monitor developments closely to make informed decisions.

What is an ecological tax system and how does it work ?

An ecological tax system is a framework designed to promote environmental sustainability by modifying tax structures to encourage eco-friendly behaviors and discourage activities that harm the environment. The primary goal of such a system is to internalize the external costs of pollution and resource depletion, thereby making environmentally harmful practices more expensive and sustainable practices more economically attractive. At the core of an ecological tax system are Pigouvian taxes, named after the economist Arthur Cecil Pigou. These taxes are levied on activities that generate negative externalities, such as pollution. By imposing a tax equal to the marginal social damage caused by these activities, the government can correct market failures where the private costs to producers do not reflect the true social costs. This encourages polluters to reduce their emissions or shift towards cleaner technologies. In addition to taxes on negative externalities, ecological tax systems often include subsidies for positive environmental behaviors. For example, governments might offer tax credits or rebates for renewable energy installations, green technology adoption, or energy efficiency improvements. These incentives make it financially advantageous for individuals and businesses to adopt sustainable practices. An ecological tax system may also involve revenue-neutral tax reform, where increases in environmental taxes are offset by reductions in other taxes, such as income or payroll taxes. This approach aims to make the overall tax burden on society constant while encouraging environmentally friendly behaviors. Feed-in tariffs (FiTs) are another component of some ecological tax systems. These are long-term contracts guaranteeing renewable energy producers a fixed price for the electricity they feed into the grid. FiTs provide a stable income for renewable energy projects, reducing investment risk and promoting the development of clean energy sources. Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, are integral parts of many ecological tax systems. These policies put a price on carbon emissions, making it more expensive for companies and consumers to use fossil fuels. This encourages a shift towards lower-carbon alternatives and supports investments in carbon capture and storage technologies. Some ecological tax systems apply differentiated taxes based on the environmental impact of products or services. For instance, gasoline taxes might be higher for fuels with a greater carbon content, promoting the use of cleaner burning fuels. Similarly, taxes on waste disposal could be adjusted based on the type of waste and its potential environmental harm. While the concept of an ecological tax system is straightforward, implementation faces several challenges: - Political Will: Governments must be willing to prioritize environmental concerns over short-term political gains. - Economic Impact: There's a need to balance environmental goals with economic growth and job creation. - Equity Considerations: Policies should not disproportionately burden low-income groups or exacerbate social inequalities. - International Cooperation: Many environmental issues are global, requiring coordinated international efforts. Despite these challenges, implementing an ecological tax system offers numerous benefits: - Environmental Protection: It directly addresses pollution and resource depletion. - Market Efficiency: It corrects market failures related to environmental externalities. - Innovation Stimulus: It encourages research and development of green technologies. - Public Health Improvements: Reduced pollution leads to better health outcomes. - Sustainable Economic Growth: It fosters industries that are sustainable in the long run. In summary, an ecological tax system is a comprehensive approach to integrating environmental considerations into fiscal policy, aiming to promote sustainable development through a mix of taxes, subsidies, and regulatory measures.

What is the role of macroeconomic indicators in stock market analysis ?

The article discusses the importance of macroeconomic indicators in stock market analysis, highlighting key indicators such as economic growth, inflation, interest rates, employment, and government policies. It suggests monitoring these indicators to identify trends and patterns that can impact the stock market, integrating this analysis with other tools for a comprehensive view.

What is the role of a broker in the stock market ?

Brokers play a key role in the stock market, acting as intermediaries between investors and financial markets. They facilitate trades, provide market information, offer investment advice, manage accounts, and execute complex trades. Their expertise helps investors make informed decisions and manage their portfolios effectively.

What role does natural gas play in the global energy market ?

Natural gas is a key player in the global energy market due to its environmental advantages, economic benefits, contributions to energy security, technological advancements, and versatile applications across sectors.

What is the difference between a bull and bear market ?

The main difference between a bull and bear market lies in the direction of the market trend and the overall sentiment among investors. Bull markets are characterized by rising stock prices and optimism, while bear markets are characterized by falling stock prices and pessimism.

How might a lunar base influence the global economy and job market ?

The establishment of a lunar base could significantly impact the global economy and job market by increasing investment in space technology, creating new industries, driving innovation, and fostering international collaboration. It could also create numerous job opportunities and expand educational opportunities focused on space-related disciplines.

What is the stock market and how does it work ?

The stock market is a financial ecosystem where investors can buy and sell ownership shares of publicly traded companies. Companies use it to raise capital, while investors aim to share in the company's success. Prices of stocks are determined by supply and demand, influenced by various factors including company performance, market trends, and economic conditions. The market is regulated to protect investors and maintain fairness. Investing in stocks comes with risks but also offers potential rewards, making it a popular choice for long-term investments.

Who are the main financial regulators in the world ?

Financial regulators worldwide play a pivotal role in maintaining the stability and integrity of the global financial system. Key institutions include the SEC, Fed, CFTC, and FINRA in the US; ECB and ESMA in the EU; BoE and FCA in the UK; BoJ and FSA in Japan; and PBOC and CBIRC in China. The Basel Committee on Banking Supervision and IOSCO also set global standards for bank regulation and securities markets, respectively. These regulators collaborate to address cross-border issues and enhance the health and integrity of the global financial system through implementing regulations, monitoring market activities, promoting transparency, and taking action against illegal or unethical practices.

How can I protect my growing wealth from market fluctuations ?

Market fluctuations are a natural part of any investment journey. However, as your wealth grows, it becomes increasingly important to implement strategies that can help protect your assets from the ups and downs of the market. Here's how you can do it: - Diversify Your Portfolio - Use Hedging Strategies - Stay Updated on Economic Indicators - Regularly Review and Rebalance Your Portfolio - Work with Financial Advisors

How do I invest in the stock market ?

The text provides a step-by-step guide on how to invest in the stock market. It emphasizes the importance of education, determining investment goals, choosing a strategy, opening a brokerage account, selecting investments, monitoring them, and maintaining patience and discipline. The process involves learning about different types of stocks, understanding risks, diversification, and risk management. It also includes researching brokerage firms, funding an account, choosing individual stocks or mutual funds based on company performance, and staying informed about market changes. Overall, the text encourages potential investors to approach stock market investing with careful planning and research to achieve their financial goals over time.

What is the importance of market trends in stock analysis ?

Market trends play a crucial role in stock analysis by providing insights into the overall direction and momentum of the market. There are three types of market trends: uptrends, downtrends, and sideways trends. Understanding market trends is essential for making informed investment decisions. By analyzing market trends, investors can identify potential opportunities and risks associated with specific stocks or sectors. To effectively use market trends in stock analysis, investors should first identify the current market trend and then analyze individual stocks or sectors relative to the overall market. Make informed investment decisions based on your analysis of market trends and individual stocks or sectors. Monitor changes in market trends and adjust your investment strategy accordingly.

How is renewable energy affecting the traditional energy market ?

Renewable energy sources are having a significant impact on the traditional energy market, affecting pricing, market share, job creation, and environmental concerns. The increased efficiency and reduced installation costs of renewable technologies have made them more competitive with traditional energy sources, leading to declining electricity prices overall. Additionally, the growing demand for renewable energy sources has led to an increase in their market share, particularly for solar and wind power. The transition to renewable energy is also creating new job opportunities across various sectors of the economy, while addressing environmental concerns associated with fossil fuel consumption.

Can I install a home security system myself or do I need a professional ?

This guide helps individuals decide whether to self-install a home security system based on technical skills, time availability, budget, and system complexity. It outlines steps for DIY installation including research, planning, choosing the right system, gathering tools, and troubleshooting. The benefits of professional installation such as expertise, guaranteed workmanship, and customization are also discussed. The conclusion emphasizes that the decision depends on personal circumstances and preferences.

What are the risks involved in investing in the stock market ?

The stock market offers lucrative opportunities for investors but also comes with its own set of risks. These include: - Market Risk, which affects the entire market and cannot be diversified away; - Liquidity Risk, where you may not be able to sell your shares quickly enough; - Interest Rate Risk, affecting bond investors and stock prices; - Business Risk, related to a company's performance declining due to factors such as poor management or increased competition; - Inflation Risk, where inflation erodes the purchasing power of your investments; - Political Risk, impacting your investments due to political events; - Currency Risk, affecting those who invest in foreign markets.