Interpreting stock charts and graphs involves understanding various components like time frames, candlestick patterns, support/resistance levels, trend lines, technical indicators, volume, and gaps. By analyzing these elements, investors can gain insights into market trends and make informed trading decisions. However, it's essential to combine chart analysis with other forms of research and risk management strategies for optimal results.

Interpreting Stock Charts and Graphs

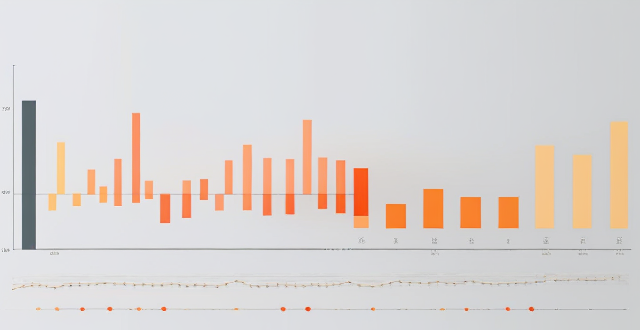

Stock charts and graphs are visual representations of a stock's price history. They provide valuable information that can help investors make informed decisions about buying or selling stocks. Here are some key aspects to consider when interpreting stock charts and graphs:

1. Time Frame

The time frame of a chart determines the amount of data displayed. Common time frames include:

- Intraday charts: Show price movements throughout the day.

- Daily charts: Display one day's worth of data per candlestick or bar.

- Weekly charts: Condense seven days of trading into one candlestick or bar.

- Monthly charts: Summarize an entire month's worth of trading in a single candlestick or bar.

2. Candlestick Patterns

Candlestick charts offer more information than line or bar charts by showing the open, close, high, and low prices for each period. Key patterns include:

- Bullish Engulfing: Signals a potential reversal from bearish to bullish.

- Bearish Engulfing: Indicates a possible shift from bullish to bearish.

- Doji: Suggests indecision in the market.

- Hammer: Could signal a bullish reversal.

- Shooting Star: May indicate a bearish reversal.

3. Support and Resistance

Support and resistance levels are crucial for understanding potential price barriers:

- Support: A level where the price tends to find a floor and bounce back up.

- Resistance: A ceiling where the price has difficulty breaking through and often falls back down.

4. Trend Lines

Trend lines help identify the overall direction of the market:

- Upward trend line: Connects a series of ascending support levels.

- Downward trend line: Joins a series of descending resistance levels.

5. Technical Indicators

Technical indicators provide additional insights based on mathematical calculations:

- Moving Averages (MA): Smooth out price data to highlight trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Bollinger Bands: Indicate volatility and potential price movements.

6. Volume

Volume represents the number of shares traded during a specific period and can reinforce signals:

- Rising volume with an uptrend suggests strong buying interest.

- Declining volume during a downtrend indicates weakening selling pressure.

7. Gaps

Gaps occur when there is a significant difference between the previous day's close and the current day's open:

- Breakaway gaps: Occur at the start of a trend.

- Continuation gaps: Form within a trend.

- Exhaustion gaps: Appear at the end of a trend.

Conclusion

Interpreting stock charts and graphs involves understanding various components like time frames, candlestick patterns, support/resistance levels, trend lines, technical indicators, volume, and gaps. By analyzing these elements, investors can gain insights into market trends and make informed trading decisions. However, it's essential to combine chart analysis with other forms of research and risk management strategies for optimal results.