Market Carbon

How can I invest in the carbon trading market ?

The carbon trading market offers a lucrative investment opportunity for those interested in environmental sustainability and financial gain. To invest successfully, one should understand the basics of carbon trading, research different carbon markets, choose a broker or exchange, determine an investment strategy, and start trading while managing risk.

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.

What are the risks associated with investing in the carbon trading market ?

The carbon trading market offers lucrative investment opportunities but also carries significant risks, including price volatility, lack of transparency, legal and regulatory changes, and environmental impacts. To mitigate these risks, investors should diversify their portfolios, conduct thorough research, stay updated on regulatory changes, and consider the environmental impact of their investments. By taking these steps, investors can potentially reduce their exposure to risks while still benefiting from the profitability of the carbon trading market.

What are the benefits of participating in the carbon trading market ?

Participating in the carbon trading market offers a multitude of benefits, which can be categorized into environmental, economic, and social aspects. Here are some of the key advantages: 1. **Environmental Benefits**: - Reduction in Greenhouse Gas Emissions: The primary goal of carbon trading is to reduce greenhouse gas emissions by creating financial incentives for companies to adopt cleaner technologies and practices. This helps to mitigate climate change and its associated impacts on ecosystems and biodiversity. - Promotion of Renewable Energy Sources: As companies strive to reduce their carbon footprint, they are more likely to invest in renewable energy sources such as solar, wind, and hydroelectric power. This shift towards green energy promotes sustainable development and reduces reliance on fossil fuels. - Enhanced Energy Efficiency: Carbon trading encourages businesses to improve their energy efficiency, leading to reduced energy consumption and lower operating costs. This results in fewer resources being used and less waste generated. 2. **Economic Benefits**: - Creation of New Industries and Jobs: The growth of the carbon trading market has led to the emergence of new industries focused on developing and implementing low-carbon technologies. These industries create job opportunities and contribute to economic growth. - Potential for Profitability: Companies that effectively manage their carbon emissions can generate additional revenue by selling excess emission allowances or credits. This provides an incentive for businesses to become more environmentally friendly while also increasing their profitability. - Access to International Markets: Participation in the carbon trading market allows companies to access global markets and take advantage of international trade opportunities related to low-carbon products and services. 3. **Social Benefits**: - Improved Public Health: By reducing air pollution caused by greenhouse gas emissions, carbon trading can lead to improved public health outcomes. This includes reductions in respiratory illnesses, heart disease, and other health issues associated with poor air quality. - Increased Awareness and Education: The existence of a carbon trading market raises public awareness about climate change and its implications. This increased understanding can drive behavioral changes among consumers, leading to more sustainable choices and lifestyles. - Community Engagement: Carbon trading projects often involve local communities, providing opportunities for community engagement and empowerment. This can lead to improved infrastructure, enhanced educational programs, and increased social cohesion within affected areas.

What are the challenges and opportunities for developing countries in the carbon trading market ?

Challenges and opportunities for developing countries in the carbon trading market include lack of infrastructure, legal and regulatory hurdles, market access and information asymmetry, capacity building needs, economic growth and investment, technology transfer and innovation, environmental sustainability, policy influence and leadership.

Who are the main participants in the carbon trading market ?

The carbon trading market is a complex ecosystem involving various stakeholders who play crucial roles in reducing greenhouse gas emissions and promoting sustainable development. These participants include governments and regulatory bodies, companies and businesses, investors and financial institutions, project developers and consulting firms, and NGOs and environmental groups. Governments establish the legal framework and policies that govern the market, while companies are required to hold sufficient allowances to cover their emissions or purchase additional allowances if needed. Investors provide liquidity by buying and selling allowances based on their expectations of future price movements. Project developers design and implement projects that generate credits for sale on the carbon market, working closely with governments, companies, and investors. NGOs and environmental groups advocate for stronger climate policies and support initiatives that promote sustainable development.

What are the benefits of implementing a carbon credit system ?

The carbon credit system is a market-based approach to reducing greenhouse gas emissions. It provides economic incentives for emission reduction, promotes innovation and technology adoption, enhances environmental stewardship, and serves as a regulatory and policy tool. By creating a market value for emission reduction, the system encourages businesses to reduce their carbon footprint and fosters global cooperation towards sustainability goals.

What is the future of carbon credit systems ?

The future of carbon credit systems is uncertain and depends on various factors such as policy decisions, technological advancements, public opinion, and market dynamics. Governments play a crucial role in shaping the future of these systems through regulations and enforcement. Technological innovations can both increase and decrease the value of carbon credits. Public opinion can drive demand for carbon credits, while market dynamics will shape the industry's evolution. Despite challenges, there are opportunities for growth and improvement in this important area of environmental protection.

How is the value of carbon credits determined ?

Carbon credits are a valuable tool in the fight against climate change. Their value is determined by supply and demand, quality of the project used to generate them, and market conditions. Supply and demand can be influenced by government regulations, public opinion, and technological advancements. The quality of a carbon offset project can be influenced by verification and certification, additionality, and permanence. Market conditions such as economic growth, political stability, and global events can also impact the value of carbon credits.

How does the carbon trading market contribute to reducing greenhouse gas emissions ?

Carbon trading markets are a key tool in the global fight against climate change by offering economic incentives for reducing greenhouse gas emissions. They set a price on carbon, encouraging businesses to invest in cleaner technologies and practices. These markets also promote innovation, international cooperation, and the implementation of robust regulatory frameworks. Additionally, they raise public awareness about the importance of combating climate change. Overall, carbon trading markets play a crucial role in mitigating the effects of climate change by creating a structured approach to reducing GHG emissions.

What are the potential benefits and drawbacks of using market-based mechanisms like carbon trading in global climate governance ?

The text discusses the potential benefits and drawbacks of using market-based mechanisms like carbon trading in global climate governance. The benefits include cost-effectiveness, flexibility and innovation, economic incentives, and global cooperation. However, there are also drawbacks such as equity concerns, complexity, uncertainty, and lack of public acceptance. It is important to consider these factors carefully when designing a carbon trading system to ensure that it is equitable, transparent, and effective in reducing carbon emissions.

What role do carbon markets play in international climate change agreements ?

In international climate change agreements, carbon markets are a crucial component. They provide a mechanism for countries to meet their greenhouse gas (GHG) emission reduction targets in a cost-effective manner by trading carbon credits. Carbon markets encourage businesses and governments to invest in cleaner technologies and practices. They offer flexibility to countries in meeting their emission reduction commitments, provide incentives for innovation, facilitate international cooperation, and can be integrated with other environmental and economic policies. Examples of carbon markets in international agreements include the Kyoto Protocol and the Paris Agreement.

How does the carbon trading market work ?

The carbon trading market is a mechanism designed to reduce greenhouse gas emissions by providing economic incentives for their reduction, operating on the principle of "cap and trade." It involves setting a cap on the total amount of greenhouse gases that can be emitted by regulated entities, who can then buy and sell allowances or credits for emissions. The process includes establishing the cap, allocating allowances, trading allowances, banking allowances, offsetting emissions through projects, verification and certification, regulation and oversight, and dealing with benefits and criticisms.

How effective is a carbon tax in reducing greenhouse gas emissions ?

A carbon tax is a fee on burning carbon-based fuels aimed at reducing greenhouse gas emissions. It creates economic incentives for behavior change, technology innovation, and revenue generation. The effectiveness depends on rate setting, equity concerns, compliance, political feasibility, and international coordination.

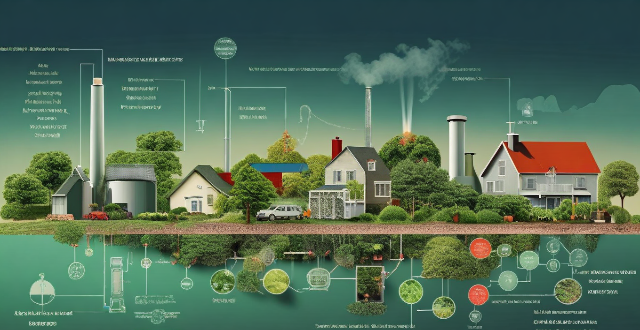

Can environmental subsidy policies help reduce carbon emissions ?

Environmental subsidy policies can help reduce carbon emissions by promoting renewable energy, enhancing energy efficiency, supporting waste reduction initiatives, and funding research and development of carbon capture and storage technologies. However, these policies must be carefully designed and adequately funded to avoid market distortions and ensure long-term sustainability without creating dependence on government support.

How do carbon credits differ from carbon taxes ?

Carbon credits and carbon taxes are two distinct mechanisms that aim to reduce greenhouse gas emissions and mitigate climate change. While both strategies involve a financial incentive to encourage companies and individuals to reduce their carbon footprint, they operate differently in terms of their structure, implementation, and impact. Carbon credits represent a certificate or a tradable allowance proving that a specific amount of carbon dioxide (or its equivalent in other greenhouse gases) has been reduced, avoided, or sequestered by an emission-reducing project. Companies or countries can earn carbon credits by investing in projects that reduce emissions below a certain baseline, such as renewable energy projects or reforestation efforts. These credits can then be sold to entities that are looking to offset their own emissions or meet regulatory requirements. The price of carbon credits is determined by supply and demand in markets where they are traded. On the other hand, a carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas) that are responsible for greenhouse gas emissions. Governments set a tax rate per ton of CO2 emitted, which is paid by companies and sometimes individuals using fossil fuels. The goal is to make polluting activities more expensive, thereby encouraging a shift towards cleaner alternatives. Carbon taxes are typically implemented at a national level through legislation. The revenue generated from the tax can be used to fund environmental initiatives or be returned to taxpayers in various ways. Key differences between carbon credits and carbon taxes include their regulatory vs. voluntary nature, direct vs. indirect incentives, and price certainty vs. market fluctuation. Carbon taxes offer price certainty for businesses when planning expenses, while carbon credit prices can fluctuate based on market demand and the success of emission reduction projects. In summary, both carbon credits and carbon taxes serve important roles in addressing climate change, but they do so through different means and with different outcomes.

What are the challenges faced by carbon credit systems ?

Carbon credit systems face challenges including lack of standardization, quality control issues, limited scope, market dynamics, inequity and accessibility, and ethical considerations. These factors affect the effectiveness and credibility of carbon offsetting efforts. Addressing these challenges is essential for improving the system's performance and trustworthiness.

Does a carbon tax lead to "carbon leakage" where companies move to areas without the tax ?

The article discusses the potential for "carbon leakage," where companies might relocate to regions without a carbon tax to avoid additional costs. It highlights economic impacts, geographical considerations, industry-specific impacts, and mitigating factors that could affect the outcome of implementing a carbon tax. The potential negative outcomes include job losses and environmental displacement, while positive outcomes could be innovation and efficiency improvements. The conclusion emphasizes the need for coordinated international efforts and support for affected industries to minimize leakage and promote sustainable practices.

How is renewable energy affecting the traditional energy market ?

Renewable energy sources are having a significant impact on the traditional energy market, affecting pricing, market share, job creation, and environmental concerns. The increased efficiency and reduced installation costs of renewable technologies have made them more competitive with traditional energy sources, leading to declining electricity prices overall. Additionally, the growing demand for renewable energy sources has led to an increase in their market share, particularly for solar and wind power. The transition to renewable energy is also creating new job opportunities across various sectors of the economy, while addressing environmental concerns associated with fossil fuel consumption.

How does a carbon credit system work ?

A carbon credit system is a market-based approach that incentivizes companies, organizations, and individuals to reduce their greenhouse gas emissions. It works by setting emission reduction targets, generating carbon credits for verified emission reductions, allowing the trading of these credits, and using them for regulatory compliance or offsetting emissions. This system fosters economic efficiency, flexibility, and innovation while encouraging global cooperation on climate action. However, challenges such as ensuring permanence of reductions and maintaining system integrity must be addressed to ensure its effectiveness.

Is it realistic for all industries to aim for carbon neutrality ?

The text discusses the feasibility and challenges of achieving carbon neutrality across all industries. It highlights industry-specific challenges, economic implications, and technological limitations as significant hurdles. However, it also points out opportunities such as innovation, market advantage, and regulatory compliance that can arise from pursuing carbon neutrality. The strategies for achieving carbon neutrality include improving energy efficiency, switching to renewable energy sources, using carbon capture and storage technology, and offsetting emissions through various projects. While the path to carbon neutrality varies by industry, collaboration between different stakeholders is crucial for creating a sustainable future.

How can individuals participate in a carbon credit system ?

Carbon credit systems enable individuals to participate in reducing greenhouse gas emissions by buying, selling, or supporting carbon offsets. Individuals can offset their own carbon footprint by purchasing credits from verified projects, sell credits generated from their sustainable projects, or support the growth of carbon credit initiatives through advocacy and investment. Participation in these systems is a significant step towards combating climate change and fostering a more sustainable environment.

How do carbon credit systems impact developing countries ?

Carbon credit systems can have both positive and negative impacts on developing countries, including economic development, environmental benefits, technology transfer, market risks, social impacts, and environmental concerns. Policymakers and stakeholders must carefully consider these impacts when designing and implementing carbon credit projects in developing countries.

How do carbon credits contribute to reducing greenhouse gas emissions ?

Carbon credits are a key tool in the fight against climate change, as they incentivize emission reductions, facilitate international cooperation, support sustainable projects, enhance transparency and accountability, and promote market efficiency. By creating economic value for carbon reduction efforts, stimulating innovation, meeting global targets, sharing mitigation burdens, financing renewable energy and forest conservation projects, ensuring rigorous monitoring and verification, promoting cost-effective abatement, and providing clear price signals, carbon credits play a crucial role in reducing greenhouse gas emissions.

Can carbon credit systems effectively combat climate change ?

Carbon credit systems are a market-based approach to reducing greenhouse gas emissions by creating financial incentives for companies and individuals to reduce their carbon footprint. While these systems can effectively incentivize reduction of emissions, promote innovation, and support sustainable development, they also face challenges such as lack of regulation and standardization, inequality and access issues, and limited scope of impact. Carbon credit systems should be part of a broader strategy that includes government regulations, public education, and international cooperation to effectively combat climate change.

What is the role of carbon credits in mitigating climate change ?

Carbon credits are a crucial tool in the fight against climate change, providing economic incentives for reducing greenhouse gas emissions. They work by allowing companies or countries that emit less than their allocated amount of carbon to sell their surplus credits, creating a market-based mechanism for efficient emission reduction. While effective, challenges include ensuring the quality of credits and addressing equity concerns. As global climate targets become more ambitious, the role of carbon credits is expected to expand, with innovations needed to enhance their effectiveness and integration with other climate policies.

Are there any drawbacks to carbon offsetting ?

Carbon offsetting, a method to reduce one's carbon footprint through investing in projects that aim to reduce or offset greenhouse gas emissions, is not without its drawbacks. These include lack of regulation in the industry, potential issues with additionality (whether the offset project would have happened anyway), permanence (ongoing maintenance and monitoring required for sustained carbon benefits), leakage (emissions reduced in one area but increased in another due to market forces), cost-effectiveness (other methods may provide greater emissions reductions at a lower cost), and ethical considerations (relying on offsets may allow individuals and organizations to continue their high-emission lifestyles without making significant changes).

Can carbon credits be a sustainable source of income for developing countries ?

The article explores the potential of carbon credits as a sustainable source of income for developing countries, highlighting their benefits in revenue generation, sustainable development, and international cooperation. However, it also underscores the challenges such as market volatility, implementation complexities, and ensuring environmental integrity. The conclusion emphasizes that with robust frameworks and transparent monitoring, carbon credits can be a cornerstone of sustainable development strategies for developing countries.