Carbon Offset

What are some examples of carbon offset projects ?

Carbon offset projects are initiatives designed to reduce or offset the emission of carbon dioxide (CO2) and other greenhouse gases into the atmosphere. These projects aim to mitigate the impacts of climate change by investing in activities that remove CO2 from the atmosphere or prevent its release in the first place. In this guide, we will explore some examples of carbon offset projects and how they contribute to the global effort to combat climate change.

How much does it cost to offset a ton of carbon dioxide ?

The cost to offset a ton of carbon dioxide varies depending on the method used and the region where the offset takes place. Factors affecting the cost include the method of offset, region, project complexity, and verification and certification processes. The average cost of offsetting a ton of carbon dioxide ranges from $10 to $100 per ton. Tree planting, renewable energy projects, and carbon capture and storage are some common methods of offsetting carbon dioxide emissions.

Are there any drawbacks to carbon offsetting ?

Carbon offsetting, a method to reduce one's carbon footprint through investing in projects that aim to reduce or offset greenhouse gas emissions, is not without its drawbacks. These include lack of regulation in the industry, potential issues with additionality (whether the offset project would have happened anyway), permanence (ongoing maintenance and monitoring required for sustained carbon benefits), leakage (emissions reduced in one area but increased in another due to market forces), cost-effectiveness (other methods may provide greater emissions reductions at a lower cost), and ethical considerations (relying on offsets may allow individuals and organizations to continue their high-emission lifestyles without making significant changes).

What is carbon offsetting ?

Carbon offsetting is a strategy aimed at counteracting the carbon emissions that contribute to global warming by funding projects that reduce or remove an equivalent amount of CO2 from the atmosphere. These projects can range from renewable energy development and reforestation to carbon capture and storage. The process involves calculating one's carbon footprint, choosing an offset project, funding it, and ensuring its effectiveness through monitoring and verification. While carbon offsetting can raise environmental awareness and support sustainable projects, it also faces criticism for potential quality control issues and the risk of being seen as a justification for not directly reducing emissions.

How can individuals participate in carbon offsetting ?

Carbon offsetting allows individuals to compensate for their carbon emissions by investing in projects that reduce atmospheric CO2. To participate, understand your carbon footprint, choose a reputable offset provider, and set an offset goal. Support green energy, plant trees, adopt sustainable practices, and educate others on the importance of offsetting. This helps mitigate personal emissions and supports sustainability initiatives.

Are there any international standards for carbon credit systems ?

There are several international standards and protocols that govern carbon credit systems, including the Climate Action Reserve (CAR), the International Carbon Reduction and Offset Alliance (ICROA), and regional and national standards such as the European Union Emissions Trading System (EU ETS) and the North American Carbon Programme (NACP). These standards ensure the credibility, transparency, and integrity of carbon offset projects by setting rigorous guidelines for project developers to follow. By adhering to these standards, organizations can demonstrate their commitment to combating climate change and contribute to a more sustainable future.

What are the benefits of carbon offsetting for businesses ?

Carbon offsetting is a strategy that businesses can use to reduce their carbon footprint and mitigate the impact of their operations on the environment. By investing in projects that offset their emissions, businesses can demonstrate their commitment to sustainability and contribute to global efforts to combat climate change. Some of the benefits of carbon offsetting for businesses include reduced carbon footprint, improved reputation and brand image, financial benefits, and stakeholder engagement. By investing in carbon offsetting projects, businesses can demonstrate their commitment to sustainability and contribute to global efforts to combat climate change.

How do carbon offset projects get verified ?

The verification process for carbon offset projects involves multiple stages, including project registration, preparation of a Project Design Document (PDD), review and approval by third-party auditors, ongoing Monitoring, Reporting, and Verification (MRV), certification, issuance of credits, continuous improvement, and re-verification. This process ensures the genuineness, effectiveness, and sustainability of these projects in mitigating climate change. Key points to remember include the importance of transparency, independent verification, continuous monitoring, and adaptability.

What role do carbon offsets play in a company's CSR approach to addressing climate change ?

**Summary:** The text discusses the role of carbon offsets in corporate social responsibility (CSR) strategies aimed at mitigating climate change. Carbon offsets, defined as investments in emission reduction projects that go beyond legal requirements, help companies counterbalance their operational emissions. Implementing carbon offsets can aid companies in achieving emission reduction targets, investing in sustainable projects, engaging stakeholders, managing risks related to environmental regulations, and fostering innovation. Key steps in implementing a carbon offsetting program include conducting an emission audit, selecting suitable offset projects, integrating offsets into the business model, ensuring transparency in reporting, and engaging stakeholders. By incorporating carbon offsets into their CSR strategies, companies can contribute to combating climate change while enhancing their reputation and potentially reaching new markets.

How does carbon offsetting work ?

Carbon offsetting works by assessing emissions, identifying suitable offsetting projects like renewable energy or reforestation, purchasing carbon credits from these projects, and continuously monitoring their effectiveness. This process helps reduce the overall carbon footprint of individuals or organizations while contributing to global efforts to combat climate change.

Can carbon offsetting be used as a substitute for government action on climate change ?

The article discusses the concept of carbon offsetting and its potential as a substitute for government action on climate change. Carbon offsetting involves investing in projects that reduce or remove greenhouse gases from the atmosphere, such as renewable energy sources and reforestation. While it has advantages like individual responsibility and immediate impact, it also has limitations like not being a complete solution and lack of regulation. Government action is crucial in addressing climate change through regulation, infrastructure, and education. The conclusion states that carbon offsetting can be a useful tool, but it cannot replace government action.

How can individuals participate in a carbon credit system ?

Carbon credit systems enable individuals to participate in reducing greenhouse gas emissions by buying, selling, or supporting carbon offsets. Individuals can offset their own carbon footprint by purchasing credits from verified projects, sell credits generated from their sustainable projects, or support the growth of carbon credit initiatives through advocacy and investment. Participation in these systems is a significant step towards combating climate change and fostering a more sustainable environment.

What actions can I take to offset the carbon footprint calculated by the calculator ?

This article provides a comprehensive guide on how individuals can offset their carbon footprint through various actions. These actions include reducing energy consumption, using public transportation or carpooling, reducing waste, eating a plant-based diet, and supporting renewable energy. Each section offers specific tips and strategies that readers can implement in their daily lives to reduce their GHG emissions. By following these steps, individuals can contribute to mitigating climate change and promoting a more sustainable future.

What is the future of carbon credit systems ?

The future of carbon credit systems is uncertain and depends on various factors such as policy decisions, technological advancements, public opinion, and market dynamics. Governments play a crucial role in shaping the future of these systems through regulations and enforcement. Technological innovations can both increase and decrease the value of carbon credits. Public opinion can drive demand for carbon credits, while market dynamics will shape the industry's evolution. Despite challenges, there are opportunities for growth and improvement in this important area of environmental protection.

How do carbon credits differ from carbon taxes ?

Carbon credits and carbon taxes are two distinct mechanisms that aim to reduce greenhouse gas emissions and mitigate climate change. While both strategies involve a financial incentive to encourage companies and individuals to reduce their carbon footprint, they operate differently in terms of their structure, implementation, and impact. Carbon credits represent a certificate or a tradable allowance proving that a specific amount of carbon dioxide (or its equivalent in other greenhouse gases) has been reduced, avoided, or sequestered by an emission-reducing project. Companies or countries can earn carbon credits by investing in projects that reduce emissions below a certain baseline, such as renewable energy projects or reforestation efforts. These credits can then be sold to entities that are looking to offset their own emissions or meet regulatory requirements. The price of carbon credits is determined by supply and demand in markets where they are traded. On the other hand, a carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas) that are responsible for greenhouse gas emissions. Governments set a tax rate per ton of CO2 emitted, which is paid by companies and sometimes individuals using fossil fuels. The goal is to make polluting activities more expensive, thereby encouraging a shift towards cleaner alternatives. Carbon taxes are typically implemented at a national level through legislation. The revenue generated from the tax can be used to fund environmental initiatives or be returned to taxpayers in various ways. Key differences between carbon credits and carbon taxes include their regulatory vs. voluntary nature, direct vs. indirect incentives, and price certainty vs. market fluctuation. Carbon taxes offer price certainty for businesses when planning expenses, while carbon credit prices can fluctuate based on market demand and the success of emission reduction projects. In summary, both carbon credits and carbon taxes serve important roles in addressing climate change, but they do so through different means and with different outcomes.

Are there any drawbacks or criticisms associated with carbon credits ?

Carbon credits are a tool used in the fight against climate change, allowing companies or individuals to offset their carbon emissions by investing in projects that reduce greenhouse gases. However, there are drawbacks and criticisms associated with carbon credits, including lack of standardization across different programs, ineffectiveness of some projects, high costs, potential for abuse, and limited scope. Addressing these issues is essential to ensure that carbon credits can play a meaningful role in mitigating the effects of climate change.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

How can I invest in the carbon trading market ?

The carbon trading market offers a lucrative investment opportunity for those interested in environmental sustainability and financial gain. To invest successfully, one should understand the basics of carbon trading, research different carbon markets, choose a broker or exchange, determine an investment strategy, and start trading while managing risk.

How effective is a carbon tax in reducing greenhouse gas emissions ?

A carbon tax is a fee on burning carbon-based fuels aimed at reducing greenhouse gas emissions. It creates economic incentives for behavior change, technology innovation, and revenue generation. The effectiveness depends on rate setting, equity concerns, compliance, political feasibility, and international coordination.

How effective are reforestation efforts in offsetting carbon emissions ?

Reforestation efforts can effectively offset carbon emissions by sequestering carbon dioxide through photosynthesis. Factors influencing its effectiveness include the type of trees planted, location and soil quality, management practices, and timescale. Challenges such as saturation points, land availability, biodiversity concerns, and water resources impact also need to be considered. A balanced approach combining reforestation with other strategies is necessary for meaningful climate change mitigation.

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

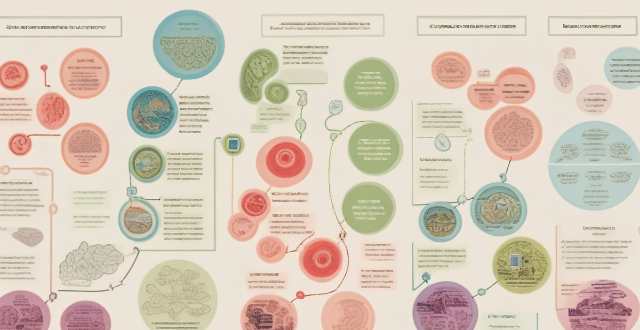

How does a carbon credit system work ?

A carbon credit system is a market-based approach that incentivizes companies, organizations, and individuals to reduce their greenhouse gas emissions. It works by setting emission reduction targets, generating carbon credits for verified emission reductions, allowing the trading of these credits, and using them for regulatory compliance or offsetting emissions. This system fosters economic efficiency, flexibility, and innovation while encouraging global cooperation on climate action. However, challenges such as ensuring permanence of reductions and maintaining system integrity must be addressed to ensure its effectiveness.

How is the value of carbon credits determined ?

Carbon credits are a valuable tool in the fight against climate change. Their value is determined by supply and demand, quality of the project used to generate them, and market conditions. Supply and demand can be influenced by government regulations, public opinion, and technological advancements. The quality of a carbon offset project can be influenced by verification and certification, additionality, and permanence. Market conditions such as economic growth, political stability, and global events can also impact the value of carbon credits.

How can a carbon tax be implemented fairly ?

The text discusses the implementation of a fair carbon tax, which is a fee on burning carbon-based fuels to reduce emissions contributing to global warming. It suggests methods such as progressive taxation, revenue neutrality, renewable energy incentives, public education, phased implementation, and international cooperation to ensure the tax does not disproportionately affect low-income households or certain industries.

How can carbon credit systems be improved to better address climate change ?

Enhancing Carbon Credit Systems for Effective Climate Change Mitigation. Carbon credit systems are financial instruments designed to reduce greenhouse gas emissions by providing economic incentives for emission reductions. While these systems have the potential to contribute significantly to climate change mitigation, they currently face several challenges that limit their effectiveness. Here's how we can improve them: 1. Strengthening Verification and Monitoring 2. Addressing Additionality and Leakage 3. Improving Permanence and Reversibility 4. Broadening Project Types and Incentives 5. Aligning with International Climate Goals 6. Expanding Market Access and Participation 7. Promoting Fairness and Justice

What are the legal obligations for companies regarding their carbon footprint ?

Companies face various legal obligations concerning their carbon footprint aimed at reducing greenhouse gas emissions and mitigating climate change. These include mandatory and voluntary emissions reporting, regulatory compliance through emissions caps and permitting, corporate governance measures like board oversight and stakeholder engagement, financial responsibilities such as carbon taxes and trading schemes, commitments under international agreements, and potential civil liabilities for negligence or human rights violations related to pollution. Companies must take proactive steps to reduce emissions, engage stakeholders, and contribute positively to global climate action, with specific requirements depending on the jurisdiction, industry, and individual company's commitments.

How do carbon credit systems impact developing countries ?

Carbon credit systems can have both positive and negative impacts on developing countries, including economic development, environmental benefits, technology transfer, market risks, social impacts, and environmental concerns. Policymakers and stakeholders must carefully consider these impacts when designing and implementing carbon credit projects in developing countries.

Can carbon credit systems effectively combat climate change ?

Carbon credit systems are a market-based approach to reducing greenhouse gas emissions by creating financial incentives for companies and individuals to reduce their carbon footprint. While these systems can effectively incentivize reduction of emissions, promote innovation, and support sustainable development, they also face challenges such as lack of regulation and standardization, inequality and access issues, and limited scope of impact. Carbon credit systems should be part of a broader strategy that includes government regulations, public education, and international cooperation to effectively combat climate change.

What are the economic implications of implementing a carbon tax ?

Implementing a carbon tax can have significant economic implications, including increased costs for businesses and consumers, potential revenue generation for governments, and both positive and negative impacts on economic growth. However, it could also encourage businesses to become more energy-efficient and innovative, potentially leading to new opportunities in clean energy and other sectors. Consumers may face higher prices but could benefit from a cleaner environment due to reduced carbon emissions.

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.