Management Innovation

What role do technology and innovation play in water resource management ?

Water resource management is a critical aspect of modern society, and technology and innovation play a crucial role in improving the efficiency and effectiveness of this process. Technology and innovation have made it easier to collect and analyze data on water quality, quantity, and usage patterns. This information can be used to identify trends and make informed decisions about how to manage water resources more effectively. Technology and innovation also play a significant role in promoting efficient water use, water quality management, and climate change adaptation. By using advanced irrigation systems, smart meters, and other technologies, water providers can reduce waste and ensure that water is used only where it is needed. Technologies such as ultraviolet disinfection, reverse osmosis, and membrane bioreactors can remove contaminants from water more effectively than traditional methods. New construction techniques and materials can make water infrastructure more resistant to extreme weather events like floods and droughts.

What role does innovation play in the success of tech stocks ?

Innovation is key to the success of tech stocks, impacting product development, market expansion, efficiency, disruption, and investor sentiment. Tech companies that prioritize innovation often outperform competitors and provide strong returns for shareholders.

What is the impact of financial regulation on innovation in the financial sector ?

Financial regulation plays a critical role in the innovation landscape of the financial sector, with both positive and negative impacts. Positively, it promotes transparency and trust, encourages responsible innovation, and facilitates access to capital. However, it can also slow down the pace of innovation, restrict experimentation, and stifle international competitiveness. To mitigate these negative effects, adaptive regulation, collaborative approaches, and education and training are recommended. Striking a balance between fostering innovation and ensuring safety is crucial.

How can educational psychology be used to foster creativity and innovation in students ?

Educational psychology can be used to foster creativity and innovation in students by understanding their cognitive, emotional, and social needs. This involves encouraging curiosity, providing challenges, creating a safe environment, promoting resilience, collaboration, and valuing diversity. Teaching strategies such as inquiry-based learning and differentiated instruction can also enhance these qualities. Alternative assessments like portfolio assessment and performance tasks, along with formative assessment through feedback mechanisms and self-assessment, can further support creativity and innovation in students.

How does Fintech drive innovation in the financial sector ?

Fintech is driving innovation in the financial sector by enhancing efficiency, democratizing access to services, improving customer experience, facilitating financial inclusion, enhancing security and compliance, and fostering innovation and collaboration.

How do renewable energy policies influence innovation and technology development ?

Renewable energy policies are crucial for driving innovation and technology development in the clean energy sector. These policies provide incentives for research, investment, and deployment, creating a favorable environment for technological advancements and innovation. Government support and funding, regulatory frameworks, market incentives, and collaboration and partnerships are all essential factors that influence innovation and technology development in this sector. By providing financial assistance, setting standards and requirements, creating demand for clean energy solutions, and fostering collaboration between different stakeholders, renewable energy policies help to accelerate the development of new technologies and improve existing ones. As we continue to face challenges related to climate change and energy security, it is essential that we continue to invest in renewable energy solutions and support policies that encourage innovation and progress in this field.

What role do technology and innovation play in improving sustainability within supply chain management ?

Technology and innovation are crucial for enhancing sustainability in supply chain management. They enable real-time monitoring, process optimization, energy efficiency, waste reduction, and transparency. By adopting these advancements, businesses can create environmentally friendly operations while maintaining profitability.

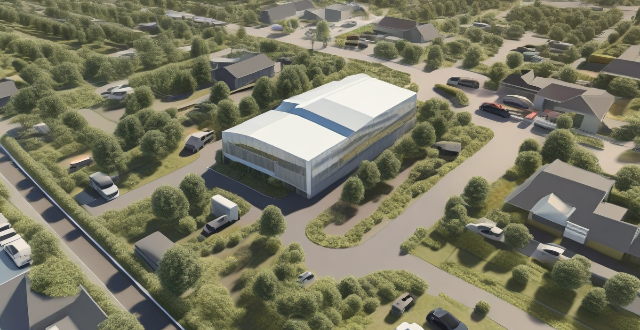

What are the best practices for sustainable groundwater management ?

The provided text discusses the importance of sustainable groundwater management and outlines several best practices to ensure the long-term availability and quality of this vital resource. These practices include monitoring and data collection, enhancing recharge, maintaining sustainable withdrawal rates, protecting groundwater from pollution, integrated water resources management, legal and policy framework, public participation and education, technological innovation, and responding to climate change. By following these guidelines, depletion, contamination, and environmental damage can be prevented, supporting ecosystems, agriculture, and human consumption.

What is risk management and why is it important ?

Risk management is a systematic approach used by organizations to identify, assess, and prioritize potential risks that may impact their objectives. It involves implementing strategies to monitor and control these risks effectively. The goal of risk management is to minimize the probability and impact of negative events and maximize the opportunities for positive outcomes. The importance of risk management includes mitigating uncertainty, enhancing decision-making, compliance and regulatory requirements, protection of reputation, financial performance, and promoting innovation. Effective risk management is crucial for any organization looking to sustain its operations, protect its assets, enhance decision-making, maintain compliance, preserve its reputation, and improve its financial performance. It enables companies to navigate challenges proactively and capitalize on opportunities while minimizing the impact of potential threats.

Where can I find comprehensive online learning resources for business management ?

The article discusses various online learning platforms that offer comprehensive resources for business management. These include Coursera, Udemy, edX, Khan Academy, and LinkedIn Learning. The courses provided by these platforms cover a wide range of topics, such as strategy formulation, financial management, human resource management, and marketing. Some of the popular courses mentioned are Introduction to Marketing by Northwestern University on Coursera, Business Finance for Non-Finance Managers on Udemy, and Strategy and Innovation in the New Economy by Stanford University on edX. The article emphasizes that these platforms offer courses suitable for learners of all levels and can help individuals acquire the necessary knowledge and skills to become successful business managers.

How do circular economy principles apply to supply chain management, and what benefits do they bring in terms of climate change adaptation ?

The circular economy is a regenerative system that replaces the "end-of-life" concept with reducing, alternatively reusing, sharing, repairing, refurbishing, remanufacturing and recycling existing materials and products. This approach minimizes waste and pollution, extends product lifecycles, and helps to mitigate climate change. In supply chain management, applying circular economy principles can bring significant benefits in terms of climate change adaptation. The key principles of circular economy in supply chain management include design for recycling and reuse, extended producer responsibility (EPR), circular procurement, collaborative partnerships, resource efficiency, digital tracking and transparency, reduction in greenhouse gas emissions, conservation of natural resources, increased resilience, innovation and economic opportunities, and improved waste management. By adopting these practices, organizations can contribute to a more sustainable economy that reduces environmental impacts and builds resilience against the effects of a changing climate.

How can technology transfer and innovation support global climate governance efforts ?

Technology transfer and innovation support global climate governance by reducing greenhouse gas emissions, adapting to climate change, and mitigating its impacts. They also enable data collection and analysis, international collaboration, and financing for climate action.

How do virtual power plants utilizing renewable energy affect grid stability and management ?

**The Impact of Virtual Power Plants Utilizing Renewable Energy on Grid Stability and Management** Virtual power plants (VPPs) aggregate various renewable energy resources to optimize electricity production and supply, enhancing grid stability and management. They balance supply and demand, reduce transmission losses, and enhance reliability by integrating distributed energy resources into a controllable network. VPPs offer operational flexibility, optimize resources, integrate electric vehicles, and facilitate energy trading. However, they also pose challenges such as complexity in management, interoperability issues, security concerns, and the need for regulatory adaptation. Overall, VPPs utilizing renewable energy sources have a profound effect on grid stability and management, offering enhanced reliability, efficiency, and flexibility, but require careful planning and adaptation to fully realize their potential.

Can starting a small business be a path to significant wealth growth ?

Starting a small business can be a path to significant wealth growth, but it comes with challenges and risks. Advantages include entrepreneurial opportunities, flexibility, innovation, and job creation. However, financial risk, market competition, regulatory compliance, and cash flow management are potential challenges. Successful strategies involve research, focusing on customer needs, building a strong brand, networking, and continuous innovation. With careful planning and hard work, entrepreneurs can increase their chances of success and achieve long-term financial stability.

What are the latest trends in transportation innovation ?

Transportation innovation trends include autonomous vehicles, electric vehicles (EVs), hyperloop technology, drone delivery, and smart mobility solutions. Self-driving cars aim to reduce accidents caused by human error and make transportation more efficient. Electric vehicles help reduce carbon emissions and improve energy efficiency. Hyperloop technology could revolutionize long-distance travel by moving people or goods through large tubes at high speeds with reduced air resistance. Drones are being used for delivery services, particularly in rural areas where traditional delivery methods may not be cost-effective. Smart mobility solutions involve the use of digital technologies to create more efficient and sustainable transportation systems.

What regulatory challenges do Fintech companies face ?

Fintech companies face regulatory challenges such as compliance with existing regulations, adapting to evolving regulations, and balancing innovation and regulation. They must deal with lack of clarity in laws, conflicting regulations, high cost of compliance, rapid changes in regulations, collaboration with regulators, fostering innovation, risk management, and educating stakeholders. To succeed, fintech companies must stay informed, collaborate with regulators, foster innovation while managing risks, and educate their stakeholders about regulatory requirements.

What role do nanomaterials play in modern battery innovation ?

Nanomaterials are revolutionizing battery technology by enhancing performance, increasing energy density, and improving safety. These materials have unique properties such as high surface area, electrical conductivity, and chemical reactivity that make them ideal for use in batteries. Nanomaterials can increase energy density, improve charging and discharging rates, extend the lifespan of batteries, enhance safety, and reduce environmental impact. With ongoing research, it is likely that we will see even more exciting developments in the world of batteries thanks to the unique properties of nanomaterials.

How can blockchain technology be used in supply chain management ?

Blockchain technology is poised to revolutionize supply chain management by offering transparency, traceability, and security. Smart contracts automate transactions, while secure data sharing promotes collaboration. The technology also reduces manual processes, paperwork, and enhances compliance.

How does TCFD contribute to achieving the United Nations Sustainable Development Goals ?

The Task Force on Climate-related Financial Disclosures (TCFD) contributes significantly to achieving the United Nations Sustainable Development Goals (SDGs). The TCFD is a global initiative that aims to provide clarity and consistency in how companies report climate-related information. This initiative helps investors, lenders, insurers, and other stakeholders understand the risks and opportunities related to climate change. ### **How TCFD Supports the SDGs** #### **1. Promoting Transparency and Accountability:** The TCFD's framework encourages businesses to disclose their environmental impact, which aligns with SDG 12 (Responsible Consumption and Production) and SDG 17 (Partnerships for the Goals). By promoting transparency, TCFD supports businesses in becoming more accountable for their actions, thereby driving sustainable practices within industries. #### **2. Enhancing Risk Management:** Climate-related financial disclosures help identify and manage risks associated with climate change. This directly supports SDG 13 (Climate Action) by encouraging businesses to take proactive steps towards reducing their carbon footprint and adapting to climate change impacts. #### **3. Facilitating Investment in Sustainable Projects:** Through clear and consistent reporting standards, TCFD makes it easier for investors to identify companies committed to sustainability. This can lead to increased investment in projects that support various SDGs, such as renewable energy (SDG 7), clean water and sanitation (SDG 6), and sustainable cities and communities (SDG 11). #### **4. Driving Innovation:** By highlighting the need for companies to adapt to climate change, TCFD indirectly promotes innovation in clean technologies and sustainable business models. This aligns with SDG 9 (Industry, Innovation and Infrastructure) and SDG 12 by fostering innovative solutions that reduce environmental impact while maintaining economic growth. #### **5. Supporting Policy Coherence:** The TCFD's recommendations can guide policymakers in developing coherent policies that support both climate action and sustainable development. This aids in achieving SDG 17 by ensuring that policies are designed to support all SDGs simultaneously. ### **Conclusion** The Task Force on Climate-related Financial Disclosures plays a crucial role in advancing the United Nations Sustainable Development Goals by promoting transparency, enhancing risk management, facilitating sustainable investments, driving innovation, and supporting policy coherence. Through its work, TCFD helps bridge the gap between financial decision-making and environmental stewardship, making it an integral part of the global effort to achieve a sustainable future.

What role does recovery play in a sports health management plan ?

Recovery is a crucial component of sports health management, enhancing performance, preventing injuries, promoting mental health, and maintaining a balanced lifestyle. It involves activities like sleep, nutrition, stress reduction techniques, and time management to ensure athletes can perform at their best while staying healthy and motivated.

In what ways can businesses engage in sustainable supply chain management as a key component of their CSR programs ?

The text discusses the importance of sustainable supply chain management in corporate social responsibility (CSR) programs. It emphasizes setting clear objectives and goals, conducting supplier audits and assessments, collaborating with suppliers, measuring performance and reporting results, and continuously improving and innovating as key steps in sustainable supply chain management. The text suggests that these practices can help businesses demonstrate their commitment to sustainability while also improving their bottom line.

What is credit management ?

Credit management is the process of managing and controlling the use of credit by individuals or businesses. It involves evaluating borrowers' creditworthiness, determining the amount of credit to extend, monitoring loan repayment, and taking action for late payments. Key components include credit analysis, evaluation, loan monitoring, collections management, risk management, and customer relationship management. Effective credit management benefits include reduced default risk, improved cash flow, increased customer satisfaction, and enhanced reputation.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do different countries approach flood control and management ?

Flood control and management strategies vary across different countries, influenced by factors such as geographic location, climate conditions, economic resources, and technological advancements. The United States relies on early warning systems, flood insurance programs, and floodplain zoning regulations. The Netherlands invests in flood barriers and dikes, water management policies, and international cooperation. China focuses on the Three Gorges Dam, flood prevention campaigns, and reforestation efforts. India adopts community-based approaches, integrated water resource management, and disaster risk reduction programs.

How can technology and social media be leveraged to enhance student leadership experiences ?

Technology and social media can enhance student leadership experiences by providing platforms for communication, collaboration, innovation, and professional networking. Students can use instant messaging tools to improve communication skills, project management tools for better collaboration, online learning platforms for fostering innovation, and LinkedIn for building professional networks. Educators should guide students in using these tools effectively and responsibly.

How does network slicing differ from traditional network management techniques ?

Network slicing, enabled by SDN and NFV, allows creating multiple virtual networks on a common infrastructure for tailored services like IoT and automotive systems. It offers dynamic resource allocation, scalability, better security, and can simplify management through automation. In contrast, traditional network management is monolithic with static resources, complex and potentially less secure. Network slicing is a more adaptable solution for diverse and growing connectivity needs.

How do financial regulations impact banks and other financial institutions ?

Financial regulations are crucial for maintaining stability in the banking and financial sector. They protect depositors' interests, promote fair competition, prevent financial crises, and impact innovation and efficiency. Regulations like capital adequacy ratios, liquidity coverage ratios, and stress testing ensure depositors' safety. Antitrust laws and consumer protection laws encourage fair competition among banks. Prudential supervision and Basel III help prevent financial crises. However, excessive regulation may negatively affect innovation and profitability. Striking a balance between safety and promoting innovation is key.

What role does investment play in women's wealth management ?

Investing is crucial for women's wealth management, offering benefits like diversification, long-term growth, inflation protection, tax advantages, and flexibility. By wisely investing, women can enhance their financial security and achieve their financial goals.

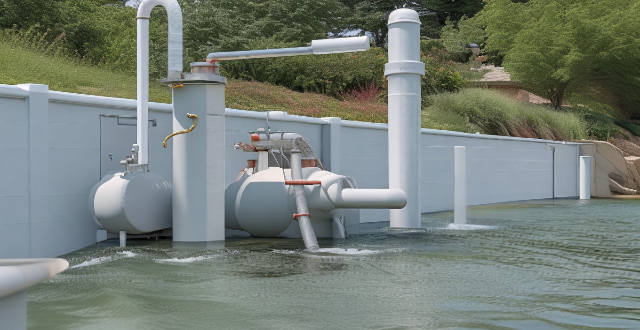

How can the energy sector reduce its water footprint through innovations in technology ?

The energy sector's substantial water consumption is a concern for sustainable development. Technological innovations, such as efficient cooling systems, advanced water treatment, renewable energy integration, smart water management, waste heat recovery, and improved desalination methods, can help reduce the sector's water footprint. These innovations offer benefits like resource conservation, cost efficiency, and reduced environmental impact, ultimately contributing to global water security.

How does stress management affect women's well-being ?

Stress management plays a crucial role in women's well-being, affecting their physical, mental, and emotional health. By managing stress, women can improve their immunity, sleep quality, and reduce the risk of chronic diseases. It also helps in improving mood, concentration, and reducing anxiety and depression. Stress management can lead to improved relationships, self-esteem, and increased resilience. Overall, it is essential for women's well-being and can lead to a happier and healthier life.