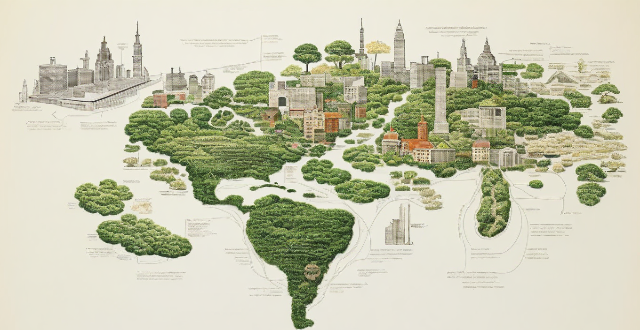

Carbon Countries

What countries have successfully implemented a carbon tax ?

Countries that have successfully implemented a carbon tax include Canada, Sweden, Finland, Norway, Switzerland, and the UK. These countries have set different rates for their carbon taxes and have seen varying degrees of success in reducing greenhouse gas emissions. While there are challenges associated with implementing such a tax, these countries demonstrate that it can be an effective tool for achieving environmental goals.

How do carbon credit systems impact developing countries ?

Carbon credit systems can have both positive and negative impacts on developing countries, including economic development, environmental benefits, technology transfer, market risks, social impacts, and environmental concerns. Policymakers and stakeholders must carefully consider these impacts when designing and implementing carbon credit projects in developing countries.

Can developed and developing countries achieve carbon neutrality at the same pace ?

The article discusses the challenges and potential solutions for developing countries to achieve carbon neutrality at the same pace as developed countries. The key differences between developed and developing countries in terms of economic development, technological advancements, and political will are highlighted. Developed countries have higher GDP per capita, more resources for research and development, and greater financial capacity to invest in renewable energy infrastructure. In contrast, developing countries have lower GDP per capita, limited resources for research and development, and less financial capacity to invest in renewable energy infrastructure. Technological advancements also play a crucial role in achieving carbon neutrality. Developed countries have advanced technology and innovation in clean energy sectors, access to cutting-edge research facilities, and well-established industries with experience in implementing sustainable practices. In contrast, developing countries have emerging technology and innovation in clean energy sectors, limited access to advanced research facilities, and infant industries with less experience in implementing sustainable practices. Political will is another factor that affects the pace of achieving carbon neutrality. Developed countries have stronger political commitment to addressing climate change through policy measures, more established regulatory frameworks for promoting renewable energy adoption, and greater public awareness and support for environmental issues. In contrast, developing countries have varying levels of political commitment to addressing climate change through policy measures, less established regulatory frameworks for promoting renewable energy adoption, and lower public awareness and support for environmental issues due to other pressing concerns such as poverty and healthcare. Developing countries face several challenges in achieving carbon neutrality, including lack of financial resources, technological barriers, and infrastructure challenges. Potential solutions for developing countries include international cooperation and funding, capacity building and education, and policy interventions and regulatory reforms. By working together through these solutions, both developed and developing countries can make significant progress towards a more sustainable future.

Can carbon credits be a sustainable source of income for developing countries ?

The article explores the potential of carbon credits as a sustainable source of income for developing countries, highlighting their benefits in revenue generation, sustainable development, and international cooperation. However, it also underscores the challenges such as market volatility, implementation complexities, and ensuring environmental integrity. The conclusion emphasizes that with robust frameworks and transparent monitoring, carbon credits can be a cornerstone of sustainable development strategies for developing countries.

How do countries measure their progress towards achieving climate goals ?

Countries measure their progress towards achieving climate goals through various indicators and metrics. These include Nationally Determined Contributions (NDCs), greenhouse gas inventories, renewable energy production, carbon intensity, forest cover and land use changes, climate finance flows, policy implementation, and public awareness and participation. By tracking these factors, countries can assess their performance in reducing emissions, adapting to climate impacts, and supporting global efforts to combat climate change.

What role do developing countries play in climate governance ?

The article discusses the crucial role of developing countries in climate governance, highlighting their vulnerability to climate change, growing greenhouse gas emissions, active participation in international negotiations, innovation and technology transfer, financing and investment needs, and capacity building requirements. It emphasizes that developing countries are essential for achieving a successful outcome in the global fight against climate change.

What actions have countries taken to meet their climate commitments ?

Countries have made commitments to reduce their carbon emissions and mitigate the impacts of climate change. They have taken various actions, including investing in renewable energy sources, improving energy efficiency, implementing carbon pricing mechanisms, focusing on forestry and land use practices, and promoting international cooperation. These efforts demonstrate a collective determination to address the urgent issue of climate change and create a more sustainable future for all.

How effective is a carbon tax in reducing greenhouse gas emissions ?

A carbon tax is a fee on burning carbon-based fuels aimed at reducing greenhouse gas emissions. It creates economic incentives for behavior change, technology innovation, and revenue generation. The effectiveness depends on rate setting, equity concerns, compliance, political feasibility, and international coordination.

What are the economic implications of pursuing carbon neutrality for a country ?

Pursuing carbon neutrality has both positive and negative economic implications for a country, including job creation, innovation, energy independence, short-term costs, impacts on traditional industries, and potential carbon leakage.

How do carbon credits differ from carbon taxes ?

Carbon credits and carbon taxes are two distinct mechanisms that aim to reduce greenhouse gas emissions and mitigate climate change. While both strategies involve a financial incentive to encourage companies and individuals to reduce their carbon footprint, they operate differently in terms of their structure, implementation, and impact. Carbon credits represent a certificate or a tradable allowance proving that a specific amount of carbon dioxide (or its equivalent in other greenhouse gases) has been reduced, avoided, or sequestered by an emission-reducing project. Companies or countries can earn carbon credits by investing in projects that reduce emissions below a certain baseline, such as renewable energy projects or reforestation efforts. These credits can then be sold to entities that are looking to offset their own emissions or meet regulatory requirements. The price of carbon credits is determined by supply and demand in markets where they are traded. On the other hand, a carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas) that are responsible for greenhouse gas emissions. Governments set a tax rate per ton of CO2 emitted, which is paid by companies and sometimes individuals using fossil fuels. The goal is to make polluting activities more expensive, thereby encouraging a shift towards cleaner alternatives. Carbon taxes are typically implemented at a national level through legislation. The revenue generated from the tax can be used to fund environmental initiatives or be returned to taxpayers in various ways. Key differences between carbon credits and carbon taxes include their regulatory vs. voluntary nature, direct vs. indirect incentives, and price certainty vs. market fluctuation. Carbon taxes offer price certainty for businesses when planning expenses, while carbon credit prices can fluctuate based on market demand and the success of emission reduction projects. In summary, both carbon credits and carbon taxes serve important roles in addressing climate change, but they do so through different means and with different outcomes.

Does a carbon tax lead to "carbon leakage" where companies move to areas without the tax ?

The article discusses the potential for "carbon leakage," where companies might relocate to regions without a carbon tax to avoid additional costs. It highlights economic impacts, geographical considerations, industry-specific impacts, and mitigating factors that could affect the outcome of implementing a carbon tax. The potential negative outcomes include job losses and environmental displacement, while positive outcomes could be innovation and efficiency improvements. The conclusion emphasizes the need for coordinated international efforts and support for affected industries to minimize leakage and promote sustainable practices.

How can a carbon tax be implemented fairly ?

The text discusses the implementation of a fair carbon tax, which is a fee on burning carbon-based fuels to reduce emissions contributing to global warming. It suggests methods such as progressive taxation, revenue neutrality, renewable energy incentives, public education, phased implementation, and international cooperation to ensure the tax does not disproportionately affect low-income households or certain industries.

How can we balance the needs of developing countries with those of developed countries when it comes to climate action ?

This article explores strategies for balancing the needs of developing and developed countries in climate action. It discusses economic disparities, environmental impact, finance and technology transfer, capacity building, equitable emission reductions, adaptation support, collaborative research and innovation, and policy coherence as key factors to consider. The article emphasizes that achieving a balance requires recognizing the unique circumstances and needs of both types of countries and implementing strategies such as financial support, technology transfer, capacity building, equitable emission reductions, adaptation support, collaborative research, and policy coherence.

How do climate policies vary between developed and developing countries ?

This article compares the climate policies of developed and developing countries, highlighting differences in economic resources, technological capabilities, and political priorities. Developed countries have larger economies and more financial resources to invest in climate change initiatives, while developing countries face challenges due to limited financial resources. Technological capabilities also differ significantly, with developed countries possessing advanced technologies for renewable energy and emission reduction strategies, while developing countries lack such infrastructure. Political priorities also vary, with developed countries often prioritizing climate action, while developing countries may prioritize other pressing issues. The article concludes that international cooperation and support mechanisms are crucial for bridging these gaps and fostering a global response to climate change that is both equitable and effective.

What role do carbon markets play in international climate change agreements ?

In international climate change agreements, carbon markets are a crucial component. They provide a mechanism for countries to meet their greenhouse gas (GHG) emission reduction targets in a cost-effective manner by trading carbon credits. Carbon markets encourage businesses and governments to invest in cleaner technologies and practices. They offer flexibility to countries in meeting their emission reduction commitments, provide incentives for innovation, facilitate international cooperation, and can be integrated with other environmental and economic policies. Examples of carbon markets in international agreements include the Kyoto Protocol and the Paris Agreement.

What countries are leading in wind energy production ?

The leading countries in wind energy production are China, the United States, Germany, India, and Spain. China has the largest installed capacity with 282 GW as of 2021, followed by the US with 119 GW, Germany with 60 GW, India with 38 GW, and Spain with 26 GW. These countries have seen rapid growth and innovation in their wind energy sectors, with key regions and states contributing significantly to their overall output. Their efforts demonstrate a commitment to reducing carbon emissions and transitioning towards sustainable energy sources.

What is the role of carbon credits in mitigating climate change ?

Carbon credits are a crucial tool in the fight against climate change, providing economic incentives for reducing greenhouse gas emissions. They work by allowing companies or countries that emit less than their allocated amount of carbon to sell their surplus credits, creating a market-based mechanism for efficient emission reduction. While effective, challenges include ensuring the quality of credits and addressing equity concerns. As global climate targets become more ambitious, the role of carbon credits is expected to expand, with innovations needed to enhance their effectiveness and integration with other climate policies.

How do developed and developing countries differ in their stance on climate change negotiations ?

The article discusses the differences in stance on climate change negotiations between developed and developing countries. Developed countries view climate change as an urgent issue that requires immediate action and are willing to take steps to reduce their carbon footprint, including investing in renewable energy sources and sustainable practices. They also acknowledge their historical responsibility for contributing to greenhouse gas emissions and are financially capable of investing in climate change initiatives. On the other hand, developing countries prioritize economic growth and development over immediate climate action and emphasize the importance of fairness and equity in negotiations. They focus on adapting to the impacts of climate change and building resilience against its effects, seeking financial support from developed nations to help them transition to low-carbon economies and implement adaptation measures. The article concludes that finding common ground between these differing perspectives will be crucial for effective global cooperation in addressing climate change challenges.

What are the challenges faced by developing countries in emission reduction ?

Developing countries face numerous challenges in reducing their greenhouse gas emissions, including lack of financial resources, technological constraints, socio-economic factors, policy and regulatory challenges, cultural and educational barriers, and natural resource availability. These challenges highlight the complex nature of emission reduction efforts in developing countries and underscore the need for international cooperation, financial assistance, and technology transfer to support their transition to a low-carbon future.

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.

How does a carbon tax impact the economy ?

**Impact of Carbon Tax on the Economy** 1. **Revenue Generation**: Increases government funds for public projects and welfare programs. 2. **Cost Pass-Through**: Businesses may increase prices, leading to inflation. 3. **Energy Efficiency**: Promotes investment in energy-efficient technologies, stimulating clean energy industries. 4. **Job Creation**: Creates jobs in clean energy sectors but can lead to job losses in fossil fuel-dependent industries. 5. **International Trade**: May affect competitiveness and increase imports from countries without carbon taxes. 6. **Environmental Benefits**: Mitigating climate change contributes to long-term economic stability.

Is carbon capture technology a viable solution for industries with high carbon emissions ?

Carbon capture technology (CCT) is a process that captures carbon dioxide (CO2) emissions from burning fossil fuels and stores it to prevent its release into the atmosphere. This technology has been proposed as a solution to reduce greenhouse gas emissions from industries with high carbon footprints. However, there are both advantages and challenges associated with CCT. The primary advantage of CCT is its potential to significantly reduce greenhouse gas emissions from power plants and other industrial processes by capturing up to 90% of CO2 emissions. It also allows the continued use of fossil fuels while reducing their environmental impact, which is particularly important for countries heavily reliant on coal or natural gas for their energy needs. Additionally, the development and implementation of CCT could create new job opportunities in research, engineering, construction, and operation of these facilities. However, one of the biggest challenges facing CCT is its high cost. The installation and operation of carbon capture systems can be expensive, making it difficult for many companies to invest in this technology. Carbon capture processes also require energy, often from burning more fossil fuels, which can lead to a net increase in CO2 emissions unless the energy source is renewable. Once captured, CO2 needs to be transported and stored safely, requiring infrastructure that does not currently exist in many regions and raising concerns about leakage and long-term storage solutions. In conclusion, while carbon capture technology offers promising benefits for reducing greenhouse gas emissions from industries with high carbon footprints, it also presents significant challenges that need to be addressed before it becomes a widely adopted solution. Cost-effectiveness, energy requirements, and storage infrastructure are key areas that require further development and investment to make CCT a viable option for combating climate change.

Can developing countries skip traditional energy sources and go straight to renewables ?

The article discusses the feasibility of developing countries transitioning directly to renewable energy sources, bypassing traditional energy sources. It examines economic, technological, political, and environmental considerations in detail. While there are challenges associated with transitioning to renewable energy, developing countries can certainly skip traditional energy sources and go straight to renewables if they receive adequate financial, technological, and political support. The benefits of doing so include job creation, reduced carbon emissions, and improved local air quality.

What are the ethical considerations surrounding the use of carbon capture technology ?

Carbon capture technology is a method used to reduce carbon dioxide emissions, but it raises ethical concerns such as cost and accessibility, potential environmental impact, long-term effects, and accountability. It is important to ensure that the technology is implemented responsibly and equitably.

Have any countries successfully implemented ecological tax systems, and what can we learn from their experiences ?

Several countries have successfully implemented ecological tax systems, providing valuable insights for others looking to follow suit. Lessons learned include the importance of gradual implementation, revenue neutrality, complementary policies, and public acceptance. By learning from these success stories, other countries can design and implement their own ecological tax systems to achieve similar results.

What are the challenges faced by carbon credit systems ?

Carbon credit systems face challenges including lack of standardization, quality control issues, limited scope, market dynamics, inequity and accessibility, and ethical considerations. These factors affect the effectiveness and credibility of carbon offsetting efforts. Addressing these challenges is essential for improving the system's performance and trustworthiness.

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

How are carbon credits traded and monitored ?

Carbon credits are a crucial component in the global fight against climate change. They represent a certificate indicating that one tonne of CO2 (or its equivalent in other greenhouse gases) has been either reduced, avoided, or sequestered from the atmosphere. The trading and monitoring of carbon credits involve several key steps and players, ensuring that the reductions are real, measurable, and verifiable. Trading platforms include centralized exchanges like the European Energy Exchange (EEX) and Chicago Climate Exchange (CCX), over-the-counter (OTC) markets for direct transactions between two parties, and brokers who facilitate buying and selling by matching buyers with sellers. Monitoring and verification processes include project registration and approval, third-party audits, issuance of credits, transaction recording, and retirement of credits. Key players involved in the process include governments, project developers, verifiers, registrars, brokers and traders, and compliance entities. Challenges and considerations include standardization, double-counting, persistence, transparency, and environmental integrity.

Is cryptocurrency legal in all countries ?

The legality of cryptocurrency varies across countries, withThe legality of cryptocurrency varies across countries, with it and others banning or The United States, Japan, and El Salvador are examples of countries where cryptocurrency is legal and regulated. In contrast, Algeria, Egypt, and Nepal have outright banned it due to concerns over financial stability and potential misuse in illegal activities. China, India, and Russia have imposed restrictions on its use but have not completely prohibited it. It is crucial to understand local laws and regulations before engaging in any cryptocurrency-related activities.

What are the challenges and opportunities for developing countries in the carbon trading market ?

Challenges and opportunities for developing countries in the carbon trading market include lack of infrastructure, legal and regulatory hurdles, market access and information asymmetry, capacity building needs, economic growth and investment, technology transfer and innovation, environmental sustainability, policy influence and leadership.